Eyes on the Economy: Durable Goods, GDP, Retail Sales

Durable Goods Stay Positive

Durable goods orders increased 3.4 percent in January, nearly double the market forecast for a 1.8 percent gain. Durable goods could play an important role in this year’s recovery.

There’s a new fiscal relief package on the way with a focus on infrastructure improvement and a theme of “Build Back Better.” The plan will benefit auto, steel, asphalt, concrete, building material, tech and utilities manufacturers. The economic boost won’t be immediate because there are very few shovel-ready projects, but when it does start, the impact should boost the current recovery.

Interestingly, President Biden wants to invest in upgrading the power grid, which could garner more support given February’s weather-related outages in parts of the country. His plan also calls for more investment in clean-energy technologies, including electrical vehicles. Infrastructure renewal is popular with the majority of Americans, but past administrations have failed to make headway due to the cost. Biden plans on raising corporate taxes from 21 percent to 28 percent to pay for some of his infrastructure plan.

GDP Ramp-Up Expected Soon

Gross domestic product growth retreated dramatically from 33.4 percent in the third quarter to 4.1 percent in 2020’s last quarter according to the U.S. Bureau of Economic Analysis’ second estimate. Strength was led by investment, especially in equipment, inventories and residential, and exports. Government spending outside of defense and imports were offsets.

Real disposable income fell 10 percent thanks to waning stimulus. There’s no doubt the U.S. economy is still operating below capacity. Unemployment insurance claims are high and consistent with December’s job losses and sagging retail sales. Lawmakers’ agreement on a $900 billion fiscal rescue package at year-end came just in time to forestall a double-dip recession.

Prospects for a stronger economy remain limited, but there are compelling reasons to be optimistic. There is also a lot of pent-up demand for various activities curtailed during the pandemic, and middle- and high-income households have plenty of financial firepower to unleash that demand. Quite simply, they just need a safe place to spend all that money.

Eye-Popping Retail Sales Launch a New Year

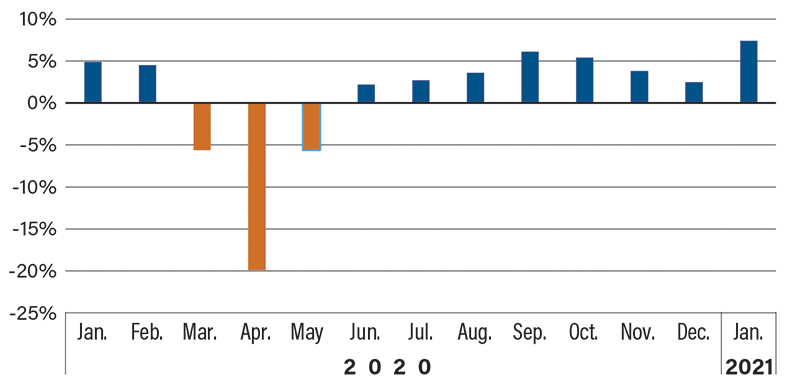

Retail sales turned the corner with the New Year, soaring beyond expectations as they posted their first month-to-month gain in four months. January sales surged 5.9 percent thanks to stimulus-supported income. Gains were widespread, led by 23.5 percent growth at department stores and double-digit gains at electronics, appliance and furniture stores along with nonstore retailers. No major segments posted declines. Year-over-year growth jumped to a stunning 7.4 percent in total. Historically, January is one of the slowest months of the year.

Online sellers are big winners, taking shares from brick-and-mortar stores at a much more rapid rate than prior to the pandemic, especially hurting sellers of apparel. The retail sector outlook is mixed. More stimulus is a clear plus. However, at some point re-openings could become a negative for retail as they facilitate a shift in spending back toward services.

Retail Sales (Year-over-Year)

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Retail Sales (Jan.) (MoM) | -1.4% | 1.0% | 5.9% |

| Durable Goods Orders (Jan.) (MoM) | 0.5% | 1.1% | 3.4% |

| Real Gross Domestic Product (Q4) (2nd Est.) | 33.4% | 4.2% | 4.1% |

Key Interest Rates

| 3/1/21 | 2/22/21 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.11% | 0.11% | -- |

| 3-mo. Libor | 0.18% | 0.18% | -- |

| 2-yr. UST | 0.14% | 0.11% | 0.03 |

| 5-yr. UST | 0.75% | 0.61% | 0.14 |

| 10-yr. UST | 1.44% | 1.37% | 0.07 |

| 30-yr. UST | 2.17% | 2.19% | -0.02 |

Rate Forecast - Futures Market

| Q1-21 | Q2-21 | Q3-21 | Q4-21 | |

|---|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | 0.25% | 0.25% |

| 1-mo. Libor | 0.10% | 0.10% | 0.10% | 0.10% |

| 3-mo. Libor | 0.20% | 0.20% | 0.20% | 0.20% |

| 2-yr. UST | 0.20% | 0.30% | 0.30% | 0.40% |

| 5-yr. UST | 0.50% | 0.60% | 0.60% | 0.70% |

| 10-yr. UST | 1.00% | 1.10% | 1.20% | 1.30% |

| 30-yr. UST | 1.80% | 1.90% | 2.00% | 2.10% |