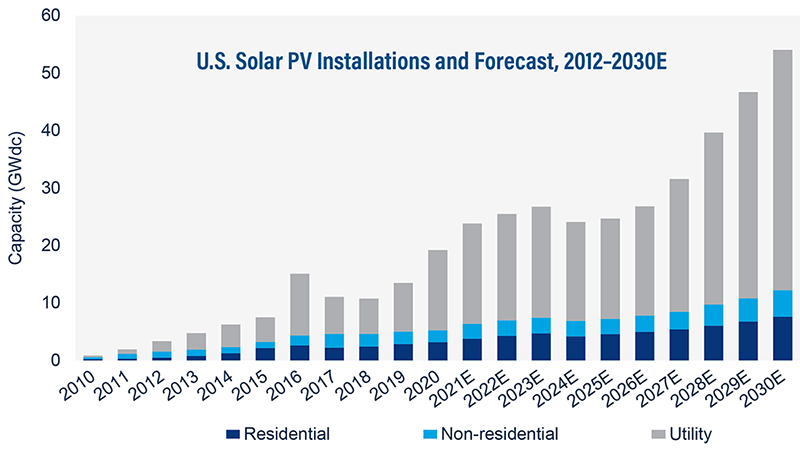

2020 Solar Growth Sets Record, Primed to Quadruple by 2030

A record 19.2 gigawatts-DC (GWdc) of solar capacity was added in the United States in 2020 according to a recent report from the Solar Energy Industries Association and Wood Mackenzie. Additions grew at a 43 percent rate over last year, an impressive feat given the pandemic-related headwinds that slowed down the industry in the second quarter. Importantly, this was the second consecutive year that solar led all other technologies in terms of annual additions, with solar representing 43 percent of new generating capacity in 2020, the industry’s largest share to date.

Source: Wood Mackenzie

Source: Wood Mackenzie

The year was capped off by 8 GWdc in additions in the fourth quarter, a quarterly record, largely driven by the utility-scale market in which developers are working through a massive backlog of projects awaiting interconnection. Utility-scale solar, which accounts for the bulk of the U.S. market, set an annual record with just under 14 GWdc of additions in 2020.

Residential solar also achieved an annual record with 3.2 GWdc in additions, up 11 percent from the prior year. The pandemic severely hampered the residential market during the first half of the year as social distancing, business restrictions and economic uncertainty hurt demand.

“The bounceback in the second half of 2020 can arguably be attributed to high demand for home improvements from motivated customers who were stuck at home,” CFC Energy Industry Analyst Bijan Patala said.

Utility-Scale Solar to Drive Growth, Residential Solar Growth Uncertain

Looking forward, multiple industry forecasters expect the U.S. operating solar fleet to be around four-times as large in 2030 versus 2020.

“The current pipeline of projects combined with multiple external drivers—decarbonization ambitions and coal and nuclear capacity retirements—supports a widely held view that annual solar capacity additions will remain strong through the end of the decade,” Patala said.

Utility-scale solar is expected to remain the primary driver of overall growth in the U.S. solar market through the end of the decade. Utility-scale solar is already a cost-competitive technology in many markets, and continued capital cost declines should offset any impact to economics coming from declining tax credits (the current 26 percent credit eventually declines to a permanent 10 percent credit for any projects not beginning construction by year-end 2023). Moreover, the expansion of decarbonization targets from states, utilities and businesses will largely underpin robust annual growth in utility-scale capacity.

The outlook for residential solar is mixed. Some believe that new types of loan products and tools to engage customers to help them make a solar financing decision will drive continued growth in the segment through the decade. While others expect annual residential solar additions to steadily decline after 2021 due to a comparatively less attractive cost trajectory. Residential solar systems have no federal tax credits available after 2023 (compared with a permanent 10 percent incentive available to utility-scale projects). Installation costs are likely to remain relatively high due to the large proportion of soft costs (e.g., customer acquisition) in residential solar system sales that are unlikely to see any material declines. To date, residential solar capacity has been highly concentrated in a small handful of states, largely driven by generous state-level incentives and favorable net-energy-metering policies.