Why Hasn’t There Been a Recession Yet?

If you’re sipping coffee and reading the current Solutions issue on a Saturday morning, wondering where is this recession everyone has been talking about, you are not alone. Many are asking the same question. There are three domestic factors that explain why we haven’t had a recession yet.

First, COVID changed the world in many ways, one of which is unprecedented backlogs of production. Think of the goods and services that were delayed because of COVID—the vehicles you ordered and received, the events that were postponed, the vacations you rescheduled, etc. There’s simply a lot of catching up to do. In manufacturing, where new orders have declined, production has declined, but thanks to backlog production, the overall decline in manufacturing is less than it would have been otherwise. In services, demand is still elevated and backlogs are still rising as firms struggle to find workers to fulfill commitments. Overall, COVID-induced backlogs have delayed or muted declines in economic activity.

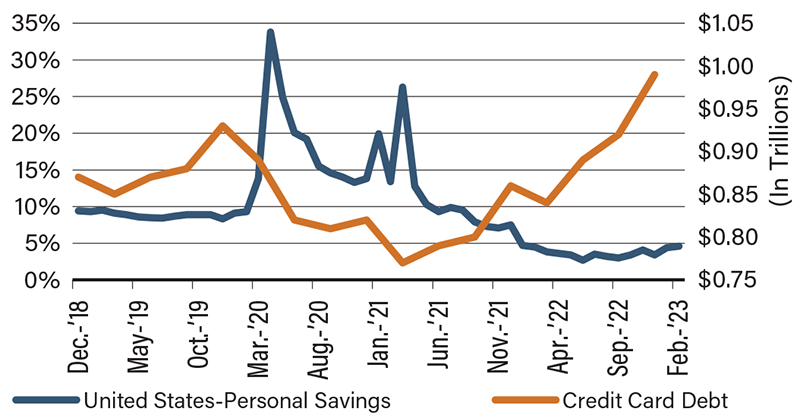

Second, thanks to COVID savings and massive liquidity injections, consumers have been able to resist spending cuts, which would have been the logical response in an inflationary and rising-rate environment. There are, however, early signs of a consumer breaking point as personal saving rates are now running below pre-pandemic levels while credit card debt has hit a new high. The days of consumer resilience may be numbered.

Lastly, U.S. corporations entered this turbulent period in relatively healthy financial conditions. Despite high inflation, corporate profits reached record levels in 2022 thanks to the ability to pass high costs on to consumers. This is about to change. Profits in some sectors will likely decline as consumers are no longer able to foot the high bills.

Overall, these three factors have been sustaining growth and delaying a decline in economic activity, but this won’t last forever. Our economy’s resilience is mostly thanks to the unique—and temporary—conditions created by COVID. Current economic activity is living on borrowed time. Whether we can avoid a recession depends on how soon we can restore price stability before reality catches up.

Is Consumer Resilience About To Break?