Fed Ends Balance Sheet Normalization

The moment finally arrived: On December 1, the Federal Reserve officially ended its balance sheet normalization—the process known as quantitative tightening. Since 2022, the Fed had been shrinking its vast holdings of Treasurys and mortgage-backed securities. Now, the drawdown has stopped. What does this decision signal about the Fed’s view and outlook?

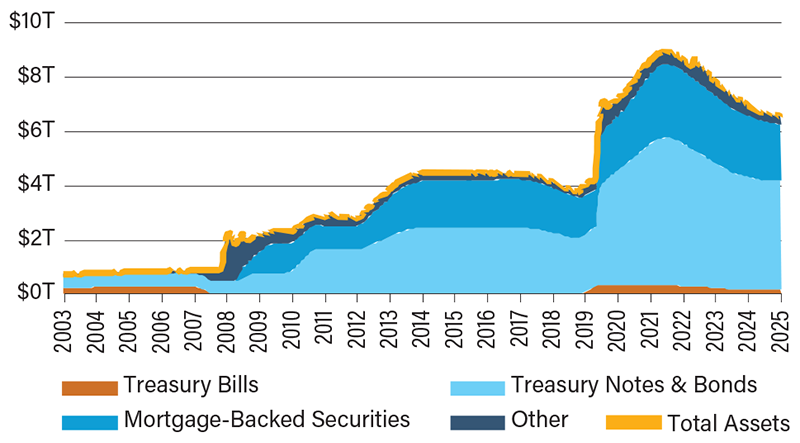

To grasp the true significance of the Fed’s recent move, it’s important to recognize that the term quantitative tightening can be misleading. Before the Fed launched its second round of quantitative easing (QE)—a policy in which it buys large amounts of government and other securities to boost liquidity, lower interest rates and support growth—its balance sheet stood near $4.2 trillion in February 2020. Over the next two years, that figure soared to nearly $9 trillion as the Fed injected unprecedented liquidity into the system. Even after years of tightening, the balance sheet today remains around $6.6 trillion, still far above pre-QE levels. In other words, this so-called tightening never fully reversed the prior expansion. The Fed didn’t restore its balance sheet to normal; it simply normalized at a higher baseline, meaning current levels are not restrictive by historical standards.

Since the Great Financial Crisis of 2008, the U.S. economy and financial markets have operated under an environment of extraordinarily accommodative monetary policy. Over time, the Fed’s balance sheet has become a central tool in sustaining that support. The Fed now uses its asset holdings to maintain a system of ample reserves—a framework in which banks hold more than enough liquidity to meet their needs without borrowing from one another, keeping short-term interest rates stable. Each time the Fed purchases securities, it credits banks’ reserve accounts, effectively creating new reserves.

Recently, however, volatility in money markets and short-term rates has caused concerns in the system. The high volume of short-term Treasury issuance has increased the supply of bills faster than investor demand, pushing short-term rates higher while the Fed’s cuts push them down. In response, the Fed ended its balance sheet normalization. By reinvesting all principal payments from its agency securities into Treasury bills (4- to 52-week maturities), the Fed aims to restore stability to short-term funding rates.

Composition of Fed's Balance Sheet

SOURCE: Federal Reserve.