Look for Data Centers To Impact US Power Markets, Co-ops

Data centers are an increasingly important industry for the world economy, helping innovate and increase efficiency across a wide variety of businesses and services. Through their vital role in supporting cloud-based services, 5G-wireless networks and the emergence of generative artificial intelligence (AI), data centers are set to be one of the fastest-growing U.S. industries.

“Given the data center industry’s large reliance on electricity, the utility sector is also estimated to experience significant growth,” CFC Energy Industry Analyst Chris Whittle said. “On average, power represents 70% of the total operating costs at a data center. Running the information technology hardware and cooling systems at these server hubs is a very power-intensive procedure, and the continued growth of generative AI is set to make the process more intensive.”

A typical rack of servers in a data center can consume around 30 to 40 kW. When rigged with AI processors, that same rack could consume 3 to 4 times more electricity, according to a recent S&P report.

In early 2023, McKinsey & Company forecasted that data center power demand could reach 35 GW by 2030. Since then, McKinsey increased its estimates by 43% to 50 GW of power demand by 2030, up from around 21 GW in 2023, representing a 13% compound annual growth rate (CAGR).

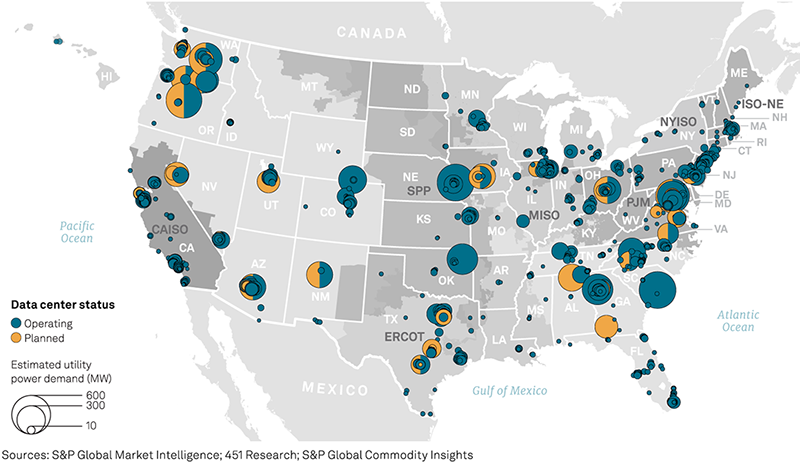

“Forecasts aside, S&P estimates that more than 9 GW of data center projects are currently planned for construction in the U.S. and that around a third of these will be served by non-investor-owned utilities,” Whittle said. “Electric cooperatives could see significant load growth in the next five years as new data centers come on-line.”

Source: McKinsey, Reuters

AI Is Expected To Drive More Power Demand from Data Centers

Source: S&P Global Market Intelligence; 451 Research; S&P Global Commodity Insights.

Data Center Investment Activity

Due to their consistent utility-like cash flows, risk-adjusted yields and future demand growth potential, the data center industry has experienced significant investor interest in recent years. In North America since 2013, the sector has experienced a 9% CAGR in transactions, the highest of all U.S. sectors other than life sciences, according to research from real estate management firm JLL.

Strong investment activity has helped fuel the industry’s growth. In the last year alone, the total amount of space occupied by data center facilities grew by 26% in the U.S. Accompanied by a record number of new facilities entering the construction pipeline, the industry is primed for future growth, consistent with power demand forecasts, according commercial real estate services and investment firm CBRE.

Data Center Geographic Preferences

The ranking of the top 15 U.S. data center markets in terms of power capacity as of 2023, according to Cushman & Wakefield, CBRE.

| Market | Demand (MW) |

|---|---|

| Northern Virginia | 2,552 |

| Dallas | 654 |

| Silicon Valley | 615 |

| Phoenix | 615 |

| Chicago | 560 |

| NYC/Northern New Jersey | 392 |

| Portland | 382 |

| Atlanta | 360 |

| Los Angeles | 206 |

| Salt Lake City | 203 |

| Las Vegas | 173 |

| Seattle | 105 |

| Boston | 95 |

| Denver | 78 |

| Columbus | 41 |

Companies choose to locate data centers in areas based on several key factors: low-cost, reliable power; robust fiber capacity; reasonable land and construction costs; and favorable economic and regulatory incentives. Data center locations share a favorable combination of these factors.

“Outside of the power needed to run the actual facility, fiber is one of the most important factors determining the productivity of a data center,” Whittle said. “The amount of fiber capacity determines the network speed and how quickly information can be shared across platforms, an aspect that is becoming increasingly vital and competitive in the industry. Strong fiber infrastructure is a main driver of these locations.”

Internet Atlas Map—The Physical Infrastructure of the Internet

Source: McKinsey & Company

At least 24 states have started offering data center incentives, mainly tax-based, in an attempt to attract new facilities and spur economic development. Many of these states have started seeing increased data center construction activity.

Research on four key markets illustrate the growth in power demand, power cost, state fiber availability, cost of data center construction and whether the state offers incentives for data centers. The markets were selected based on 2023 data availability from real estate firm Cushman & Wakefield, CBRE and Statista, a global data and business intelligence firm.

| Market | Capacity (MW) | Y-o-Y Change (MW) | Y-o-Y Change (%) | Power Cost (cents/kWh/month) vs U.S. Average | State Fiber Availability (%) | Cost of Data Center Construction ($/watt) | Incentives Offered by State |

|---|---|---|---|---|---|---|---|

| Northern Virginia | 2,552 | 439 | 20.8% | -0.98 |

50.09% | 10.2 | Yes |

| Dallas | 654 | 173.1 | 36.0% | -2.11 | 43.84% | 8.8 | Yes |

| Chicago | 560 | 217.4 | 63.5% | -0.6 | 33.75% | 10.44 | Yes |

| Atlanta | 360 | 57.5 | 19.0% | 0.17 | 36.88% | 8.83 | Yes |

“Northern Virginia and Chicago are two of the top data center markets that experienced significant growth over the last year,” Whittle said. “Even though both of these markets have construction costs on the more expensive side, their combination of below U.S. average power costs, strong fiber availability and state-level incentives have made these ideal environments to host data centers. Dallas is another large market that experienced significant growth.”

Dallas and its surrounding areas, have a strong mixture of lower-cost power, high fiber availability, inexpensive construction costs and state incentives.

With these factors in mind, Whittle explained, “Electric cooperative service territories that possess a preferable combination of these characteristics should prepare for increased interest from data center developers looking to connect on their systems.”

Hurdles Impacting Data Center Growth

The exploding demand for these technology warehouses has started to raise questions about the risk of supply shortages in the industry. The lead times to obtain necessary data center equipment have increased significantly, according to a recent Wall Street Journal article. Current lead times for custom cooling systems are expected to be five times longer compared with a year ago, taking as long as six to eight months. For backup generators, delivery times have increased from at least a month to as long as two years, according to The Wall Street Journal.

“Trouble securing the required parts needed to operate a data center could slow down the start times of planned facilities all over the country,” Whittle said.

As the utility industry faces retirements of dispatchable generation sources, reliable power is also at risk of supply issues. According to IHS Markit North American Power Market Outlook, there are expected to be more than 93 GW of dispatchable retirements in the U.S. from now through 2030.

Much of the capacity entering the lengthy process of interconnection queues is intermittent renewable resources. The amount of capacity in interconnection queues grew by more than 900 GW in 2023 to a total 2.6 TW, with solar, wind and battery storage projects making up 95% of the backlog.

“As grid operators have to grapple with the surging amount of interconnection requests and transmission upgrades, wait times in queue for many solar and wind projects have been going up,” Whittle said.

The median amount of time spent in queue, until receiving an interconnection agreement, increased to more than 40 months for solar projects and 50 months for wind, according to Lawrence Berkeley National Lab.

“These power supply challenges are a potential risk to hindering the growth of the U.S. data center market, as well as the growth of other U.S. sectors,” Whittle concluded. “Electric cooperatives expecting future load growth from data centers should be mindful of these potential risks.”