Battery Storage Costs Expected To Continue To Rise Through 2023

As power generation in the United States continues to shift toward a more renewable mix, battery energy storage systems (BESS) will become increasingly important to integrate the intermittent nature of wind and solar generation.

Last year, wind and solar capacity additions totaled around 32 gigawatts. These additions made up almost 76 percent of the total capacity additions in 2021. Battery storage additions have so far lagged behind the pace of wind and solar, only adding around 3.4 GW during the same period. The lack of BESS capacity limits the further implementation of wind and solar generation.

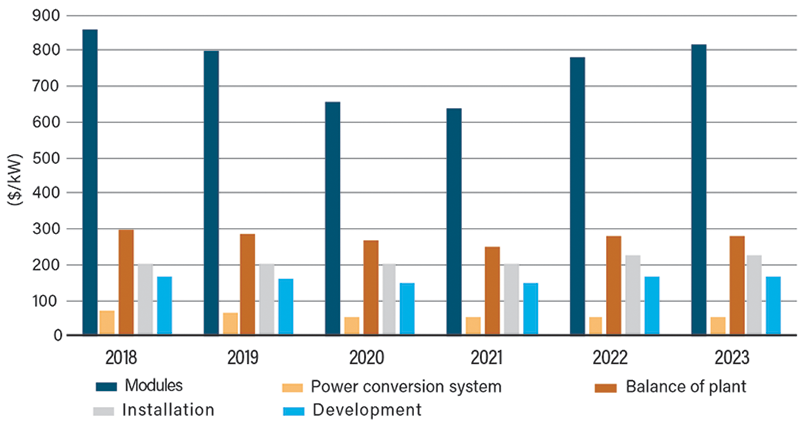

In the first half of 2022, BESS additions have been hindered by rising costs as a result of supply chain challenges, high material prices and labor shortages. According to IHS Markit, capital costs for battery storage systems increased 10 percent in the first half of 2022, as compared with the start of 2021.

BESS Capital Cost by Component - Utility Scale (50 MW/200 MWh)

Source: IHS Markit

“The main culprit that drove those system cost increases was higher battery module prices,” CFC Analyst Chris Whittle said. “Prices for both lithium-iron-phosphate and nickel-manganese-cobalt battery modules were up 15 to 20 percent since the start of 2021, marking the first-ever year-over-year increase in battery module prices.”

Commodity Prices Drive Battery Storage Cost Increases

The price increases came amidst surging cobalt, lithium and nickel commodity prices. With over half the world’s lithium and cobalt processing and refining capacity located in China, these prices have been largely affected by high global demand, tariffs and supply chain issues. In May 2022, lithium prices were more than seven times higher as compared to the start of 2021. Nickel prices were also surging due to Russia’s invasion of Ukraine. Russia supplies 20 percent of the world’s high-purity nickel. IHS Markit forecasts that battery costs will continue to climb through 2023.

The intermittent nature of wind and solar generation makes reliability a concern. Operators use batteries to store excess solar and wind power generated when demand is low, and then discharge it when demand is high.

“Batteries are a great way to leverage unused solar and wind power for later consumption.” Whittle explained. “Otherwise, there’s no way to use these renewable sources when the sun isn’t shining or the wind isn’t blowing, which makes them hard to rely on.”

Grid operators are currently struggling with this challenge. Even though solar and wind generation have increasingly dominated capacity additions over the last couple of years, their contribution to peak hour generation has been less significant. In the second quarter of 2022, solar and wind generation made up around 16 percent of the total U.S. generation mix. Yet, during peak hours, renewables were only estimated to contribute 8.5 percent of the generation mix, as a weighted average across all ISOs, according to S&P Global. The lack of battery storage makes using solar and wind generation assets less desirable when demand is high.

In an attempt to increase the penetration of batteries, the Inflation Reduction Act includes a significant incentive on investments in stand-alone battery storage systems. That is, an investment tax credit (ITC) for 30 percent of the investment costs through 2032. Electric cooperatives will be able to take advantage of this incentive through a direct pay option. Research company Wood Mackenzie projects that this new incentive for battery storage will significantly increase the amount of investment and deployment in the sector. The researcher forecasts the 10-year outlook on battery storage to amount to 135 GW of capacity, equating to more than $160 billion of investment through 2031.