Natural Gas, Power Prices Expected To Increase Through 2022

Natural gas prices have jumped recently due to several factors, pushing up wholesale power prices, and by extension, electric cooperative operating costs. This situation is expected to continue through the year, according to Jan Ahlen, CFC’s vice president of utility research and policy.

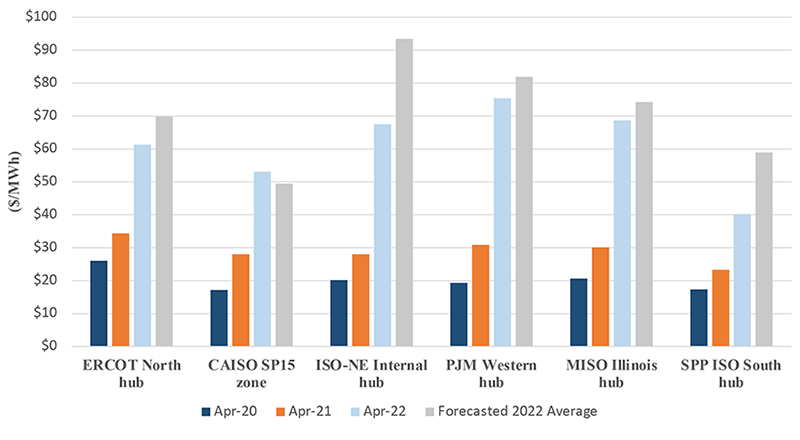

“Except in California, wholesale power prices in each region of the country still have a good amount of room to go higher before reaching the U.S. Energy Information Administration’s (EIA) forecasted average price for this year,” Ahlen said. “Cooperatives should prepare to pay higher prices for wholesale power for the rest of 2022, and may need to adjust their rates accordingly.”

Wholesale Power Prices

The jump in the price of natural gas is the main reason for increasing power prices.

“Given that natural gas is the largest electric generation source, power prices are strongly influenced by natural gas prices,” Ahlen said. “Natural gas prices edged higher toward the end of 2021, and has continued through this year.”

In May, the Henry Hub day-ahead natural gas price averaged $8.07 per million British thermal units (MMBtu), which was nearly 2.8 times the May 2021 average of $2.91/MMBtu. EIA expects spot prices to continue rising, averaging $8.59/MMBtu in the second half of this year. NYMEX futures contracts for Henry Hub Natural Gas are currently trading in the $8-$9/MMBtu range until March 2023.

“Natural gas prices could rise significantly above forecast levels if summer temperatures are hotter than assumed in EIA’s forecast and electricity demand is higher,” Ahlen added.

The jump in natural gas prices is caused by several factors, including higher U.S. electricity demand as consumption patterns continue to return to pre-pandemic levels, as well as the war in Ukraine.

Higher U.S. Electricity Consumption

This summer, EIA expects total U.S. retail sales of electricity to end-use customers to be 0.4 percent higher than last summer. Lower forecast residential usage resulting from milder expected temperatures is more than offset by increasing consumption in the commercial and industrial sectors.

In 2023, U.S. power consumption is expected to continue to increase due to general economic growth, as well as increased electrification of the economy—especially in buildings and transportation (i.e., electric vehicles). EIA is forecasting a consumption increase of 0.7 percent in the residential sector and 0.2 percent in the commercial sector compared with 2022 levels, and a jump of 2 percent in industrial electricity consumption.

Ukraine War

Perhaps the biggest impact on natural gas prices recently has been the war in Ukraine. In response to the war, Europe Union countries have been trying to replace Russian natural gas, which makes up more than 40 percent of their natural gas consumption, with liquefied natural gas (LNG) imports from other countries. The United States is seeing the bulk of that demand, with EIA forecasting U.S. LNG exports to average an equivalent of 12 billion cubic feet per day (Bcf/d) this year, a 23 percent increase from 2021.

That demand has caused a strong, upward swing on swap prices for LNG, and has led to higher U.S. exports of natural gas, which has boosted both spot and futures prices in the United States and around the world.

For example, LNG cargoes in East Asia sold for an average of $23.51/MMBtu in the week ending May 19. At the Title Transfer Facility (TTF) in the Netherlands, the LNG spot market in Europe, the average was $28.11/MMBtu. Those prices were nearly three times the level in the same week last year, when East Asia was at $9.48/MMBtu and TTF was at $9.17/MMBtu.

“U.S. natural gas prices have been responding very aggressively to increased demand pressures for U.S. exports, and to the general uncertainty as to how long the U.S. will need to be exporting LNG at historically high levels,” Ahlen said.

The increased demand is, however, pushing up U.S. gas production, with EIA forecasting dry natural gas production to average 96.7 Bcf/d this year, which would be 3.2 Bcf/d more than in 2021. Production is expected to jump to an average of 101.7 Bcf/d in 2023.

“The increased production is expected to eventually push down gas costs, with EIA forecasting that prices of domestic natural gas will start moving to more historically normal levels of $3 to $4 per MMBtu toward the middle of 2023,” Ahlen said. “This is also shown by the NYMEX futures curve.”

Ahlen concluded, “In the meantime, electric cooperatives should prepare to pay higher prices for natural gas generation and perhaps should explore fuel switching options, if possible.”