Eyes on the Economy: Rates, Housing, Inflation

Fed Plans Ongoing Rate Hikes

As expected, the Federal Open Market Committee decided at its March 16 meeting to raise the overnight interest rate by 25 basis points. Federal Reserve officials anticipate ongoing rate hikes, possibly one at every meeting this year. Fed Chair Jerome Powell cited the strength of the economy for supporting the hawkish move.

The committee also revised its Personal Consumption Expenditures price index inflation forecast to 4.3 percent from the previous projection of 2.7 percent. Inflation is expected to remain high through mid-2022.

Powell said the Fed could start shrinking its balance sheet as soon as the next meeting in May, suggesting both a rate hike and an announcement of asset downsizing will come then. Last but not least, the Fed chair does not foresee a recession, bringing much-needed relief to markets.

Housing Market Remains Hot

There is some positive news in the housing market as February’s new construction posted an increase of 6.8 percent from the previous month, suggesting home construction is recovering from the labor shortage caused by the pandemic. However, building permits—an indicator for future construction—saw a 1.9 percent decrease, driven by declines in the Midwest (8.4 percent) and the South (5.5 percent). Inventory may continue to struggle to meet demand for some time, even as interest rates go up.

In the rental market, consumers face rising prices at 4.2 percent, the highest annual rate since 2007. Luckily, new renter median income has gone up significantly. This is largely driven by certain high-income households being priced out of the buying market—making the American dream less attainable as housing unaffordability keeps renters and first-time buyers awake at night.

Americans See Inflation as the Top Economic Indicator

As an old saying goes, inflation should be low enough that people are not thinking about it. While economists point to economic indicators such as jobs and gross domestic product (GDP) growth to spotlight the recovery and resilience of the U.S. economy, 52 percent of Americans see prices of goods and services—far ahead of personal finances and unemployment rate—as the best indicator of how the national economy is doing.

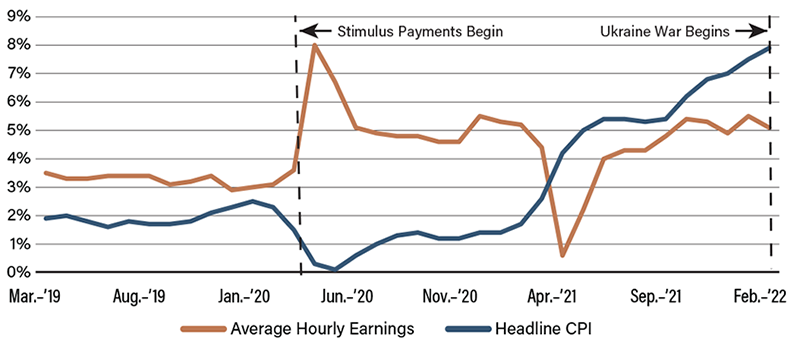

Although the Ukraine war plays a role in energy price hikes, inflation had been high, widely spread and trending upward before the war broke out. February’s year-over-year headline Consumer Price Index reached a 40-year high of 7.9 percent while the Producer Price Index climbed 10 percent. With upward pressure from demand and persistent supply-chain issues, the transitionary inflation is not so transitionary after all.

Many are concerned that tightening monetary policy could slow down growth. But when it comes to GDP vs. inflation, it is the latter that is felt by everyone in the economy. Consumers face the same price levels within a given market, but not everyone gets the same share (if any at all) of the aggregated growth. Economic concerns change over time, but as of now, inflation remains on top.

Inflation Rises Faster Than Earnings (YoY)

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Federal Funds Rate | 0.25% | 0.50% | 0.50% |

| Housing Starts (Feb.) (MoM) | -5.5% | 6.80% | 0.02% |

| Building Permits (Feb.) (MoM) | 0.5% | -1.9% | -1.5% |

| Headline CPI (Feb.) (YoY) | 7.50% | 7.90% | 7.90% |

Key Interest Rates

| 3/21/22 | 3/14/22 | Change | |

|---|---|---|---|

| Fed Funds | 0.5% | 0.25% | 0.25 |

| 1-mo. Libor | 0.44% | 0.43% | 0.01 |

| 3-mo. Libor | 0.96% | 0.88% | 0.08 |

| 2-yr. UST | 2.01% | 1.86% | 0.15 |

| 5-yr. UST | 2.22% | 2.09% | 0.13 |

| 10-yr. UST | 2.23% | 2.14% | 0.09 |

| 30-yr. UST | 2.48% | 2.47% | 0.01 |

Rate Forecast - Futures Market

| Q1-22 | Q2-22 | Q3-22 | Q4-22 | |

|---|---|---|---|---|

| Fed Funds | 0.50% | 0.95% | 1.25% | 1.55% |

| 1-mo. Libor | 0.79% | 1.29% | 1.81% | 2.27% |

| 3-mo. Libor | 1.07% | 1.49% | 1.97% | 2.42% |

| 2-yr. UST | 1.54% | 1.66% | 1.80% | 1.92% |

| 5-yr. UST | 1.80% | 1.92% | 2.01% | 2.10% |

| 10-yr. UST | 1.91% | 2.09% | 2.18% | 2.30% |

| 30-yr. UST | 2.28% | 2.39% | 2.50% | 2.59% |