Natural Gas Demand Makes Coal Less Costly for Generators

The steep increase in U.S. natural gas prices in September has made coal a financially attractive fuel for electricity generation around the world. Henry Hub, the most common reference for natural gas pricing and the basis for gas futures contracts traded in the U.S., saw day-ahead natural gas markets clearing at close to $6 per million British Thermal Units (MMBTU) last month, while November 2021 through April 2022 futures were clearing near $6.50 per MMBTU. Both are about 40 percent higher than their August clearing price.

U.S. natural gas prices are being driven by concern about winter supply, liquefied natural gas (LNG) exports and the delay of production coming back online following the pandemic recession, according to IHS Markit’s North American Natural Gas Short-Term Outlook.

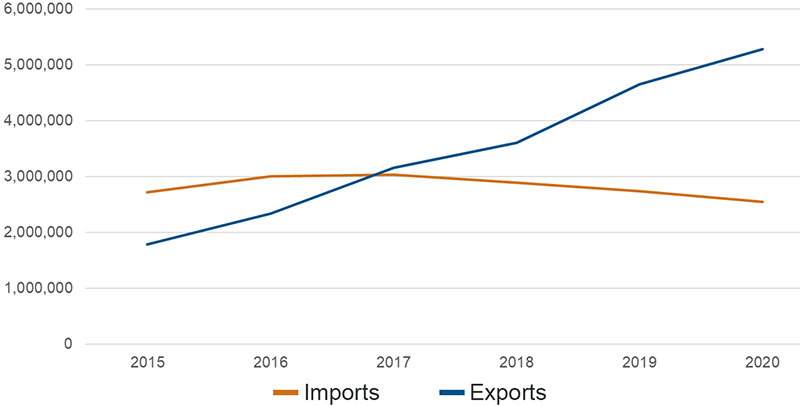

The growth in demand for natural gas in the Lower 48 is due to the increased export of LNG and is expected to continue to increase in the next several years. Export growth is being driven by demand in Europe and Asia following their economic recovery, global LNG supply disruptions, diminished post-winter inventories and unseasonably high natural gas prices, according to the U.S. Energy Information Administration.

U.S. Natural Gas Imports and Exports (million cubic feet)

Source: U.S. Energy Information Administration

Source: U.S. Energy Information Administration

Following the 2020 recession, U.S. energy companies held off investment in natural gas exploration and drilling operations and have been slow to renew their investments according to analysts at Fitch Ratings.

“In competitive organized markets where natural gas tends to set the market price of electricity, cooperatives with short positions who are subject to the market fluctuations are seeing higher bills for wholesale electricity,” CFC Vice President of Industry Research and Consulting Mark Schneider said. “Market participants expect natural gas supply and demand to improve in 2022 and beyond.”

The supply constraints mean coal has become a more cost-competitive generation alternative in the U.S. and globally. Demand for U.S. coal has outpaced supply and drained excess stockpiles, creating market tightness in 2021 and into 2022 according to IHS Markit’s October U.S. Coal Market Briefing. U.S. coal production cannot ramp up quickly due to mine closures and short-term impacts of the pandemic.

“As the U.S. has become a major supplier of LNG to the global market, domestic natural gas prices will continue to experience greater impacts from global supply and demand fundamentals,” Andy Whitesitt, senior vice president and chief business development officer for ACES, said. “Increased natural gas price volatility will put greater pressure on coal and renewable assets to perform and potentially increase volatility in wholesale electricity prices. Maintaining a portfolio with a diverse resource mix and implementing other strategic risk management practices can help limit the impact of commodity price volatility.”

Increased Coal Production to Continue Through 2022

While increased coal demand has caused prices to increase in the second half of 2021, it remains within the normal historical price range. IHS Markit expects coal power generation to increase in 2021 and remain above 2020 levels through 2023, despite the high rate of coal unit retirements. Coal production is expected to increase over the next year and then return to its steady annual decline.

“For generation and transmission cooperatives operating coal assets, their generators are running closer to capacity, spreading their fixed costs over more kilowatt-hours sold at higher prices,” Schneider added. “As natural gas prices increase, some coal asset owners may be experiencing some financial relief.”