Eyes on the Economy: Consumer Confidence, Durable Goods, Home Prices

Consumer Confidence Rises

The Conference Board Consumer Confidence Index increased to 102 in May after three consecutive months of declines. The improved confidence was driven by optimism in the labor market although consumers’ assessment of the current business conditions was slightly worse than the previous month. The Expectation Index—a component of consumer confidence—improved from 68.8 in April to 74.6 in May. However, it still marked the fourth consecutive month of the index falling below 80, the threshold signaling a recession ahead. Contrary to consumer expectations, economists do not currently foresee a recession. In a separate survey of CEOs, only 35% anticipated a recession within 12 to 18 months.

Despite improved confidence, consumers continued to believe inflation had the most impact on their view of the economy, and inflation expectations ticked up while interest rates were also expected to increase. In a six-month moving average, confidence is highest among the youngest (under 35) and wealthiest (income over $100K).

Durable Goods Orders Unexpectedly Increase

Durable goods orders increased 0.7% in April, beating market forecasts of a 0.8% decline. Excluding transportation, orders increased 0.4%. Excluding defense goods, there was no gain. The overall gain was largely driven by demand for transportation equipment, followed by computers and electronics, fabricated metal products and machinery. Durable goods orders have posted gains for three straight months.

In dollar value, durable goods orders have been higher than pre-COVID levels. However, it must be noted that orders are measured in current dollar. While seasonally adjusted, values are not adjusted for inflation. Thus, higher values have been largely reflecting high inflation and the steeper prices of goods.

American Home Prices Break Another Record

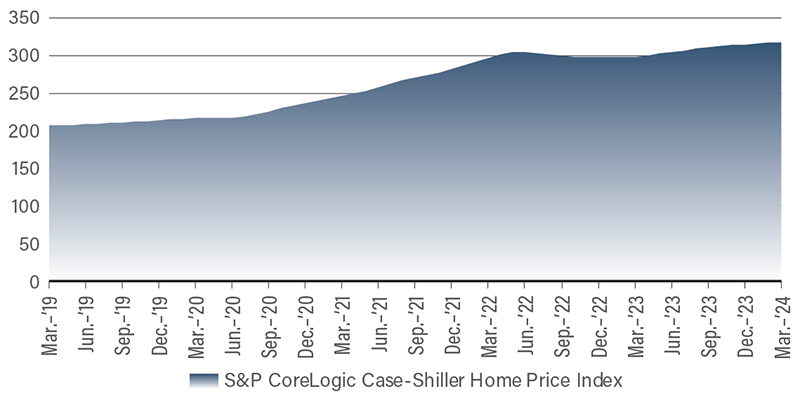

U.S. home prices are showing no sign of slowing down as the S&P CoreLogic Case-Shiller National Home Price Index broke another record in March. Posting an increase of 6.5% year-over-year and 1.3% month-over-month, home prices have broken a new record every month since June 2023. Judging by prices alone, one may see the housing market in a positive light. However, prices have been driven up by supply shortages largely related to the lock-in effect—when homeowners who have locked in low mortgage rates refuse to sell their homes in a high interest rate environment. Until existing owners open up housing supply, home prices are set to continue on an upward trajectory. Meanwhile, monthly existing-home sales fell to 4.14 million in April. Since early 2023, existing-home sales have been far below pre-COVID levels, which often ran well above 5 million each month.

While prices are breaking records and mortgage rates are higher than pre-COVID, demand has not been deterred given the U.S. structure of financing. Home buyers are willing to borrow at high rates knowing that they can refinance when interest rates come down. This reflects broad belief that the Federal Reserve will cut interest rates in the near future.

Home Prices Break Records Every Month Since June 2023

Source: S&P Global.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| The Conference Board Consumer Confidence Index (May) | 97 | 95.9 | 102 |

| Durable Goods Orders (Apr.)(MoM) | 0.8% | (0.8) | 0.7% |

| S&P CoreLogic Case-Shiller Home Price Index (Mar.)(YoY) | 6.4% | N/A | 6.5% |

| Existing-Home Sales (Apr.) | 4.22M | 4.21M | 4.14M |