Eyes on the Economy: Home Prices, Inflation, Job Openings

Small Business Optimism Slightly Improves

The National Federation of Independent Business (NFIB) Small Business Optimism Index ticked up from 89.7 in April to 90.5 in May, a five-month high. However, the index typically ran well above 100 the few years prior to COVID. This is the 29th consecutive month where small business owners expressed low optimism.

Inflation remained the single most important problem in operation identified by business owners. A net 28% of owners reported planning to increase their prices while a net 15% is planning to hire. The NFIB chief economist said inflation has not eased much on Main Street. This struck a different tone in views on the economy compared with Wall Street, where optimism is higher and corporate profits are breaking records. Overall, we have seen an increasing divide in the economy where experiences diverge, particularly related to the impact of inflation.

Unit Labor Cost Rises, Productivity Decelerates

Labor productivity, or output per hour, in the nonfarm business sector rose 0.2% on a quarter-over-quarter basis in the first quarter of 2024, following a 3.5% increase in the final quarter of 2023. Output went up 0.9% while hours worked edged up 0.6%. Meanwhile, unit labor cost—the ratio of hourly compensation to labor productivity—jumped 4%, reflecting a mere 0.2% increase in productivity and a 4.2% surge in hourly compensation. Both output and hours worked in the manufacturing sector decreased 0.2%.

Unit labor cost in the sector rose 3.1%, reflecting an increase in hourly compensation companied by no change in productivity. Overall, high unit labor cost poses a concern on the progress of disinflation. The more it costs to produce one unit, the higher the prices that consumers will face.

Labor Market Remains Strong, Could Delay Rate Cuts

It’s good news and bad news. The good news is the labor market remains strong, adding 272,000 jobs in May, following a downwardly revised job growth of 165,000 in April. May’s reading exceeded forecasts of 185,000. However, the bad news is the strong job growth solidifies the outlook for delayed and slow central bank interest rate cuts.

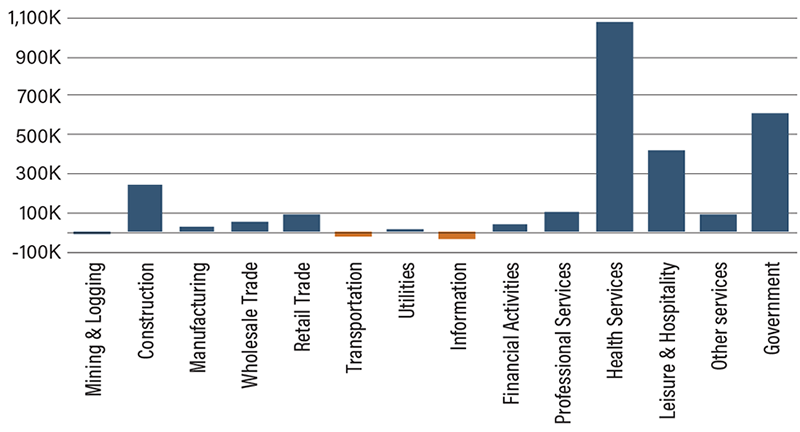

The unemployment rate edged up to 4% for the first time in more than two years. The labor force participation rate edged down from 62.7% in April to 62.5% in May. Meanwhile, wage growth ticked up from 4% to 4.1% after decelerating in the previous three months. While economists claim the job gains in May were broad-based, the 12-month net change paints a labor market where growth has been mostly driven by health services, government and leisure. Over a period of 12 months ending in May, health services accounted for almost 40% of net change in nonfarm payroll, government over 22% and leisure over 15%—that is a total of more than 77% of all net gains. While the labor market isn’t declining, it has decelerated for all but these three sectors—a matter the Federal Reserve should take into consideration.

12-Month Net Change in Nonfarm Payroll

Source: U.S. Bureau of Labor Statistics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| NFIB Business Optimism Index (May) | 89.7 | 89.8 | 90.5 |

| Unit Labor Cost (Q1)(QoQ) | (2.8%) | 4.9% | 4.0% |

| Nonfarm Payroll (May) | 165K | 185K | 272K |

| Unemployment Rate (May) | 3.9% | 3.9% | 4.0% |