Eyes on the Economy: Interest Rate, Geopolitics, Labor Market

Fed Signals Rate Increase

In testimony to Congress, Federal Reserve Chairman Jerome Powell made clear that the current state of the economic recovery no longer justifies monetary policy accommodation, citing improved labor market conditions and resilient economic recovery. While noting the uncertainty brought about by the Russia-Ukraine war, Powell stated that he was in favor of a March rate increase of 25 basis points.

If inflation proves to be more persistent than expected, the Fed could be more aggressive, according to Powell. Some economists believe the geopolitical uncertainty means the speculated hawkish hiking path of a 50 basis-point increase is now unlikely. However, high inflation remains a top concern, suggesting that aggressive hikes in 2023 may very well be in the picture.

In its efforts to restore price stability, the Fed has phased out its net asset purchases as it prepares to raise the federal funds rate at its March meeting, which will start the process of removing its policy accommodation. Look for two things to take place this year: increases in the target range of the federal funds rate and a downsize of the Fed’s balance sheet.

Geopolitics Fuels Inflation

As the Russia-Ukraine war continues, Americans are feeling the impact across the Atlantic, especially when it comes to fuel prices since Russia is a major energy exporter. Unlike its European allies, the U.S. is self-sufficient for natural gas. Tensions with Russia, however, may force America to increase export supply to Europe, causing prices to go up at home. In the meantime, crude oil has now surpassed $118 per barrel while the national average price for gasoline topped $4 per gallon. The U.S. and its allies are attempting to ease the oil supply shock by promising to release 60 million barrels from reserves, but markets are unimpressed.

The skyrocketing energy prices not only impact U.S. energy consumption but also hurt ordinary Americans through price increases for other goods. According to forecasting by Bloomberg Economics, March inflation could reach 9 percent. Undeniably, this is going to make the Fed’s job even more challenging. Whether its rate hikes will effectively bring down inflation remains to be seen. Right when we thought the world could finally catch a break from the once-in-a-lifetime COVID-19 crisis, another catastrophe hit. And just like that, 2022 is another year of uncertainty.

Labor Market Trajectory Is Looking Good

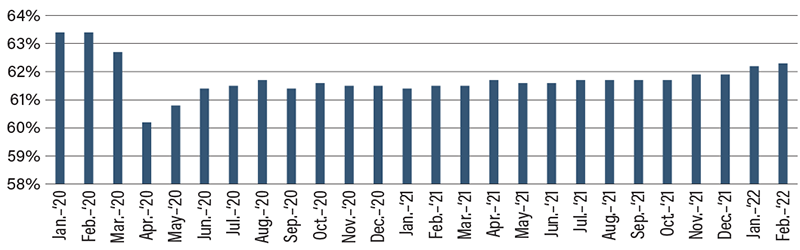

The Fed’s confidence in moving forward with rate hikes is backed by the labor market recovery. February’s unemployment figure dropped to 3.8 percent while nonfarm payrolls increased by 678,000, the highest since July. The labor force participation rate also increased to 62.3 percent. While the labor market remains tight, the increase in the participation rate may suggest that improvement is coming along.

Let’s hope it continues for the rest of this decade. Projections by the U.S. Bureau of Labor Statistics suggest that labor force participation will fall to 60.4 percent in 2030 as the youngest boomers approach retirement age.

Labor Force Participation Rate

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Fed Rate Increase Prediction | 0.25% | 0.50% | 0.50% |

| Nonfarm Payrolls (Feb.) (MoM) | 467,000 | 423,000 | 678,000 |

| Unemployment Rate (Feb.) | 4.0% | 3.9% | 3.8% |

| Average Hourly Earnings (Feb.) (YoY) | 5.48% | 5.80% | 5.10% |

Key Interest Rates

| 3/7/22 | 2/28/22 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.31% | 0.14% | 0.07 |

| 3-mo. Libor | 0.64% | 0.50% | 0.14 |

| 2-yr. UST | 1.56% | 1.43% | 0.13 |

| 5-yr. UST | 1.71% | 1.72% | (0.01) |

| 10-yr. UST | 1.79% | 1.83% | (0.04) |

| 30-yr. UST | 2.19% | 2.16% | 0.03 |

Rate Forecast - Futures Market

| Q1-22 | Q2-22 | Q3-22 | Q4-22 | |

|---|---|---|---|---|

| Fed Funds | 0.50% | 0.85% | 1.15% | 1.40% |

| 1-mo. Libor | 0.15% | 0.46% | 0.74% | 0.94% |

| 3-mo. Libor | 0.48% | 0.79% | 1.07% | 1.27% |

| 2-yr. UST | 1.27% | 1.44% | 1.57% | 1.69% |

| 5-yr. UST | 1.71% | 1.83% | 1.91% | 1.99% |

| 10-yr. UST | 1.90% | 2.03% | 2.12% | 2.21% |

| 30-yr. UST | 2.23% | 2.35% | 2.43% | 2.52% |