Eyes on the Economy: Manufacturing, Imports, Jobs

Manufacturing Index Remains in Contraction for June

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) measured 49.0 in June, beating forecasts of 48.8 and improving from May’s 48.5. The ISM PMI is a monthly gauge of the health of the U.S. manufacturing sector based on a survey of executives and supply managers at manufacturing firms. An index above 50 signals expansion while a reading below 50 indicates contraction.

Production began to expand in June, rebounding from 45.4 to 50.3, and the rate of contraction in inventory slowed. Despite these improvements, indicators for employment and new and backlogged orders contracted at a faster pace while prices experienced rapid expansion as a result of inflationary and tariff-related upward pressures. These effects ultimately dragged the overall index under the growth threshold. Contraction is expected to continue into July.

Imports Decline in May

U.S. imports continued to decrease in May, falling 0.1% to a seven-month low of $350.5 billion. The $0.2 billion drop in goods imports was due mainly to decreases in technology accessories, finished metal products and household goods, while increases in computers, cars and pharmaceuticals partially offset these declines. Exports also decreased in May, falling 4% to $279 billion after hitting a record-high $290.6 billion in April. The largest declines came from gold, natural gas and finished metal, while exports rose for technology accessories and pharmaceuticals. Service exports such as travel and transport also contracted.

Trade activity continues to be shaped by uncertainty surrounding U.S. trade policy. A July 9 deadline for tariff negotiations with trading partners has been extended to Aug. 1, leading some forecasters to predict another record-high for exports in June. Specific tariffs levied on products such as copper and pharmaceuticals may also affect the goods that drove the highest variation in May’s trading.

Robust Labor Report Hides Signs of Slowdown

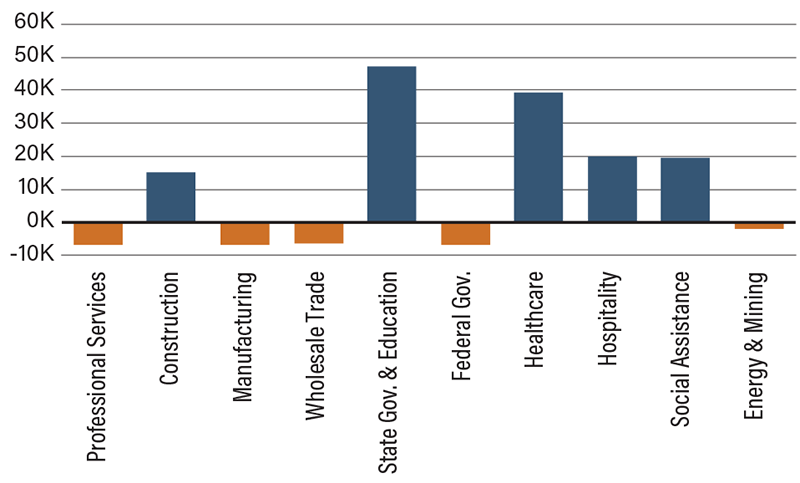

The U.S. economy added 147,000 jobs in June, closely matching May’s 144,000 and the 12-month average of 146,000 while topping forecasts of 110,000. However, these headline figures can be misleading. Despite solid overall job growth and a drop in unemployment to 4.1%, private-sector hiring fell nearly 46% month-over-month and over half of private industries cut jobs as the existing labor force shrank. Additionally, net job gains were not equally distributed among industries—growth was heavily concentrated in education, healthcare, and state and local government, while federal government, professional services and manufacturing sectors lost approximately 7,000 jobs each. State government employment was largely due to seasonal education hiring tied to the end of the school year, rather than a sign of sustained growth.

Economic uncertainty prompted by questions around fiscal, trade and domestic policy has led businesses across the nation to freeze hiring, leading to a stunted private sector. Even healthcare, which has been a primary driver of job growth for 2025, added only 39,200 jobs compared with 63,600 in May. With job growth heavily reliant on a few industries and a shrinking labor force, economists continued to forecast slower gains in July and beyond.

June 2025 US Job Gains by Sector

Source: U.S. Bureau of Economic Analysis.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| U.S. Nonfarm Job Additions (June) | 144K | 110K | 147K |

| U.S. ISM Manufacturing PMI (June) | 48.5 | 48.8 | 49.0 |

| U.S. Imports (May) | $350.8B | $350.0B | $350.5B |

| U.S. Exports (May) | $290.6B | $278.0B | $279.0B |