U.S. Economy: How Would You Like the Landing?

Since the Federal Reserve announced rate hikes, many are concerned about the impact on the economy. The tightening policy is the Fed’s attempt to curb inflation amid criticism that it has been behind the curve. The central bank hopes to engineer a soft landing—raising rates just enough to fight inflation without crashing the economy—although some have questioned the likelihood of that outcome. As things stand, are we looking at a soft landing or a recession?

One thing is clear: We will not have a recession this year. A Bloomberg survey of economists puts the probability of a recession next year at 27.5 percent while Goldman Sachs estimates a 35 percent probability of recession over the next two years. Although the risk is rising, it is far from certain.

What about a soft landing? That, too, is far from certain, not only because the Fed has rarely achieved this outcome but also because it may not be the result some Fed officials have in mind. For instance, top Fed official James Bullard recently remarked that it is a “fantasy” to think current inflation could be reduced without raising interest rates to a level where the economy is constrained. Although his opinion is in the minority among the voting members, other officials may reconsider their views if inflation proves to be resistant to moderate, steady rate hikes.

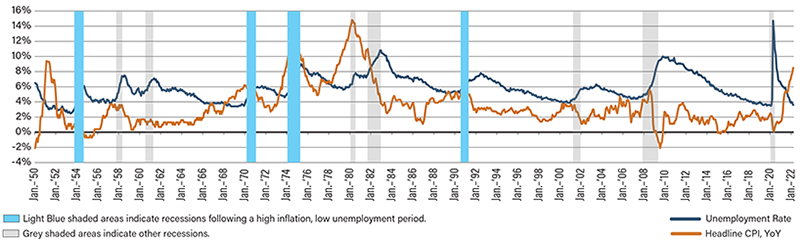

Former Treasury Secretary Larry Summers argued that disinflation would only happen once unemployment rises meaningfully, suggesting there’s no less painful way. Historically, there has never been a time with inflation above 4 percent and unemployment below 5 percent that was not followed by a recession within two years, he said. Living standards accelerate when wages grow at 4 percent and decline when wages rise at 5 percent or higher, according to Summers, implying that the current overheated labor market is not a desirable long-term outcome for workers.

To be clear—no one is rooting for a recession or suggesting that one will definitely happen. The conflicting opinions stem from different perspectives on what the Fed could and should realistically do to achieve its dual mandate of full employment and price stability.

U.S. Recessions (1950–Present)