Don Spotlights Economy, Opportunities for Co-ops

CFC CEO Andrew Don shared his perspectives on global economic volatility, the coming opportunities for electric cooperatives to benefit from building renewable generation and the latest news on environmental, social and governance (ESG) investing in his 2022 CFC District Meeting remarks.

Before highlighting the electric cooperative network’s opportunities, Don recapped how almost every single economic consensus forecast over the past 18 months was wrong. From the Federal Reserve’s transitory inflation call, its expected gradual increase in short-term interest rates and the global supply chain improving this summer to continued economic growth and labor participation returning to pre-pandemic levels—forecasters missed the mark.

“The Fed’s call was well behind the curve and massively off base,” Don said. “Inflation was not transitory. The Fed has raised the overnight funds rate by 75 basis points three times and has raised rates in nine months to a level higher than had been forecasted for the end of 2024. The Fed is playing catch-up and has conceded that it may not pull off the soft landing it was aiming for.”

Don described how China’s zero-COVID policy caused more closed factories, resulting in a continued disruption of the global supply chain. The outlook for a return to semblance of supply chain normalcy is now expected in the first half of 2024. While the National Board of Economic Research has not officially stated that the U.S. economy is in recession, the probability for one has gone up significantly over the last six months.

“Even with all of these economic challenges, the utility industry, and especially the electric cooperative network, is well prepared to weather them,” Don explained. “Although the risk of a U.S. recession has increased, I have extreme confidence our network’s financial and operational strength will enable us to take advantage of the coming opportunities, overcoming rising costs, labor shortages and supply chain challenges over the next several years.”

Federal Incentives Now Available to Cooperatives

One of the opportunities Don discussed was the amount of federal incentives available to address the U.S. economy’s continued transition to lower carbon emissions.

“I would like to congratulate and thank Jim Matheson and the NRECA team on their hard work to encourage Congress to pass the Inflation Reduction Act (IRA) that calls for direct-pay incentives for cooperatives while also not mandating reductions in carbon dioxide emissions or requiring the closures of existing power plants,” Don said.

He noted investors and rating agencies are taking notice of the potential for the utility industry—and electric cooperatives specifically—to increase capital expenditures because of the new federal incentives and other investment needs. Fitch Ratings, one of the agencies that covers CFC, recently shared its perspective on the IRA and, specifically, what the introduction of direct-pay tax credits could mean for the public power sector.

“Fitch sees the potential for increased capital spending, spurred on by the tax credits, will drive increased borrowing,” Don said. “The good news is increased debt-funded capital spending by public power utilities is unlikely to materially weaken the network’s credit quality.”

While the new direct-pay incentives may be tempting, Don cautioned, cooperatives should not build renewable generation or take unreasonable risks with new, cleaner power technologies, unless they meet a member need.

“Each generation and transmission (G&T) and distribution cooperative will need to consider what is best for their members and make investment decisions that ensure—that we as a network—continue to provide affordable, reliable and sustainable power to our members,” Don explained.

More Debate About ESG Investing

While there have been some contrarian perspectives on the benefits of environmental, social and governance (ESG) investing on corporate profits, business valuations and on society in general, Don noted, ESG investing has not changed materially over the last couple of years.

Those perspectives are pushing some ESG proponents to take a more pragmatic approach. BlackRock CEO Larry Fink has struck a more nuanced note compared with last year.

“Fink is adding a level of pragmatism to his prior dire warnings to business leaders,” Don said. “This new conciliatory tone is based on the realization that countries must be able to provide affordable, reliable and sustainable energy, and fossil fuels will need to play an important role for power generation and heating for years to come.”

This new approach has not stopped critics from launching their own investment alternatives to BlackRock’s managed ESG funds. The goals of these types of funds are to remove the politics, or perceived left-leaning ESG priorities, from corporate decision-making and push companies to focus on making the right business decisions, which is the most integral part of their fiduciary duty to their shareholders.

“While most of us would agree on removing roadblocks for companies reliant on the production and/or usage of fossil fuels over the next five to 10 years, the overall market continues to move away from investing in companies associated with fossil fuels,” Don said. “These conversations and contrarian points of view are healthy and help ensure more voices are heard as markets digest news.”

Proposed SEC Climate Risk Disclosure

Earlier this year, the U.S. Securities and Exchange Commission (SEC) proposed requirements for companies to disclose information about climate-related risk, such as drought, wildfires or market shifts, that are likely to have an impact on their business, as well as climate goals or planning processes that the company has developed in response to climate risks.

Don put these proposed requirements in context. No matter the outcome, having this conversation now is important as the SEC considers new policies and regulations affecting reporting requirements that may impact electric cooperatives either directly or indirectly through their commercial and industrial members.

*As of May 31, 2022.

*As of May 31, 2022.

“It is important to have an ongoing and proactive dialogue with your members to understand their ESG reporting requirements, goals and how G&T and distribution cooperatives can meet those needs,” Don said. “Despite some pushback on the acceleration to ESG investing, it is not going away.”

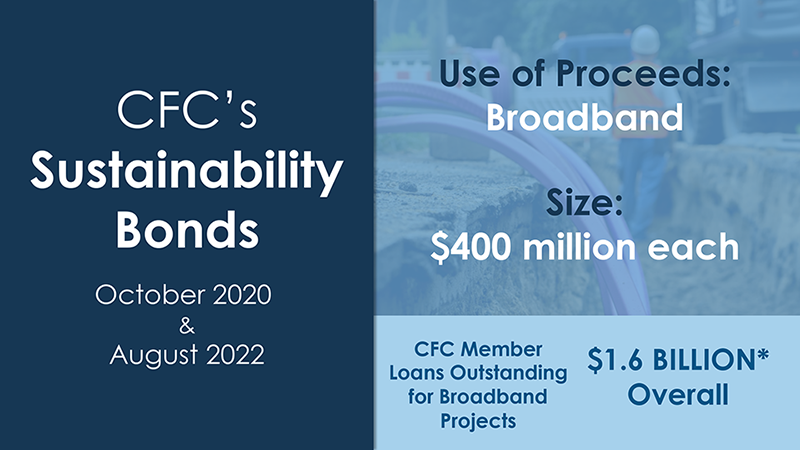

He used CFC’s two sustainability bonds as examples of the great initiatives electric cooperatives throughout the network are pursuing to improve life in rural America. CFC issued these bonds because there was market demand and it made good business sense for CFC, its members and their communities.

“Despite current economic volatility, we see opportunities for the electric cooperative network,” Don concluded. “I see a bright future as we continue to expand access to high-speed broadband and build renewable generation that delivers on our mission to provide affordable, reliable and sustainable power to our member-owners.”