Keeping Up with the Federal Reserve

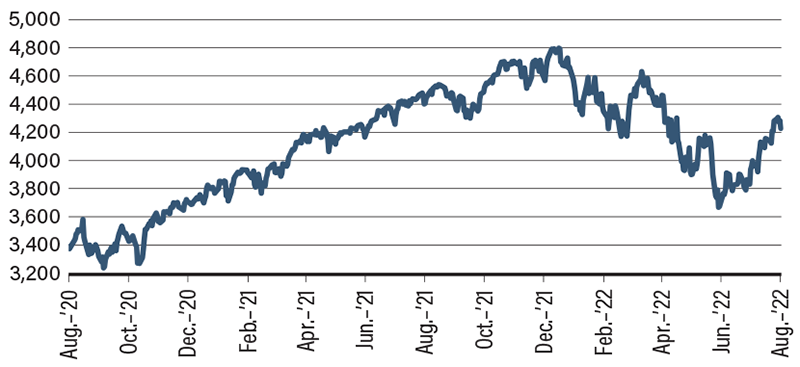

From Team Transitory to Team Soft Landing to Team Undecided, the Federal Reserve is anything but easy to keep up with. This is apparent in the volatility in the equity market.

The Fed has made it repeatedly clear its top priority is fighting inflation. Of course, one would not have doubted the central bank had it not recently insisted inflation was transitory, only to find itself way behind the curve. Nonetheless, after four rate hikes in only five months, the Fed’s hawkish policy should have been self-evident except for the mixed signals it has been sending in recent weeks.

First, it stopped short at suggesting the size of the rate hike in its September meeting. Then, it seemed to suggest it does not know where or when to stop, with some Fed officials bluntly stating they do not know how far rate hikes will go. Finally, Fed officials insist a slower pace of rate hikes will only happen when they are completely convinced inflation is cooling down without actually explaining what exactly it will take them to be completely convinced.

Wall Street was unimpressed and has called the Fed’s bluff as it bet on the Fed lowering rates sometime next year. The bet is evident in recent rallies in the equity market. The only problem is further rallies mean financial conditions would loosen up, working against efforts to tame inflation. If inflation proves hard to tame, the Fed would have to continue raising rates, which means Wall Street will lose the bet and losses would stretch across the sector.

Make no mistake: Wall Street is trying to keep up with the Fed. Just ahead of the Jackson Hole Economic Symposium, the equity market turned gloomy as investors once again feared further aggressive rate hikes.

Why, then, won’t the Fed make its plan clear? The answer is because it doesn’t have a plan. It has come to the painful realization that its record in forecasting inflation, growth and financial indicators is not impressive. That is why Federal Reserve Chairman Jerome Powell insists on going to a meeting-by-meeting basis. Stay tuned for the next episode.

High S&P 500 Volatility in 2022