Eyes on the Economy: Jobs, Inflation, Manufacturing

Job Forecasters Miss Big

Payrolls increased by 379,000 in February—outpacing the market estimate of 200,000, while the unemployment rate edged down to 6.2 percent, from 6.3 percent. The leisure/hospitality sector drove the gain, adding 355,000 jobs in a welcome sign for states that rely heavily on this industry. Winter weather did dampen some sectors, notably construction, suggesting that spring will bring an even bigger pop. The public sector, which represents roughly 12 percent of the labor force, also undermined the top line.

In addition, the combination of the stimulus passed in December and President Biden’s American Rescue Plan will juice the economy. Some may question whether more stimulus is required given that a variety of economic indicators are improving, such as retail sales and manufacturing. However, given the severity of the pandemic-induced decimation of the labor market, aggressive measures are still needed to return it to good health. There are still 9.5 million fewer jobs in the economy than there were a year ago and about 10 million more people who are unemployed now than a year ago. Labor market recovery will continue well past 2023.

Inflation Tops Market Focus

Inflation is garnering a lot of attention because it looks poised to accelerate over the next few months; however, analysts have heard this before. If it does happen, the acceleration won’t last and won’t cause the Federal Reserve to consider raising interest rates. Based on current projections the Fed’s first hike is not expected until the second quarter of 2023.

On a year-ago basis, the Consumer Price Index (CPI) rose 1.7 percent in February, compared with a 1.4 percent bump in January. Core CPI was up 1.3 percent, weaker than the previous 1.4 percent rise. Even with the increases, both measures remain below the Fed’s 2 percent target.

Manufacturing Is Recovering Quicker Than Anticipated

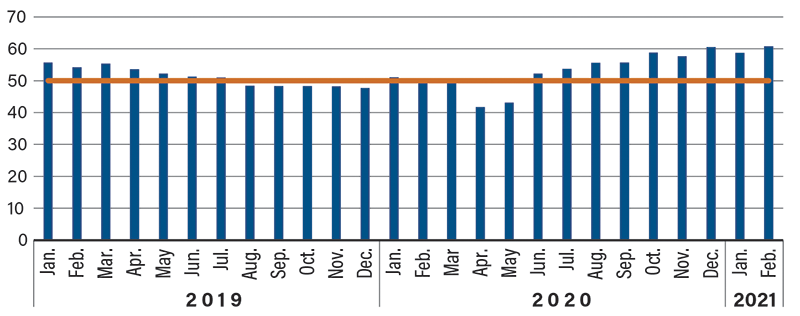

The Institute for Supply Management Manufacturing Index rose to 60.8 in February from 58.7 in January, beating the market’s consensus forecast of 58.9. The production index rose to 63.2 from 60.7.

Manufacturing is doing well, but don’t expect smooth sailing over the next few months. Producers are facing supply-chain disruptions, slow delivery times and a global shortage of semiconductors, which is particularly problematic for U.S. auto manufacturers. Depending on the model, a vehicle could require hundreds of semiconductors. Because of the shortage, auto manufacturers are cutting production schedules, temporarily closing plants, and building partially completed vehicles and storing them until semiconductors become available. Some companies, like Toyota Motor Corp., had an ample chip stockpile. Other manufacturers weren’t so lucky. The U.S. global share of semiconductor chips produced domestically has declined from 37 percent in 1990 to 12 percent today. Despite this, manufacturing is expected to hold up well this quarter and should contribute positively to GDP growth.

Institute for Supply Management Manufacturing Index

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| ISM Manufacturing (Feb.) (MoM) | 58.7 | 58.9 | 60.8 |

| Change in Nonfarm Payrolls (Feb.) (MoM) | 49K | 200K | 379K |

| Unemployment Rate (Feb.) | 6.3% | 6.3% | 6.2% |

| Consumer Price Index (Feb.) (YoY) | 1.4% | 1.7% | 1.7% |

Key Interest Rates

| 3/15/21 | 3/8/21 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.11% | 0.11% | -- |

| 3-mo. Libor | 0.18% | 0.18% | -- |

| 2-yr. UST | 0.14% | 0.17% | -0.03 |

| 5-yr. UST | 0.85% | 0.86% | -0.01 |

| 10-yr. UST | 1.64% | 1.59% | 0.05 |

| 30-yr. UST | 2.40% | 2.31% | 0.09 |

Rate Forecast - Futures Market

| Q1-21 | Q2-21 | Q3-21 | Q4-21 | |

|---|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | 0.25% | 0.25% |

| 1-mo. Libor | 0.10% | 0.10% | 0.10% | 0.20% |

| 3-mo. Libor | 0.20% | 0.20% | 0.20% | 0.30% |

| 2-yr. UST | 0.20% | 0.30% | 0.30% | 0.40% |

| 5-yr. UST | 0.90% | 1.00% | 1.10% | 1.20% |

| 10-yr. UST | 1.44% | 1.52% | 1.58% | 1.67% |

| 30-yr. UST | 2.45% | 2.53% | 2.60% | 2.70% |