Strait Talk: Iran-Controlled Hormuz Is Key Energy Gateway

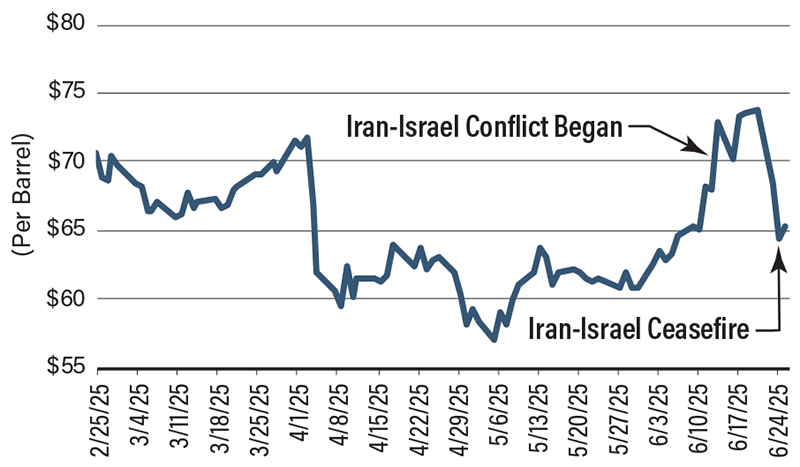

As trade uncertainty looms large, the Iran-Israel conflict has raised the stakes—threatening to choke off the Strait of Hormuz and send shockwaves through the global energy supply chain. The vital waterway lingered in obscurity until U.S. airstrikes landed on Iran June 22. Since then, those following the news have become familiar with the name.

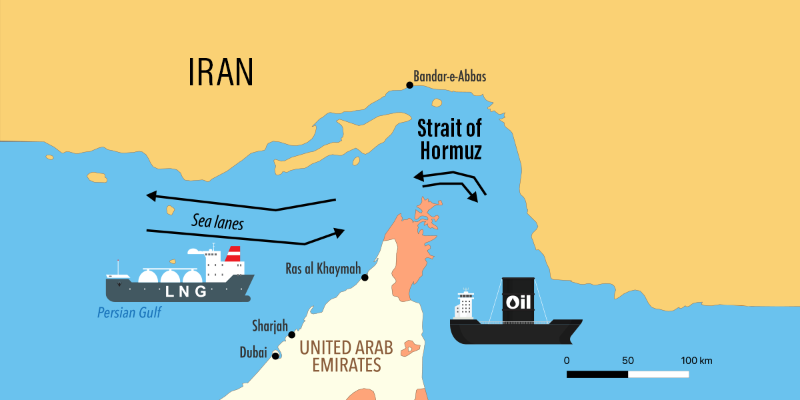

The Strait of Hormuz, linking the Persian Gulf to the Gulf of Oman, is the only maritime gateway from the Persian Gulf to the open ocean—making it one of the world’s most vital chokepoints for global energy trade. The 12-day conflict between Iran and Israel, which triggered U.S. strikes on Iranian nuclear sites, ended with a ceasefire—but not without threats, including Iran’s warning to close the strait. The ceasefire put that threat to rest—for now. The situation remains volatile. If there’s one thing we know about conflicts in the Middle East, it’s that a ceasefire can turn into full-scale attacks at any moment.

Why were markets alarmed by the threat to close the strait? Iran controls the northern side of this critical trade artery. If tensions escalate, it could block passage or target cargo vessels and energy tankers. Around 20 million barrels of oil—nearly 20% of global daily consumption—move through the strait each day. About 20% of global liquefied natural gas exports also pass through, mostly from Qatar. Any disruption could rattle global energy markets.

However, Iran has made similar threats before without following through, in part because its own oil exports rely on the same route. Still, it could target individual tankers without a full closure—though such acts may be considered acts of war under international maritime law.

While the United States, as a major energy producer, can meet some global demand, it is farther from Europe and even more so from Asia—adding to export costs. For this reason, the Middle East’s power lies not just in its oil reserves, but also in its location between Europe and Asia. As a result, global energy markets are very vulnerable to conflicts in the region.

Oil Prices Fluctuate Following Iran-Israel Conflict

SOURCE: Trading Economics.