What Electric Cooperative Leaders Need To Know About SMRs

The potential of Small Modular Reactors (SMRs) is gaining traction as a technology that could reshape the U.S. energy landscape. Understanding SMRs’ opportunities and challenges is essential for strategic decision-making at electric cooperatives. SMRs promise to enhance energy diversification, improve grid stability and support low-carbon initiatives, but their commercial deployment remains in the early stages and uncertain.

What Are SMRs, How Do They Differ from Microreactors?

SMRs are advanced nuclear reactors designed to generate up to 300 megawatts (MW) per module. Their compact, modular design allows for factory fabrication, which reduces on-site construction time and cost uncertainties. Unlike traditional large-scale nuclear reactors, SMRs offer incremental scalability, meaning additional modules can be deployed as energy demand grows.

Microreactors, on the other hand, are an even smaller class of advanced nuclear reactors, typically producing 1 to 20 MW of power. While SMRs are designed to provide reliable, low-carbon baseload power for utility-scale applications, microreactors are geared toward specialized uses, such as remote military installations, industrial sites or emergency backup power. The key differences between the two include:

- Size and Output: SMRs generate significantly more power than microreactors, making them more suitable for cooperative-scale deployment.

- Use Cases: Microreactors are typically used in off-grid applications, while SMRs are designed to integrate into the existing power grid.

- Deployment Time: Microreactors, due to their smaller size and simpler design, can be deployed more quickly and with fewer regulatory hurdles.

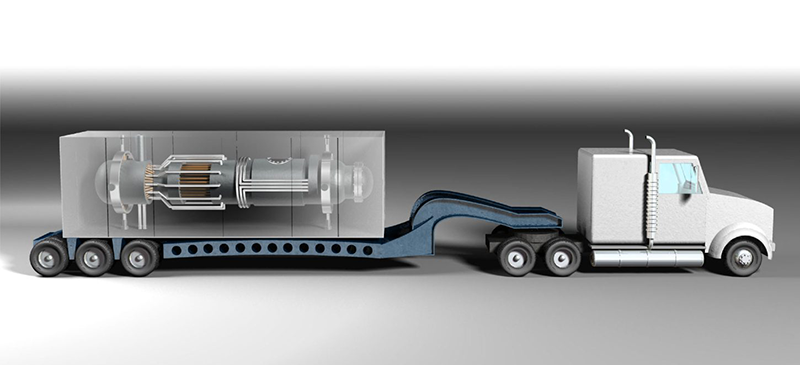

Idaho National Laboratory rendering of a microreactor.

Idaho National Laboratory rendering of a microreactor.

Market Developments and US Government Support

The U.S. is actively investing in SMR technology, with federal initiatives accelerating research, development and regulatory approval:

- Regulatory Advances: The U.S. Nuclear Regulatory Commission (NRC) has updated its licensing framework to accommodate SMRs, streamlining approvals and reducing barriers to market entry. However, critics claim that more could be done.

- Federal Funding and Incentives: The U.S. Department of Energy (DOE) has committed significant funding to support SMR development through the Advanced Reactor Demonstration Projects initiative. On March 24, DOE reissued a $900 million funding solicitation to support the development of Generation III+ SMRs.

- Demonstration Projects: While no SMRs are operational in the U.S., several projects are at different stages of early development. The Tennessee Valley Authority has committed to being a fast follower of an SMR project at Ontario Power. Ontario Power is working with GE Hitachi to build an SMR that is scheduled for commercial operation by 2029, with all units online in the mid-2030s. When the four units are fully operational, they are expected to generate 1,200 MW.

- Operational SMRs:

- Russia’s Akademik Lomonosov, a floating nuclear power plant, has been operational since 2019, providing power and heat to the Arctic port town of Pevek. It was constructed using two reactors from an icebreaking ship.

- China’s Shidao Bay SMR, a 200 MW high-temperature, gas-cooled reactor, was connected to the grid in 2022.

- Under Construction:

- China’s Linglong One (ACP100), a 125 MW pressurized water reactor, began construction in 2021 and is expected to be completed by 2026, serving electricity, heating, steam and desalination needs.

- Development and Planning:

- Over 80 SMR designs are currently in development across 18 countries, with nations such as Canada, the United Kingdom and Japan actively pursuing projects. The International Atomic Energy Agency notes four SMRs in advanced construction stages in Argentina, China and Russia, with ongoing research in several emerging nuclear energy nations.

The Role of SMRs in Supporting Data Centers

A growing area of interest for SMR deployment is the data center sector. As energy-intensive facilities that require continuous power, data centers are seeking low-carbon solutions to reduce emissions while maintaining operational reliability. SMRs could provide a steady and scalable power source for these facilities, opening opportunities for cooperatives to form energy partnerships with data center operators. However, headlines around the applicability have little relation to the current market of SMRs.

Challenges and Considerations

Despite their promise, SMRs face several hurdles:

- High Initial Costs: While modular construction is expected to reduce expenses over time, upfront capital requirements remain significant.

- Regulatory Complexity: Navigating nuclear certification processes can be time-intensive and require specialized expertise.

- Public Perception and Workforce Development: Addressing community concerns about nuclear energy and ensuring a skilled workforce for SMR operations are critical factors for successful deployment.

SMRs represent a compelling opportunity to enhance energy reliability and sustainability. While challenges such as high costs and regulatory requirements persist, ongoing government support and technological progress are making SMRs an increasingly plausible future option for the grid.