Market Constraints Sustain Higher Renewable PPA Prices

Demand for renewable power purchase agreement (PPA) contracts has been very strong in recent years. However, with supply chain, interconnection and transmission constraints, these hopeful buyers were competing for a limited number of higher-cost projects, driving up prices for wind and solar over the last three years.

“With no signs that these market constraints and high prices will ease in the near future, market participants are skeptical that PPA prices will return to their pre-pandemic levels,” CFC Energy Industry Analyst Chris Whittle said. “A higher-priced environment for PPAs could push would-be buyers to look for more economical ways of meeting their renewable goals.”

The U.S. saw PPA dealmaking slow in the third quarter of 2023, with renewable buyers investigating other avenues for meeting their renewable energy goals, according to LevelTen Energy.

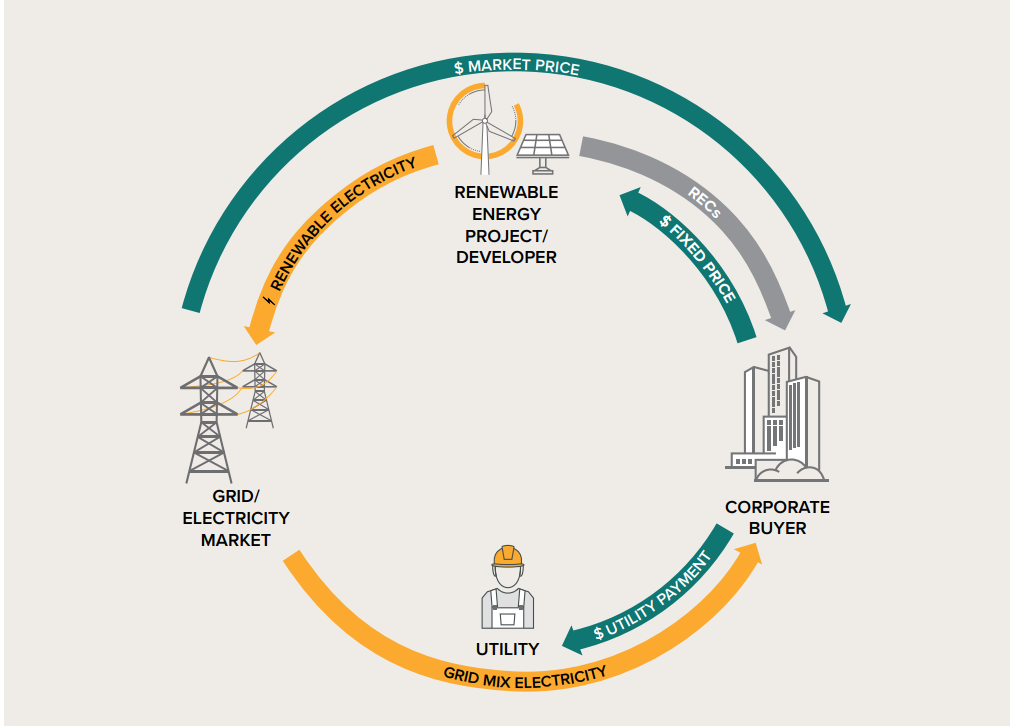

“Tax equity and credit transfers, including direct-pay options, seem to be favored alternatives,” Whittle said. “Some corporate buyers are even exploring virtual PPAs (VPPAs).”

The Complete Picture of a VPPA Transaction

Source: Rocky Mountain Institute

Solar PPA prices dropped over the second quarter of 2023 for the first time in more than three years, following a strong start to the year for solar component imports. This gave many in the utility industry hope that prices would begin to decline.

“Despite the hope, it did not last long,” Whittle said. “Solar PPA prices increased more than 4% over the third quarter and are up more than 21% compared with last year, crossing the $50/MWh threshold for the first time.”

Prices in most markets remained relatively flat over the third quarter, but significant increases in PJM and SPP were enough to move the market-averaged prices higher, according to LevelTen Energy.

Renewable PPA Prices — Market Averaged National Index

Source: LevelTen Energy

Wind PPA prices fell by almost a percent over the third quarter to $57.51/MWh, but are still largely elevated compared with last year, up almost 16%. Prices remained stable in most markets. However, a significant decline in prices in SPP helped lower the market-averaged prices, according to LevelTen Energy.

“Local policies and market conditions largely drive the cost of renewable development, causing prices to vary widely by region,” Whittle explained. “In some instances, this makes VPPAs a viable option for corporate buyers looking to meet their renewable energy goals.”

A VPPA is a contract that provides financial hedging but does not involve the physical transfer of energy due to geographic constraints. A corporation looking to increase its renewable portfolio, instead of using a solar PPA in PJM at an average cost of $72/MWh, might explore a wind VPPA in SPP where it’s less than half the price, according to LevelTen Energy. The corporation pays a fixed price for the VPPA, and even though it doesn’t receive the physical electricity itself, it receives the Renewable Energy Credits and the floating market price of the electricity sold.

“As the industry continues to grapple with adverse market constraints, participants will have to explore a wide variety of options in order to determine what’s best for them,” Whittle concluded.