Eyes on the Economy: Business Optimism, Consumer Sentiment, Inflation

Business Optimism Climbs

The National Federation of Independent Business Small Business Optimism Index increased to 89.7 in April from a more-than-12-year low of 88.5 in March. Despite the slight improvement, April’s reading marked the 28th consecutive month of running below the 50-year average of 98. Inflation remained the number-one problem for small business owners, with 22% reporting inflation being their single most important challenge in operating their business, followed by labor quality (19%).

A net 26% of owners reported planning price hikes in April. Meanwhile, 56% hired or tried to hire. Of these owners, 91% reported few or no qualified applicants for the opening positions. In the challenging recruiting environment, a net 38% said they raised compensation in April while a net 21% said they planned to raise compensation in the next three months. Overall, cost burdens appear to pose challenges for business owners and consequently impact consumer prices.

Consumer Sentiment Drops to Six-Month Low

Moods turned sour in May as the University of Michigan Consumer Sentiment Index declined to 67.4, well below market forecasts of 76 and marking the lowest in six months. Inflation expectations for the year ahead reached a six-month high of 3.5%, up from 3.2% last month. Meanwhile, the five-year inflation outlook edged up to 3.1%, also the highest in six months.

Views on current economic conditions worsened, moving from 79 in April to 68.8 in May. Expectations also fell from 76 to 66.5 as consumers “expressed worries that inflation, unemployment and interest rates may all be moving in an unfavorable direction in the year ahead.” Recent data of various indicators are pointing to a change in moods—all connected to inflation and its direct impact as well as indirect impact through higher interest rates.

Consumer Inflation Edges Down Slightly

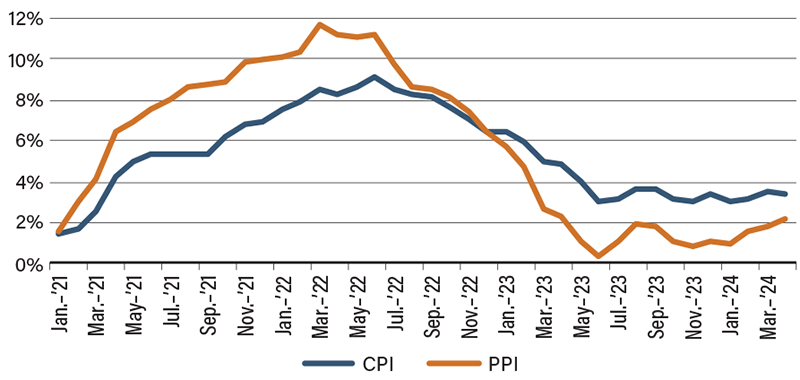

The Consumer Price Index (CPI) increased 3.4% year-over-year in April, slightly below March’s reading of 3.5% and in line with market expectations. Excluding food and energy, core CPI increased 3.6%, down from 3.8% in March. Food inflation held steady at 2.2% while energy inflation accelerated to 2.6% from 2.1%. Shelter, the largest contribution to inflation, increased 5.5%, below March’s reading of 5.7%.

Markets responded very positively to the small movement. Treasury yields immediately declined while stocks rose. The renewed optimism will likely lead financial conditions to loosen up even more, potentially harming inflation progress. Markets now see a higher probability of rate cuts. However, the Fed is not likely to act as rashly.

Meanwhile, the Producer Price Index, which measures wholesale inflation, went up 2.2% year-over-year in April, posting the biggest increase in one year. Excluding food and energy, core wholesale inflation accelerated to 2.4% from March’s 2.1%, marking the steepest rise in eight months. As retailers see fast price increases, the cost burdens will likely be passed on to consumers, adding inflationary pressures in consumer prices.

Wholesale, Consumer Inflation

Source: U.S. Bureau of Labor Statistics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| NFIB Small Business Optimism Index (Apr. 24) | 88.5 | 88.1 | 89.7 |

| University of Michigan Consumer Sentiment Index (May 24) | 77.2 | 76.0 | 67.4 |

| Producer Price Index (Apr. 24)(YoY) | 1.8% | 2.2% | 2.2% |

| Consumer Price Index (Apr. 24)(YoY) | 3.5% | 3.4% | 3.4% |