Summer Heat Puts the U.S. Electric Grid to the Test

Extreme heat across vast sections of the United States is straining energy systems in several parts of the country, driving up electricity demand for cooling and challenging the stability of the electric grid.

Some localities in Wyoming, Tennessee, Alabama, Mississippi, North and South Carolina, Utah and Colorado recorded their highest temperatures on record in July. Over 11 million people in California, Oregon, Idaho and Washington were exposed to excessive heat last month as well. Similarly, higher-than-normal temperatures drove power demand in Texas and the Southwest Power Pool (SPP) to break records the second week of July. Texas regional officials twice called on residents to reduce demand during afternoons to avoid power outages.

To cope with the increasing demand, the Texas grid operator is using the state’s industrial demand response program and a mechanism called reliability unit commitments, which allows the operator to order generation units to remain in service and postpone planned maintenance.

Short-Term Solution Delays Planned Maintenance

“This is seen as a short-term solution,” CFC Senior Energy Industry Analyst Roman Siegert said. “Generating units need scheduled maintenance to maintain reliability, especially those nearing their retirement ages. But given the current weather and demand forecasts, operators are willing to push the limits of those units to ensure service continuity.”

A factor challenging the capacity of the grid to provide reliable power in some states is a steadily growing population triggered by migrations from other parts of the country, a trend that accelerated during the pandemic.

“This growth has resulted in higher loads on the grid that come close to generation capacity during times of peak demand.” Siegert said. “In others part of the country, existing generation capacity may be insufficient to face extreme summer weather events.”

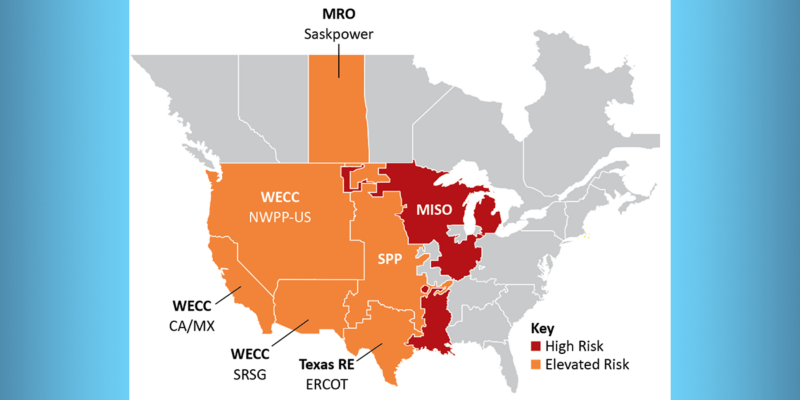

That is the case of the Midcontinent ISO where load-serving entities, mostly in the North/Central region, did not clear enough capacity during the annual planning resource auction last April. As a result, the region is planning to use load-modifying resource mechanisms, such as demand response in the case existing capacity does not meet operating requirements.

In New England, there is sufficient generation capacity to meet the summer demand forecast. However, extraordinary summer peak loads could require the grid operator to put mitigation measures in place, including demand response.

Another risk factor threatening the reliability of the grid is the extended drought causing reduced summer hydropower output, especially in the Western Interconnection. Besides limiting hydropower generation, droughts are also reducing the use of water to cool power plants during normal operations, as is the case with the Missouri River that serves SPP.

Natural Gas Takes Dominant Role Despite Costs

“In addition to extreme weather conditions, the generation stack has gone through substantial changes in recent years,” Siegert explained. “Traditional generation plants, such as coal-fired and nuclear, are being retired, allowing natural gas to take a dominant role as the main power generation fuel. However, natural gas is also a precious commodity used in geopolitics these days.”

Earlier this year, the United States committed to increase exports of liquefied natural gas (LNG) to Europe to mitigate the supply cuts announced by Russia. This policy, in part, limited natural gas availability for U.S. domestic power generation, driving the prices of both natural gas and electricity up during the first half of 2022.

Penetration of renewables, mainly solar and wind generation, has steadily increased during the last decade. Although this additional capacity is welcome by grid operators to satisfy power demand, its contribution to increased system reliability is not significant given their intermittent nature.

As a response to this, operators are installing batteries to absorb excess solar or wind power generated when demand is low for discharge when demand is high.

Battery Storage Can Help Renewable Generation

“More than 93 percent of battery capacity installed in 2021 was co-located with solar,” Siegert said. “The implementation of renewables and battery storage, however, is constrained by the current supply chain crisis.”

During the first quarter of 2022, battery metal costs went up substantially, threatening the sustained implementation of battery storage projects. Price hikes ranged from single digits to more than 200 percent. Lithium-ion battery storage plans are being revised to adjust for current inflationary pressures. Despite the cost increases, there is a robust demand for battery storage, mainly because the volatility seen in wholesale electricity prices is offsetting increasing battery-storage capital investment costs.

The federal government has taken some actions recently to mitigate supply chain bottlenecks. In early June, President Joe Biden issued plans for a 24-month exemption from tariffs for solar panel imports from certain Asian countries, and invoked the Defense Production Act to boost domestic manufacturing in critical power grid infrastructure and clean energy technologies, including solar panels.

“A large portion of the U.S. is at risk of higher power prices and potential outages caused by heat, drought and constrained fuel supplies,” Siegert said. “The good news is there is a strong focus to expand the transmission connections between regions to keep power reliable and affordable, and the expected additions of wind and solar capacity coupled with batteries will contribute to increasing the overall reliability of the system during peak demand.”