Economic Analysis of the 2023 KRTA Results

Electric Cooperatives Remain Resilient in a Stubborn-Inflation, High-Rate Environment

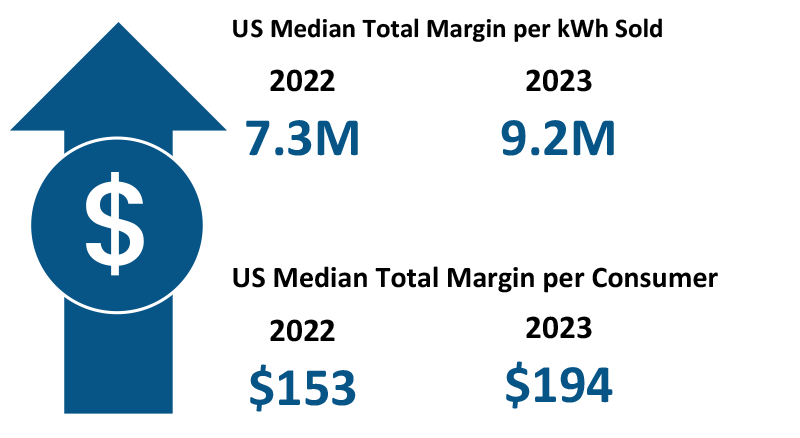

The economy, as well as the utilities industry, has faced many headwinds in the past few years, from broken supply chains and labor shortages to stubborn inflation and elevated interest rates. Emerging from strains caused by the pandemic, electric cooperatives have navigated a new economic environment where inflation has proved persistent and interest rates have shifted and stayed higher for longer. Amid slower consumer growth and declining equity ratios, cooperatives saw improved margins in 2023 after a decline in 2022. Note that the data reported below reflect median trends.

SOURCE:

Inflationary Pressure Still Impacts Operating Expenses

Although inflation decelerated in the overall economy, inflationary pressures faced by electric cooperatives were more of a mixed story in 2023. On the positive side, as energy commodity prices moderated, median power cost posted a year-over-year decline, stabilizing the median total cost of electric service per kWh sold, which saw little change between 2022 and 2023. Conversely, median total cost of service, excluding power cost, accelerated drastically from 0.8% in 2022 to 8.9% in 2023. This suggests that easing inflationary pressure was driven mostly by the decline in power cost, making any upside shock to energy commodity prices a greater risk to cooperatives. However, power costs were still higher than pre-COVID—despite the decrease from 2022—so there is still room for further declines. If the trend continues, cooperatives may see less pressure on total cost of service.

On the other hand, a slump in median sales growth and slow consumer growth made inflationary pressure on operating expenses challenging to manage. Median operating expenses per kWh sold increased 2.7% in 2022 and then accelerated to 7.7% in 2023, as median kWh sales growth declined while total costs remained elevated. Meanwhile, growth in median operating expenses per consumer eased from 7.3% in 2022 to 4.4% in 2023, reflecting slow consumer growth accompanied by stabilizing, but elevated, total cost.

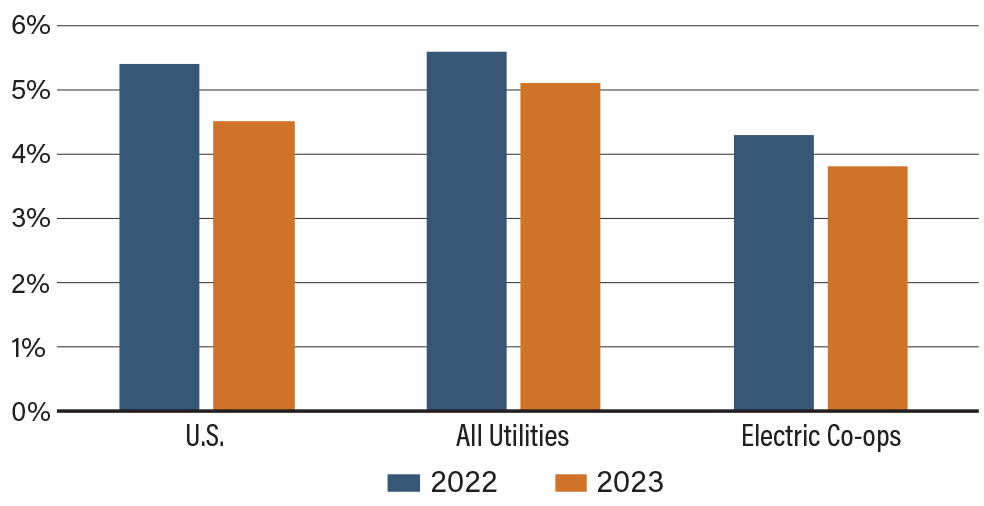

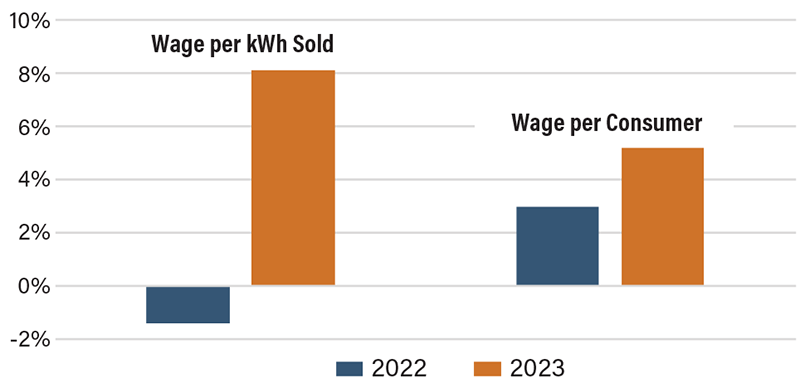

Median wage inflation decelerated from 4.3% in 2022 to 3.8% in 2023. Note that wage inflation has been lower in cooperatives than the national average and the overall utilities industry. Nonetheless, a drop in median sales growth and slow consumer growth impacted labor cost efficiency. Even though median wage inflation decelerated, median wage per kWh sold accelerated to 8.1%, and median wage per consumer moved to 5.2% in 2023.

In spite of the challenges, stabilizing total costs—thanks to declining power costs—led to improved median operating margins.

Wage Inflation Is Lower in Cooperatives

SOURCE: 2023 KRTA reports.

Unit Wage Cost Accelerates in Cooperatives

SOURCE: 2023 KRTA reports.

Cooperatives Have Successfully Managed in High-Rate Environment; Risk Management Must Not Be Overlooked

As a capital-intensive industry, utilities are vulnerable to fluctuations in interest rates. Since the Federal Reserve began raising its policy rate, interest rates have risen significantly across maturity terms. Short-term rates move more in lockstep with the federal funds rate, while long-term rates have seen more fluctuations since 2022, making financial planning with long-term rates more challenging. Despite the high-rate environment, cooperatives maintained a resilient position thanks to continued affordable access to capital from reliable sources such as CFC.

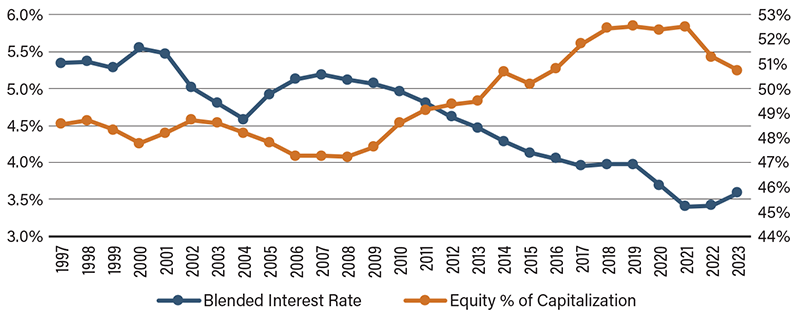

Although benchmark rates, such as the 10-year U.S. Treasury yield, had pushed above 4%, median blended interest rates—effectively, the borrowing cost—of cooperatives rose from 3.42% in 2022 to only 3.59% in 2023 and remained well below pre-COVID levels. This reflects the relief driven by loans originated in the extremely low-rate environment between 2020 and 2022. However, as interest rates are unlikely to return to the COVID-era levels, or even the immediate pre-COVID levels, cooperatives may expect rising blended interest rates that are driven by two factors: new, larger loan sizes to meet capital needs and higher interest rates. The combination of the two factors may put heavy upward pressure on blended interest rates. Therefore, interest rate risk management must not be taken lightly and there are no grounds for complacency.

Reflecting cooperatives’ resilience in challenging economic times, the median times interest earned ratio (TIER) improved in 2023, as the positive factors in margins outweighed the impact of rising interest rates. Standing at 2.73, median TIER suggests that cooperatives were in a good position to generate earnings to cover interest expenses. Furthermore, the median debt service coverage ticked up to 2.11 in 2023, in line with pre-COVID levels. This suggests that cooperatives were still in a good position to cover principal and interest payments on their debts.

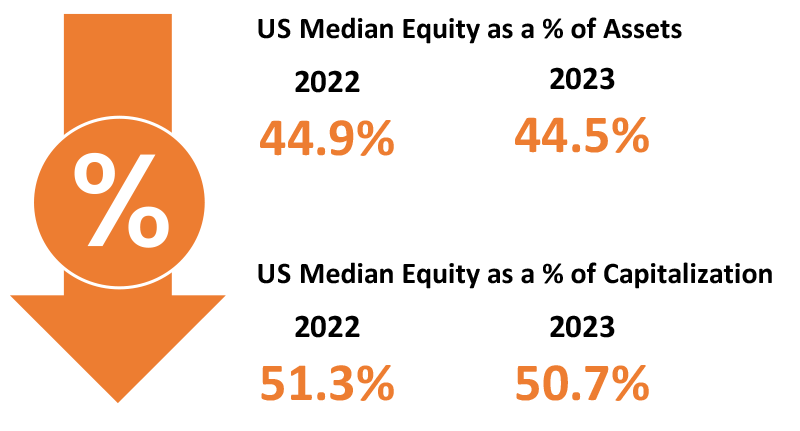

Equity Ratio Declines as Blended Interest Rate Rises

SOURCE: 2023 KRTA reports.

Meanwhile, the median equity level as a percentage of total capitalization had trended down since the Fed began raising interest rates. Standing at 50.75% in 2023, the median equity level was not lower than the historical average. Nonetheless, the downward trend calls for attention to long-term debt.

Overall, cooperatives have maintained resilience in the high-interest-rate environment, but not without challenges. Despite emerging from 2023 in a strong position, cooperatives should not be complacent about uncertainty in interest rates coupled with future capital needs and their potential impact on liquidity.