Eyes on the Economy: Budget Deficit, Inflation, Consumer Debt

U.S. March Budget Deficit Falls as Revenue Rises

The U.S. budget deficit declined to $193 billion in March, significantly lower than the $660 billion gap posted in the same month last year. It is also well below the February figure of $217 billon. The improvement reflects the reduction in COVID relief spending as well as record levels of tax receipts.

According to the U.S. Treasury, COVID relief outlays fell 45 percent from March 2021, when the deficit hit a record due to the $1,400 COVID payments to millions of people. At the same time, tax receipts posted a year-over-year increase of 18 percent, setting a new record for March. The surge in revenue reflects a strong economic recovery and low unemployment. Overall, the figures paint a positive macroeconomic condition and strong government recovery from the COVID-driven deficit.With COVID-19 restrictions being phased out and inflationary pressure mounting on income, hopefully more Americans will have strong incentive to rejoin the labor force. If the labor market continues this momentum, supply and demand for workers may soon reach a new equilibrium, which will contribute to restoring the U.S. supply chain.

Inflation Saga Continues

Inflation once again rose above expectations as the year-over-year headline Consumer Price Index (CPI) reached 8.5 percent in March, leading Americans to face the highest inflation rate of all the G-7 countries. In the same month, the Producer Price Index (PPI) increased 11.2 percent, the highest since records began. Both figures suggest the saga of four-decade-high inflation is nowhere near an end.

While much of the increases may be explained by the war in Ukraine, which has pushed food and energy prices up, core CPI and PPI (measured without food and energy) reached a 40-year high of 6.5 percent and a record high of 9.2 percent, respectively. Furthermore, consumer fears over inflation also hit a record high in March. In spite of concerns over the impact of the Federal Reserve rate hikes, these inflation figures reinforce the central bank’s decision to move forward with its tightening policy.

Consumer Debt Sharply Rises Above Expectations

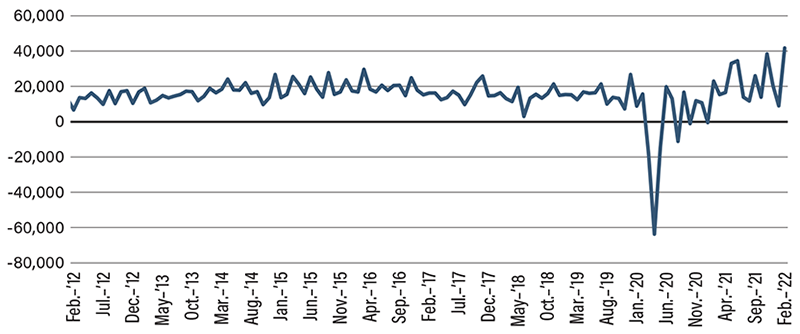

Despite entering this year in solid financial positions, U.S. consumers are finding out just how quickly inflation is changing their finances. The latest Fed consumer credit report reveals that February’s consumer credit (debt) increased by almost $42 billion, more than double a forecast figure of $16.65 billion. This translates to a year-over-year increase of 11.3 percent, setting a new high and quickly going far over January’s increase of 2.4 percent.

Revolving credit—such as credit cards—increased at a year-over-year rate of 20.7 percent, compared with January’s figure of 4 percent. This may suggest that consumers are turning to credit cards to cover expenses as they face prices that are rising faster than their income. Additionally, this reminds us to be careful in reading personal spending figures. High numbers may not suggest that consumers are purchasing more units of items; rather, they may very well be purchasing fewer units at significantly higher prices. Just a few weeks ago, U.S. consumers were believed to be able to weather this persistently high inflation. The latest consumer credit report figures, however, prove we might have underestimated the magnitude and speed of inflation’s impact on Americans.

Change in Total Consumer Credit

(Year-over-Year, Dollars in Millions)

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Budget Deficit (Mar.) (YoY) | $660B | $191B | $193B |

| Headline CPI (Mar.) (YoY) | 7.90% | 8.40% | 8.50% |

| Consumer Credit Change (Feb.) (MoM) | $8.93B | $16.65B | $41.82B |

Key Interest Rates

| 4/18/22 | 4/11/22 | Change | |

|---|---|---|---|

| Fed Funds | 0.5% | 0.5% | --- |

| 1-mo. Libor | 0.60% | 0.52% | 0.08 |

| 3-mo. Libor | 1.06% | 1.02% | 0.04 |

| 2-yr. UST | 2.46% | 2.50% | (0.04) |

| 5-yr. UST | 2.78% | 2.80% | (0.02) |

| 10-yr. UST | 2.85% | 2.78% | 0.07 |

| 30-yr. UST | 2.95% | 2.81% | 0.14 |

Rate Forecast - Futures Market

| Q2-22 | Q3-22 | Q4-22 | Q1-23 | |

|---|---|---|---|---|

| Fed Funds | 1.35% | 1.90% | 2.25% | 2.55% |

| 1-mo. Libor | 0.76% | 1.40% | 1.89% | 3.07% |

| 3-mo. Libor | 1.68% | 2.36% | 2.87% | 3.17% |

| 2-yr. UST | 2.52% | 2.66% | 2.72% | 2.81% |

| 5-yr. UST | 2.60% | 2.69% | 2.72% | 2.81% |

| 10-yr. UST | 2.58% | 2.268% | 2.74% | 2.83% |

| 30-yr. UST | 2.69% | 2.82% | 2.90% | 3.00% |