US Interest Spending Is Testing Historical Limits

Throughout history, the fall of empires has rarely come suddenly or solely through military defeats. Very often, decline unfolds gradually, eroded from within by economic stagnation, political fragmentation and unsustainable debt. Great powers from Habsburg Spain to the Ottoman Empire have risen to global prominence only to falter when the costs of maintaining influence outpaced their ability to finance it. Behind the battles and treaties, a pattern has emerged: great powers that fail to balance military strength with financial discipline eventually lose their status. This idea is at the heart of Ferguson’s Law, which holds that any great power that spends more on servicing its debt than on defense puts its status as a great power at risk.

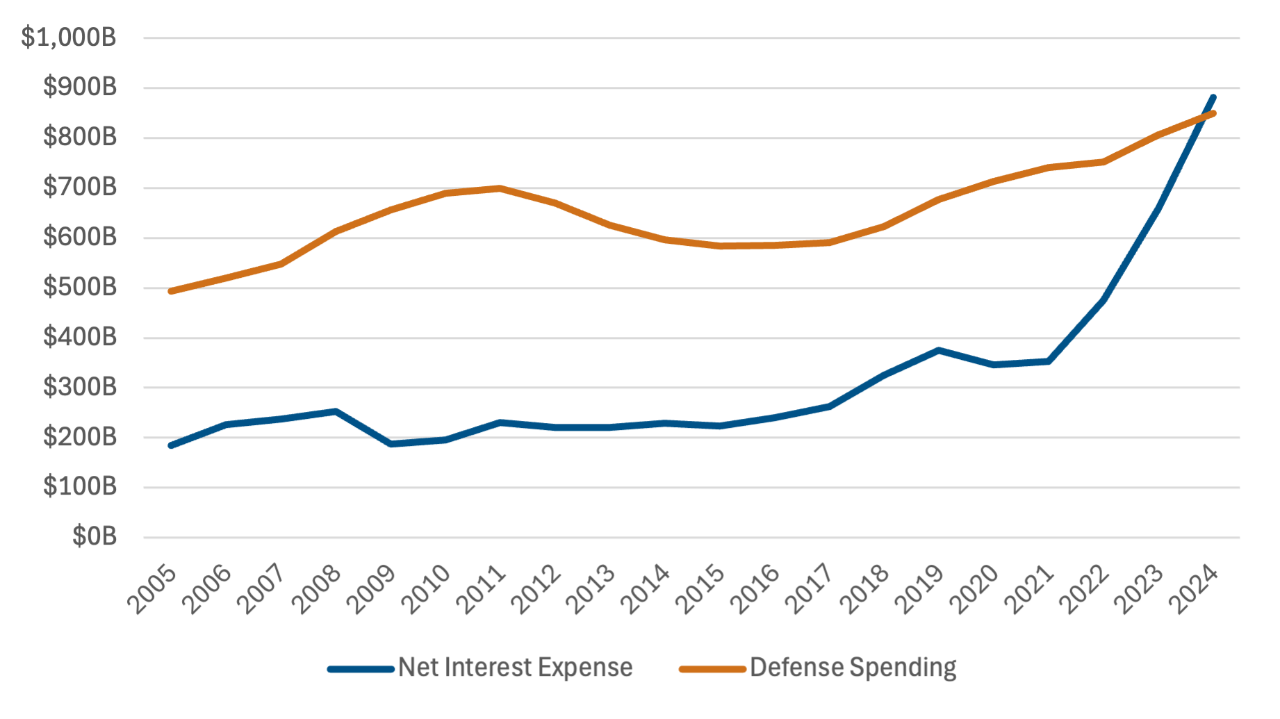

British historian Sir Niall Ferguson examined the relationship between debt servicing and defense expenditure from the 16th century to modern times. His research defines the “Ferguson limit” as the point at which a nation’s interest payments surpass its defense spending—marking a critical tipping point where rising debt begins to undermine a great power’s geopolitical strength. As more resources are consumed servicing debt, less remains for national security, leaving the state increasingly exposed to military threats and unable to sustain its global influence. This was true of Hapsburg Spain, ancien régime France, the Ottoman Empire and the British Empire. More recently, the law is being put to the test by the United States, which crossed the Ferguson limit in 2024 as it spent $881 billion in interest on its debt, exceeding the approximately $850 billion spent on its defense.

Although rare, returning to the right side after crossing the Ferguson limit is not unprecedented. Britain’s experience between the two world wars most closely parallels the current U.S. fiscal and strategic challenges. Cost of servicing debt consistently exceeded defense spending by the British government after World War I. Britain eventually returned to stay within the Ferguson limit with imperial retrenchment, arms control and political concessions across the British Empire. However, the most decisive factor was the sharp decline in interest rates during the economic downturn of the 1930s. Britain crossed the Ferguson limit on more occasions, and it only became militarily inconsequential after crossing the limit in 2010, according to Ferguson. Now it’s the U.S.’s turn to see how many times it can test the limit.

Interest Expense Exceeds Defense Spending in 2024

SOURCE: Congressional Budget Office.