Can the S&P 500 Score Another Comeback in 2020

As we look ahead, it’s going to be challenging to find a year as topsy-turvy as 2019. If the economy were a sporting event, all the main action took place in the second half.

In a bombshell move on July 31, the Federal Reserve reduced its target overnight funding rate to 2.25 percent in response to slowing growth nationally and globally. That turned out to be the first of three rate reductions the Fed would implement in 2019—catching every major U.S. banking institution unaware as not even a single rate cut was in the forecast.

August brought more surprises when President Trump announced 10 percent tariffs on $300 billion worth of Chinese products, leaving the market afraid the trade tiff with China was only getting worse, not better. While the U.S. economy is somewhat insulated from trade volatility (trade represents only about 14 percent of overall gross domestic product), it is still an important growth driver. Many multinational U.S. companies depend on foreign sales to boost earnings and ensure strong stock prices. As a late-August shock, the yield curve inverted—signaling a possible U.S. recession on the horizon.

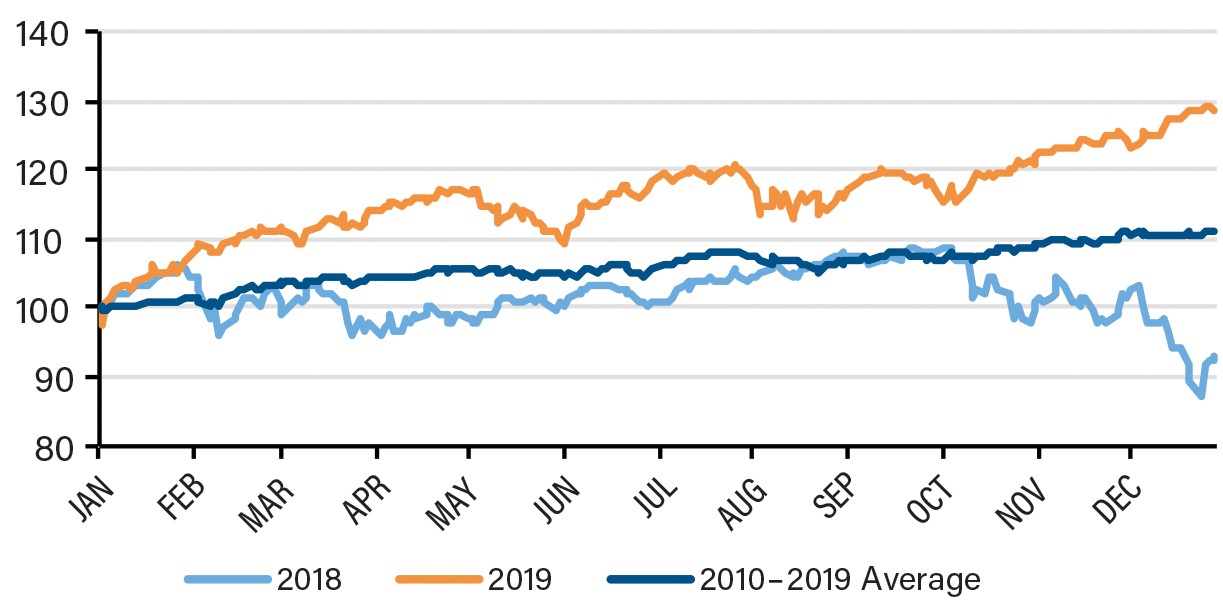

Thanks to this grab-bag of surprises, the S&P 500 fell more than 800 points in August. However, all this action was trumped (no pun intended) by a remarkable market turnaround before year-end. In fact, the S&P 500 surged 29 percent for all of 2019—its best return since 2013. The stellar performance was primarily fueled throughout 2019 by surging tech stocks. The index’s information-technology group saw its best yearly gain since 2009. Ironically, the information technology sector is also one of the most dependent on foreign sales. Go figure.

Unfortunately, while stock market performance is a sign of wealth accumulation, it is not shared equally among all Americans. In fact, only 52 percent of Americans have money invested in the stock market. The other 48 percent missed out on the windfall.

One reason 2019 saw such strong gains is because the S&P 500 finished the previous year on a very weak note. Trade uncertainty, Fed rate hikes and geopolitical turmoil caused a lot of angst in the market at year-end 2018. That has been more than made up in 2019.

As investors enter a new decade, the biggest question looming for all is the uncertainty of what’s in store for 2020. Market consensus predicts the double-digit returns of 2019 will be extremely hard to repeat. In fact, virtually all major asset classes posted a once-a-decade performance, and if history sets the stage for future performance, the chances of duplicating this feat are very slim.

S&P 500 Index Relative Movement

Source: Bloomberg

Source: Bloomberg