Ebb and Flow: Global Money Boosts US Businesses

The United States makes up roughly a quarter of the global economy, but it received over 40% of the global gross capital inflows and more than 70% of the global private investment capital flows in 2024. Although economic productivity and financial stability played a big role in attracting capital, the United States’ disproportional share of global capital inflows also had a lot to do with its imbalanced goods trade account with the rest of the world.

Think of the financial relationship between a banker and a dairy farmer. The banker purchases dairy products from the farmer every day, ending up with a goods trade deficit with the farmer. The farmer deposits the profits he makes into a bank account—managed by the banker. The United States has a similar relationship with many of its trading partners. For example, Asian exporters typically sell goods manufactured in their countries to the United States and then invest the proceeds in American assets. Trillions of dollars of investments in the United States come from these foreign exporters. This is partly how the United States ends up with so much capital inflows.

For a long time, this was a solid strategy for many emerging-market exporters, helping them diversify their investment portfolio. The influx of capital arguably led to “hot money” in the United States, which was one of the factors triggering the global financial crisis of 2008. Although Asian investors have moderated since then, the U.S. markets have remained the top capital destination. Europeans, who seek high growth that they can’t find in Europe, are the largest foreign direct investors for the United States. Once again, the capital doesn’t come out of thin air. A large portion of it comes from proceeds of their goods trade surplus with the United States.

Excess capital inflows can turn into hot money and easily lead to financial bubbles, but we must remember that the high availability of capital has kept the cost of borrowing relatively low in the United States. In an indirect way, trade has impacted access to capital and funding cost, allowing U.S. firms to emerge and grow at a rate not typically seen anywhere else.

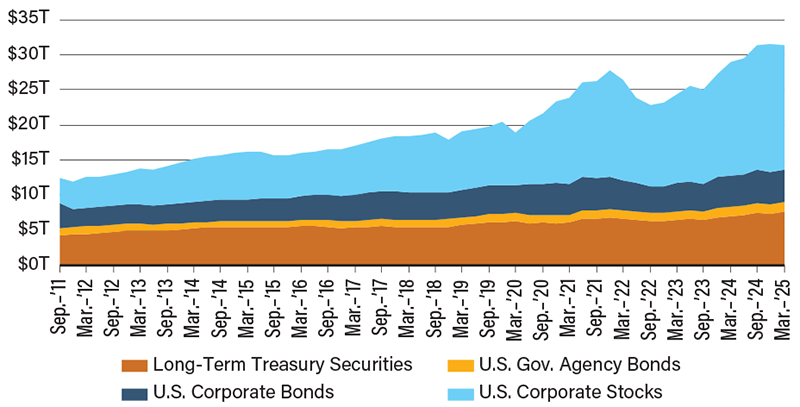

Foreign Long-Term Investment in US Assets

SOURCE: U.S. Department of Treasury.