2023 Power Generation, Natural Gas Costs Expected To Decline

The share of U.S. generation output from renewables, including biomass, geothermal, solar and wind, is set to keep rising in 2023. In the latest release of the Short-Term Energy Outlook, the U.S. Energy Information Administration (EIA) expects renewable sources to provide 24 percent of U.S. generation in 2023, up from 22 percent in 2022, while natural gas and nuclear generation shares remain steady, and coal-fired generation declines due to the expected retirement of a number of units.

Although renewable-installed capacity is increasing, new projects are expected to face hurdles next year. The first is the intermittent nature of renewables and the negative effect on grid reliability. Battery storage systems are being considered in Texas and California to help balance the large volumes of solar and wind power. About 30 GW of battery storage is under development in the two states, but battery storage costs are expected to continue to rise through 2023.

Other issues include interconnection backlogs, supply chain bottlenecks, labor shortages and obstacles facing new transmission lines. More than 32 GW of renewable capacity was delayed since the end of 2021. Of that, 64 percent is solar capacity, 23 percent wind and 13 percent storage.

“While renewable obstacles are sorted out, natural gas has taken a dominant position as a generation fuel,” CFC Senior Energy Industry Analyst Roman Siegert said. “Even though natural gas price volatility has been the norm in 2022, high production levels and reduced demand should help balance the market by the end of this winter. We should see reduced prices starting in the second quarter of next year as the NYMEX contract is expected to lose over a third of its value between winter's peak (normally in January) and the start of the spring injection season in April 2023, according to S&P Global.”

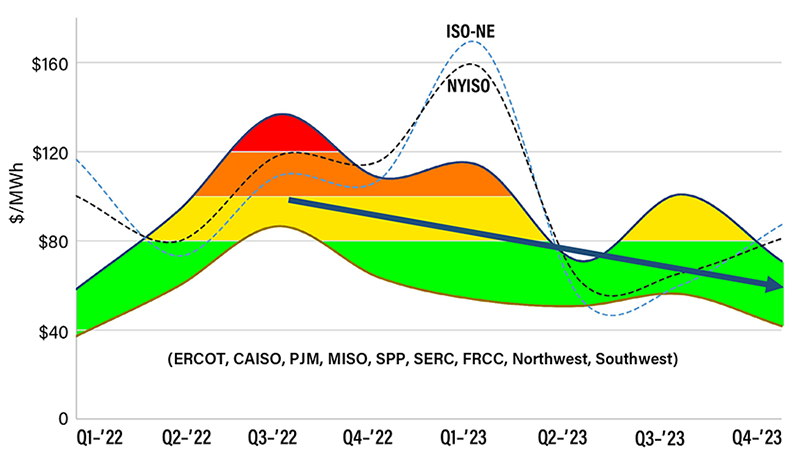

U.S. Electricity Price Forecasts

Source: U.S. Energy Information Administration

Source: U.S. Energy Information Administration

Grouping nine of the main wholesale electricity regional markets (ERCOT, CAISO, PJM, MISO, SPP, SERC, FRCC, Northwest and Southwest) gives a general idea of how U.S. prices will evolve.

“EIA forecasts that wholesale electricity prices will peak in the first quarter of 2023 in these regions,” Siegert said. “On the other hand, ISO-NE and NYISO have somewhat different price trends compared with the regional markets group. The highest wholesale electricity prices are expected in New England due to natural gas pipeline constraints, reduced fuel inventories for power generation and uncertainty regarding liquefied natural gas market dynamics. All in all, EIA data suggest wholesale electricity prices will decrease over the next year from the historical high prices observed last summer.”

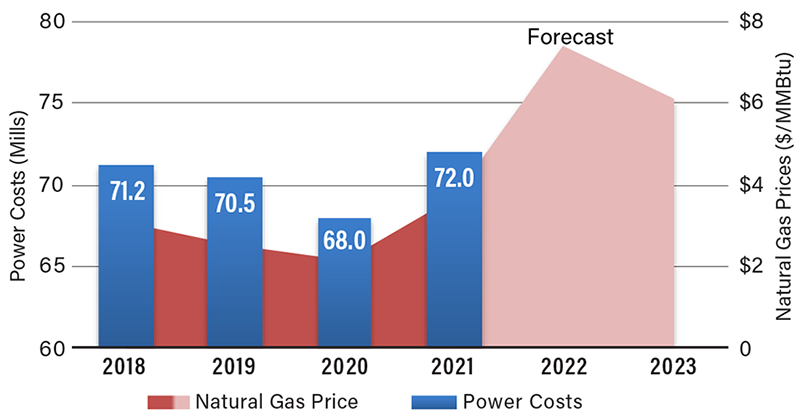

Higher Power Costs Expected for Electric Cooperatives in 2022, Easing in 2023

Sources: U.S. Energy Information Administration; CFC KRTA data

Sources: U.S. Energy Information Administration; CFC KRTA data

As more coal-power generation is retired, distribution cooperative power costs tend to follow natural gas price trends. Power costs are defined as the sum of power production expense, cost of purchased power, transmission expense and regional market operation expense.

“Power costs decreased up until 2020, when the supply chains started to suffer interruptions caused by the pandemic,” Siegert said. “As a consequence, power costs started to increase that year following a surge in fuel prices, mainly natural gas.”

As natural gas prices increased in 2022, so did power costs. Looking forward, EIA expects natural gas prices to decrease in 2023.

“Assuming power costs continue to follow the historical natural gas prices trend, it is expected that power costs will ease in 2023 compared with 2022,” Siegert concluded.