Oil Prices Fluctuate While Equities Slip Into Bear Market

The overheating oil prices have started to cool; however, volatility is constant while geopolitical events unfold. With news of talks between Russia and Ukraine, and world leaders on a mission to find alternatives to Russian energy supplies, market panic was briefly eased although it is only a matter of time before the hypersensitive market sends oil prices in wildly unpredictable directions once more.

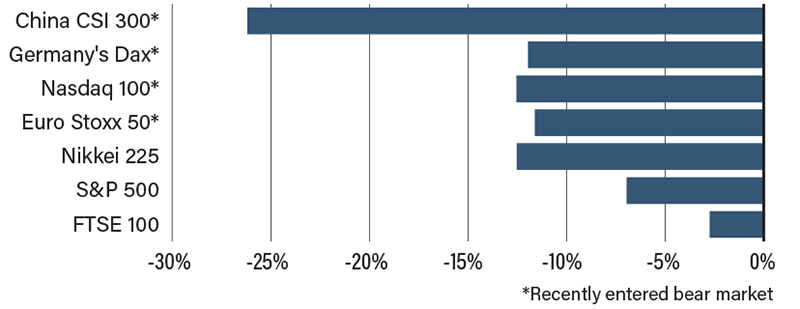

The equities market is also unsettled. Investors are taking note of the growing list of global indices falling into bear market territory—defined as a decline of 20 percent or more from recent highs accompanied by gloomy investor sentiment. From Asia to Europe, a number of major stock indices have sharply declined at some point this year with the tech-heavy Nasdaq 100 being the latest to join the list. The rest of the major indices have entered the correction territory—a decline of 10 percent or more from recent highs. All S&P 500 major sub-indices, except for energy, declined this year. Utilities saw the least loss while information technology, communication services and consumer discretionary goods experienced the biggest losses.

Both stocks and bonds recently fell as fears over economic stagnation and persistent inflation (stagflation) loom. U.S. stock indices gained immediately after the Federal Reserve’s March 16 rate hike. Fed officials claim the economy remains strong with no recession in sight, giving markets some level of clarity. Although the recent gains brought some indices out of the correction and bear market territory, U.S. equity futures have taken some hits thanks to the continuous risk posed by the Russia-Ukraine war. Look for sustained volatility in the equities market. Interest-rate sensitive companies such as Apple could face further declines as the Fed rate hikes move forward. Other companies are dealing with their exposure to inflation. For example, giants like Amazon and FedEx are facing higher costs for labor, transportation and commodities.

The current environment is best described as volatile. Markets are (over)reacting quickly to every piece of information related to the war. In reality, however, geopolitical risks do not change that fast. Negative impact is likely to run in longer terms. Don’t panic over the falling equities. After all, finally, something is affordable in this time of high inflation!

Major Indices: Change from All-Time Highs to March 21 Closing