Eyes on the Economy: Payrolls, NFIB, Vehicles

Payrolls Stumble Again

The May employment report was better than last month’s, though payroll increases again fell below market expectations. Huge swings in the leisure/hospitality sector accounted for 60 percent of private payroll gains in May. Other industries that made positive contributions were education/healthcare and professional/business services. Government payrolls are recovering as well.

Despite loosening COVID-related restrictions across the country and the abundance of available jobs, the employment recovery is moving slowly. Many reasons have been suggested to explain the bumpy gains, including lack of childcare, illness or fear of illness, the unwillingness to return to low-paying and low-quality jobs, and generous unemployment insurance benefits. Adding to the challenges is the aging workforce that allowed many older workers to go ahead and retire during the pandemic. Also, it simply takes time to find qualified candidates. These hurdles should gradually dissipate by the fall. The current labor force participation rate is 61.6, far below its pre-pandemic average of 63.3 percent. Though a huge number of jobs were lost very quickly, it will take time to reabsorb the available labor. Payrolls remain 7.63 million below their pre-pandemic peak.

NFIB Takes a Breather

The NFIB Small Business Optimism Index slipped in May, coming in at 99.6, which is slightly short of April’s 99.8 and below consensus expectations. This snaps a streak of three consecutive monthly gains and is likely attributed to uncertainty surrounding U.S. corporate taxes and inflation, which is being driven by supply chain issues and commodity shortages. Many of these disruptions are attributable to the quick snapback of the recovery, causing demand to outstrip supply. Details within the report were mixed, as small businesses turned more pessimistic about the economy’s near-term prospects but a decent share of respondents still plan to make capital expenditures and hire.

Vehicle Sales Remain Robust for Now

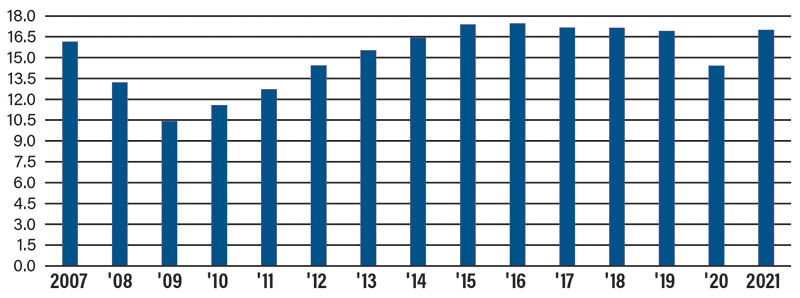

New-vehicle sales came back down to Earth in May, though they still posted 17 million annualized units. Weighed down by increasingly tight supply, the new-auto market cooled significantly from the record-breaking April. May’s number was well above the recessionary period of 2020 and slightly below 2019 rates. Compared to the Great Recession of 2008, the 2020 glitch has seen a quick snapback in auto sales. That’s because this recovery is more like a response to a natural disaster versus financial imbalances, which take much longer to get over. Similar to the robust housing market, more than one-third of new vehicles that are sold sat on the lot less than 10 days. This is likely to persist for months. Already, many dealerships are selling vehicles before they’ve even received the shipment. Driven by continued low supply and high demand, wholesale used-vehicle prices have risen by 32 percent since the start 2021 and are 51 percent higher than in May 2019. The road ahead for new-auto sales is fraught with peril. Expect the third quarter to be the hardest hit from the international semiconductor shortage, causing the industry to lose out on more than 5 percent of sales because of a lack of inventory.

Average Vehicle Sales

(Seasonally Adjusted Annual Rate)

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Change in Nonfarm Payrolls (May) (MoM) | 266K | 675K | 559K |

| Labor Force Participation Rate (May) | 61.7% | 61.8% | 61.6% |

| NFIB Small Business Optimism (May) | 99.8 | 100.9 | 99.6 |

Key Interest Rates

| 6/7/21 | 6/1/21 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.08% | 0.09% | (0.01) |

| 3-mo. Libor | 0.12% | 0.13% | (0.01) |

| 2-yr. UST | 0.14% | 0.16% | (0.02) |

| 5-yr. UST | 0.78% | 0.81% | (0.03) |

| 10-yr. UST | 1.56% | 1.62% | (0.06) |

| 30-yr. UST | 2.24% | 2.30% | (0.06) |

Rate Forecast - Futures Market

| Q2-21 | Q3-21 | Q4-21 | Q1-22 | |

|---|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | 0.25% | 0.25% |

| 1-mo. Libor | 0.12% | 0.15% | 0.20% | 0.20% |

| 3-mo. Libor | 0.20% | 0.25% | 0.30% | 0.30% |

| 2-yr. UST | 0.30% | 0.30% | 0.40% | 0.40% |

| 5-yr. UST | 1.00% | 1.10% | 1.20% | 1.20% |

| 10-yr. UST | 1.78% | 1.85% | 1.95% | 1.95% |

| 30-yr. UST | 2.53% | 2.60% | 2.70% | 2.70% |