Rate Cuts Won’t Bring Back Cheap Credit

A common myth in recent years is that low interest rates are just a Federal Reserve decision away—as if Jerome Powell alone stands between borrowers and cheaper credit. At CFC’s recent economic update sessions, the most frequent question we hear is, “When will the Fed cut rates?” You may be puzzled when the answer is, “Why do you want to know?”

Yes, the Fed may lower rates soon. But that doesn’t necessarily mean your borrowing costs will return to past lows. Structural forces are pushing in the opposite direction. Governments around the world are taking on more debt to fund entitlement programs and military spending while businesses are seeking funding for AI investments and rising operational costs—both fueling an increased demand for credit. At the same time, the pool of savings to finance those loans is shrinking as Baby Boomers retire, pulling their savings out of the markets to support their retirement.

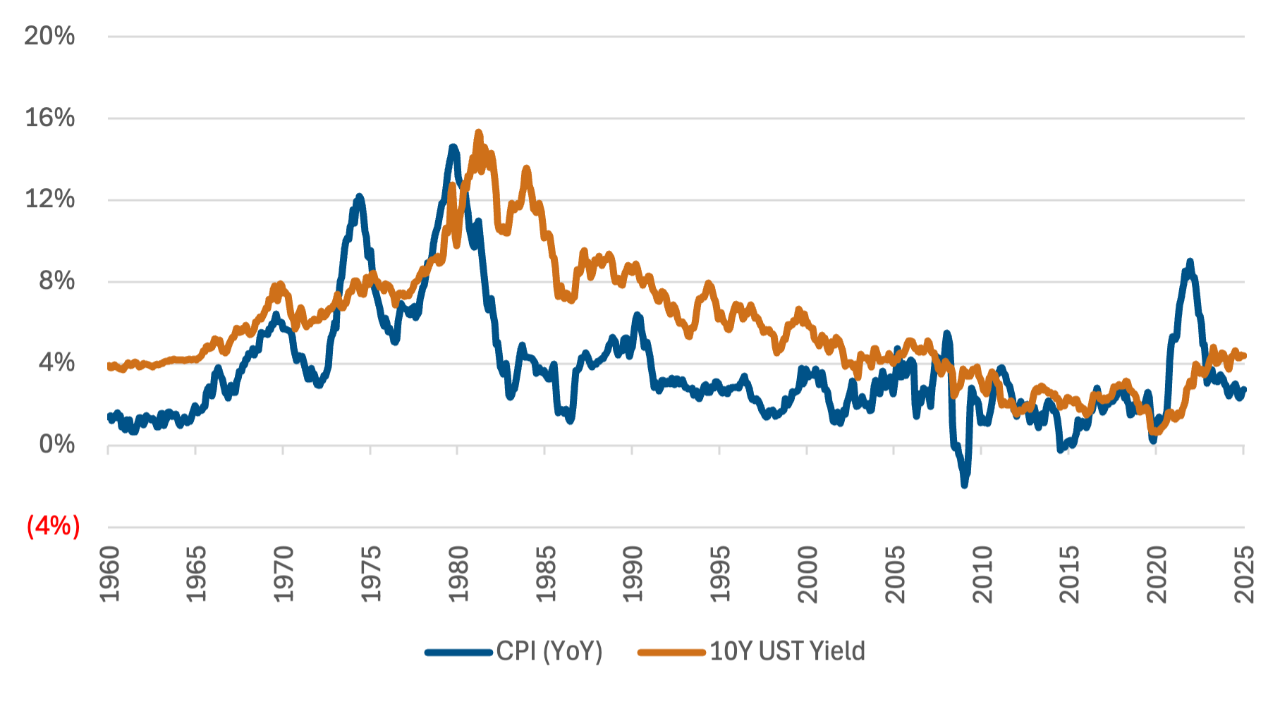

Inflation is another key force keeping interest rates elevated. When inflation runs high, the Fed holds its policy rate up. But even if the central bank cuts the federal funds rate—the overnight rate it directly controls—the effect on overall borrowing costs is likely to be small. Long-term rates are set by the market, not dictated by a single authority. Although the Fed’s policy impacts market expectations, it’s only one of the many factors driving long-term rates. Investors will seek higher returns if they believe inflation will erode the value of their money.

Think back to Econ 101: Prices are driven by supply and demand. In the case of money, the price is the interest rate—what it costs to borrow. The supply comes from savings and investments; the demand comes from borrowing. Right now, borrowing demand is rising while savings are shrinking, especially as retirees pull money from the market. Investors are cautious as well, seeking returns that beat inflation. This imbalance—high demand and low supply—pushes interest up rates. So instead of just asking when the Fed will lower rates, ask the more important question: What conditions would actually make rates fall?

Interest Rates and Inflation Typically Move in the Same Direction

SOURCE: Federal Resersve Bank of St. Louis.