Eyes on the Economy: Services Sector Stagnation, Trade Deficit, Job Growth

Services Sector Nearly Stagnates in July

The U.S. services sector unexpectedly almost reached stagnation in July. The Institute for Supply Management’s (ISM) Purchasing Managers Index came out at 50.1, down from June’s 50.8. A reading of over 50 indicates expansion while a reading below 50 means contraction. The subindices for business activity (52.6) and new orders (50.3) remained in growth territory, though both declined from the previous month. The employment subindex fell further into contraction at 46.4, marking the fourth decline in five months. The price subindex surged to 69.9, the highest level since October 2022, raising concerns about inflationary pressures. Supplier deliveries slowed slightly, while inventories and inventory sentiment showed modest expansion. Notably, export and import indexes turned negative, with respondents pointing to tariff impacts on global trade. While weather and seasonal factors weighed on growth, ISM Chair Steve Miller noted that continued business activity and orders underscore the sector’s resilience despite rising costs and labor market weakness.

US Trade Deficit Shrinks to 21-Month Low in June

The U.S. trade deficit narrowed sharply to $60.2 billion in June, driven by a major decline in consumer goods imports, while the trade gap with China fell to its lowest level in over 21 years. The data reflect the growing impact of President Trump’s broad tariffs on global trade flows. This marks a notable improvement from May’s revised $71.7 billion shortfall and beat market expectations of $61.6 billion. Imports fell 3.7% to $337.5 billion, the lowest level since March 2024. Exports also slipped, down 0.5% to $277.3 billion, the weakest since January.

The smaller trade deficit was a major contributing factor in the rebound of Gross Domestic Product to 3% in the second quarter. It marked a reversal from the first quarter, when a surge in imports—spurred by efforts to get ahead of the tariffs—weighed on growth.

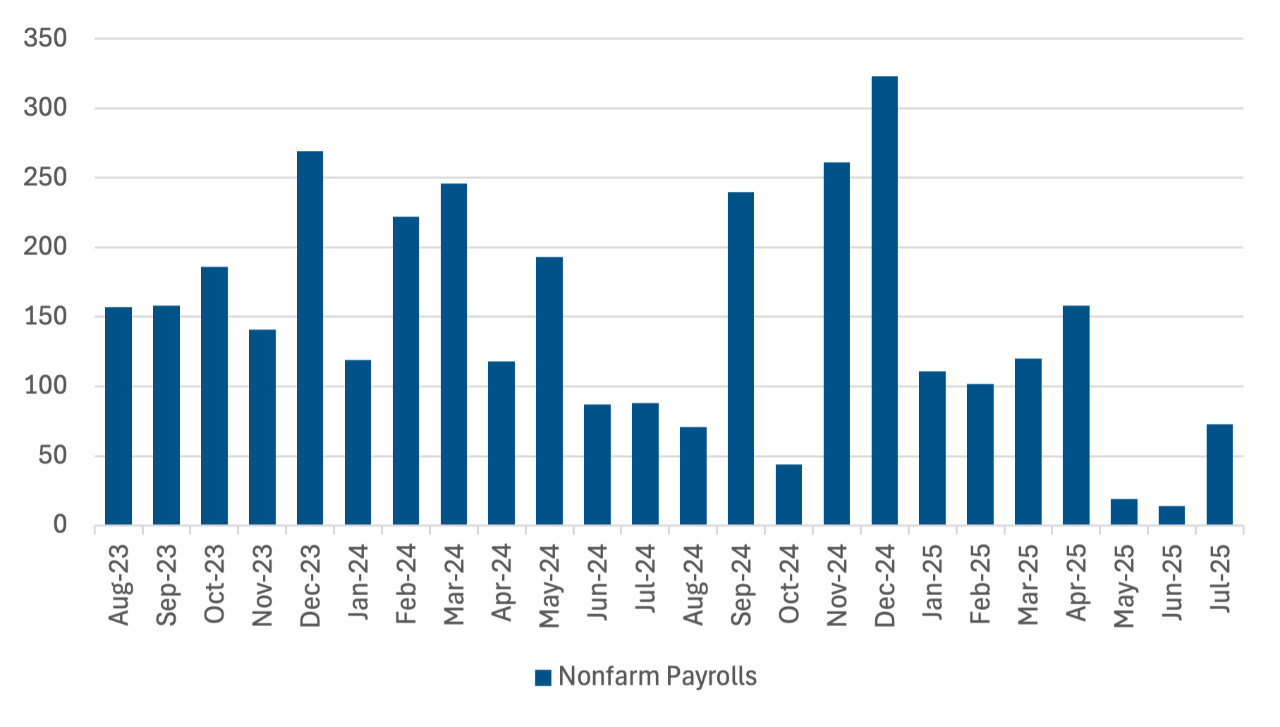

Job Growth Slows Sharply in July Amid Downward Revisions

The U.S. economy added 73,000 jobs in July, falling well short of market expectations for 110,000 jobs gained and pointing to a notable weakening in the labor market. June’s job growth was revised dramatically downward—from 147,000 to only 14,000—while May’s figure was cut by 125,000. These revisions indicate employment in May and June was 258,000 lower than initially reported. In July, health care and social assistance continued to drive job growth. However, other major sectors saw little change. Federal government employment declined by 12,000 and has dropped 84,000 since January.

The unemployment rate edged up to 4.2%, in line with forecasts. In July, the number of unemployed workers increased by 221,000. Employment fell by 260,000 and the labor force decreased by 38,000. The labor force participation rate dipped to 62.2%, the lowest since November 2022. Meanwhile the employment-population ratio dropped to 59.6%. Despite the weak job growth, average hourly earnings rose 3.9% year-over-year, the strongest gain in four months, beating the forecast rate of 3.8%. The acceleration of wage inflation suggests the overall inflationary pressure on workers, not labor demand, is the driving factor.

Job Growth Has Slowed Significantly

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| ISM Services PMI (July) | 50.8 | 51.5 | 50.1 |

| U.S. Trade Balance (June) | ($71.7B) | ($61.6B) | ($60.2) |

| Nonfarm Payrolls (July) | 14K | 110K | 73K |

| Average Hourly Earning (July)(YoY) | 3.8% | 3.8% | 3.9% |

Key Interest Rates

| 8/4/25 | 7/28/25 | Change | |

|---|---|---|---|

| Fed Funds | 4.50% | 4.50% | --- |

| 2-yr. UST | 3.68% | 3.93% | (0.25) |

| 5-yr. UST | 3.74% | 3.98% | (0.24) |

| 10-yr. UST | 4.20% | 4.42% | (0.22) |

| 30-yr. UST | 4.80% | 4.97% | (0.17) |

Rate Forecast — Futures Market

| Q2-25 | Q3-25 | Q4-25 | Q1-26 | |

|---|---|---|---|---|

| 4.25% | 3.75% | 3.75% | 3.50% | |

| 3.71% | 3.58% | 3.50% | 3.45% | |

| 3.91% | 3.82% | 3.77% | 3.74% | |

| 4.29% | 4.23% | 4.20% | 4.18% | |

| 4.75% | 4.69% | 4.66% | 4.62% |