Bitcoin Hits New Record, Drives Higher Power Consumption

Bitcoin’s recent price surge pushed it to a new all-time high in March, at more than $73,000. That is around 200% higher compared with last year, according to Yahoo Finance. Higher bitcoin prices often increase the industry’s power consumption because it significantly raises miners’ profit margins.

“The mining process is so power intensive that bitcoin mining companies prefer to locate in areas with competitively priced, reliable electricity,” CFC Energy Industry Analyst Chris Whittle said. “This has made some electric cooperative service territories popular locations for these facilities. An environment with elevated bitcoin prices could have electric cooperatives seeing more requests from mines looking to connect to the grid. Additionally, electric cooperatives who already serve these facilities could experience increased demand in their service areas.”

Bitcoin is a digital currency whose transactions are managed by a decentralized system with no single regulating entity. It is a self-regulated system where bitcoin transactions are verified by the active miners on the network. Such mining involves high-powered computers verifying each live bitcoin transaction. Once the transaction is verified, it is then encrypted and stored on the blockchain, or digital ledger. The miners who helped verify and encrypt the transaction are then rewarded with newly minted bitcoins.

“In the last three years, the U.S. has become the largest bitcoin mining hub in the world,” Whittle said. “At the start of 2021, the U.S. accounted for around a 10% share of global bitcoin mining activity. Most recent estimates suggest that share could be upwards of 38% today, according to Cambridge Center for Alternative Finance.”

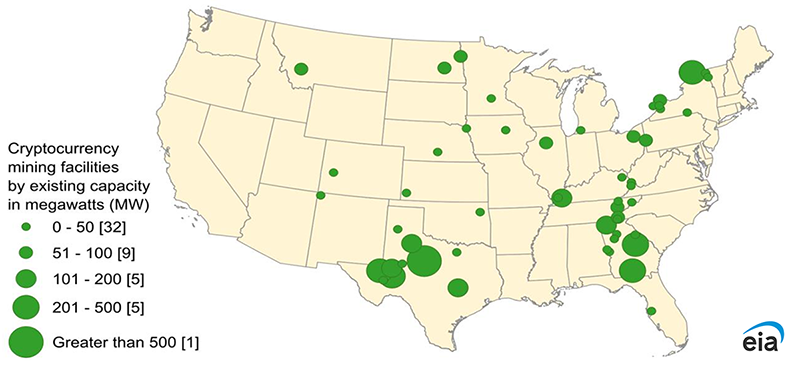

The Energy Information Administration (EIA) has identified 137 cryptocurrency mining facilities in the U.S. Of those, EIA estimates the maximum electricity demand at 101 of the facilities to be around 10,275 MW, or a 2.3% share of the average annual electricity demand in the U.S., comparable to the annual electricity demand of more than 6 million homes.

While the majority of U.S. mining is concentrated in Texas (28.5% share), Georgia (9.6% share) and New York (8.8% share), new industrial-sized facilities have spread across the country, with states like North Dakota, Montana and Kentucky being home to cryptocurrency mines with estimated power demands ranging from 51 MW to 200 MW, according to EIA and Foundry, a digital asset mining and staking company.

Locations of 52 U.S. Cryptocurrency Mining Operations, as of January 2024

Source: Digiconomist, Yahoo Finance