Natural Gas Prices Ease After Volatile Year

Natural gas storage capacity has remained constant over the last decade, only growing 0.05% from 2017 to 2021. Meanwhile, natural gas demand has grown nearly 20% from 2017 to 2022, with exports growing more than 440% over the same time period according to the U.S. Energy Information Administration (EIA).

“Natural gas demand growth far outpacing that of storage inventories has helped add increased volatility to natural gas prices when shortages arise,” CFC Analyst Chris Whittle said. “Additionally, the ability for the electricity sector to switch to coal when shortages arise has been diminishing, adding further tightness and price volatility.”

Natural gas storage inventories follow a cyclical path. The injection period goes from April to November, so typically, storage inventories grow throughout the period. Then, over the winter months, storage inventories fall as demand for heating rises. The cycle repeats itself the following April. Since storage inventories follow a similar path every year, looking at the difference between current inventories and the five-year average can be very revealing as to when the market is experiencing abnormal conditions, such as a shortage.

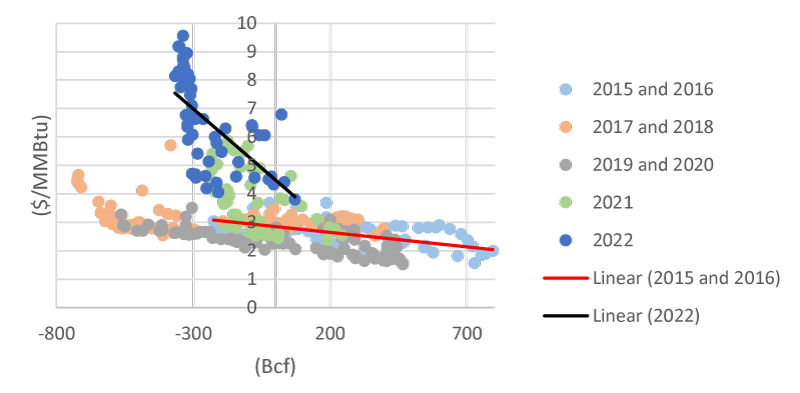

Weekly Natural Gas Prices vs. Inventory Relative to 5-Year Average. Increased Price Volatility in Recent Years.

Horizontal axis represents the difference between natural gas storage inventories and the rolling 5-year average; the vertical axis represents weekly Henry Hub natural gas prices.

Horizontal axis represents the difference between natural gas storage inventories and the rolling 5-year average; the vertical axis represents weekly Henry Hub natural gas prices.

Source: EIA.

“From 2015 to 2020, natural gas prices gradually increased when inventories moved below the five-year average,” Whittle explained. “However, if we look at data from 2021, and especially 2022, the relationship is far more extreme. Here, prices spike and move drastically higher when inventories drop below the five-year average.”

In 2022, natural gas consumption from the electric power sector grew 7.5% and liquefied natural gas (LNG) exports grew 8.5%, making up almost 11% of the total U.S. dry gas production in the year. This put pressure on inventories that trailed close to the five-year minimum for most of the year. The lack of inventory growth along with historical demand made natural gas prices very sensitive to these shocks.

Working Gas in Underground Storage. 2022 Storage Levels Closely Followed 5-Year Minimum.

Source: EIA.

The Henry Hub natural gas spot price averaged $6.42/MMBtu in 2022, the highest since 2008, with prices going north of $9/MMBtu for much of August. Relief came at the end of the year as natural gas production grew and consumption slowed.

Total dry gas production in the fourth quarter of 2022 was around 3% higher compared with the year before, at 100.15 billion cubic feet (Bcf) per day. A warmer-than-normal winter for most of the U.S. restrained domestic demand of natural gas during the winter months. Natural gas consumption for January 2023 was around 10% lower compared with the January prior. Additionally, the eight-month closure of the Freeport LNG terminal following a June 2022 explosion made more natural gas available domestically, around 2 Bcf per day.

“This helped relieve a lot of the pressure on inventories and prices,” Whittle said. “The EIA expects inventories at the end of March to total around 1.8 trillion cubic feet, 16% higher than the five-year average. Over the six-month period ending March 1, 2023, Henry Hub natural gas prices had fallen by 72% according to S&P, and EIA estimates prices to average $3.02/MMBtu over 2023.”

NYMEX Henry Hub Spot and Futures Prices. Lower Prices in 2023.

Source: S&P Capital IQ Pro. Data as of March 2, 2023.

Natural gas is the biggest generation source for electric cooperatives and the country as a whole.

“As natural gas prices remain at lower levels in 2023, generation costs and wholesale electricity prices will ease as well,” Whittle said.

Utility fuel costs are usually based on longer-term contracts with providers and spot purchases made at a wholesale price. In some areas of the country, generation costs might drop more quickly in response to the lower natural gas prices compared with others. In 2023, EIA expects wholesale power prices to fall significantly in all ISOs/RTOs compared with their 2022 averages.

Wholesale Electricity Prices. Lower Prices in 2023.

Source: EIA.