Data Center Demand Accelerates in Recent Forecasts

Increasing electricity demand will be a main driver of U.S. economic growth for years to come, serving as an input for many emerging sectors like new manufacturing, electric vehicles, building electrification and, most notably, the emergence of digitization and artificially intelligent technologies.

The applications of artificial intelligence (AI) are expected to substantially impact the world economy. The potential value of the emerging AI sector should not be understated. McKinsey estimates that generative AI has the potential to create between $2.6 trillion and $4.4 trillion in global economic value.

“Data center and electric utility infrastructure will need to significantly grow to support the rapidly expanding AI industry, posing challenges and opportunities for the electric cooperatives involved in powering these facilities,” CFC Energy Industry Analyst Chris Whittle said.

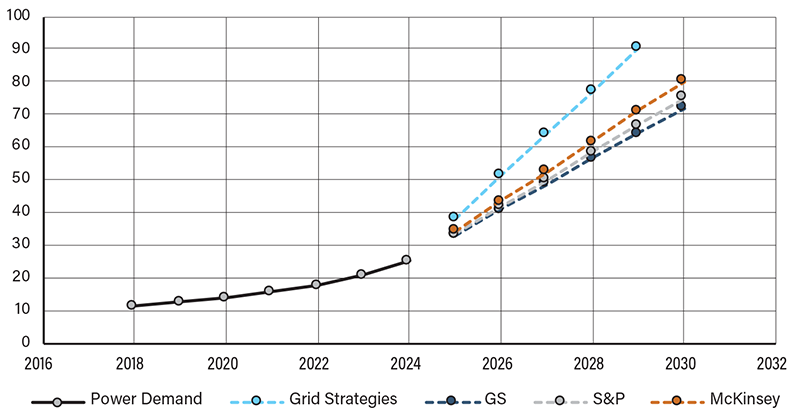

US Data Center Power Demand Forecast

SOURCE: Grid Strategies, Goldman Sachs, S&P Global, McKinsey.

Data center power demand in the U.S. was estimated to be 25 gigawatts (GW) in 2024. Some aggressive forecasts now suggest that data center power demand could reach upwards of 90–100 GWs before the end of the decade, according to Lawrence Berkeley National Laboratory and Grid Strategies. However, more conservative forecasts predict that data center power demand could grow more in the 70–80 GW range by 2030, as supply constraints and increased lead times continue to delay active projects, according to groups like Goldman Sachs, S&P Global and McKinsey.

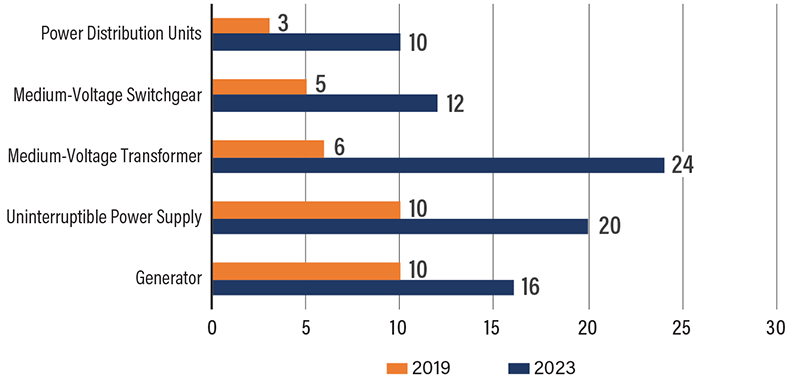

Lead Time of Data Center Inputs (months)

SOURCE: McKinsey.

Adding even 50 GW of new data center capacity by 2030 would require significant investments, including more than $500 billion in internal data center infrastructure, at least $60 billion in new generation and $15 billion in transmission infrastructure, according to McKinsey and S&P Global.

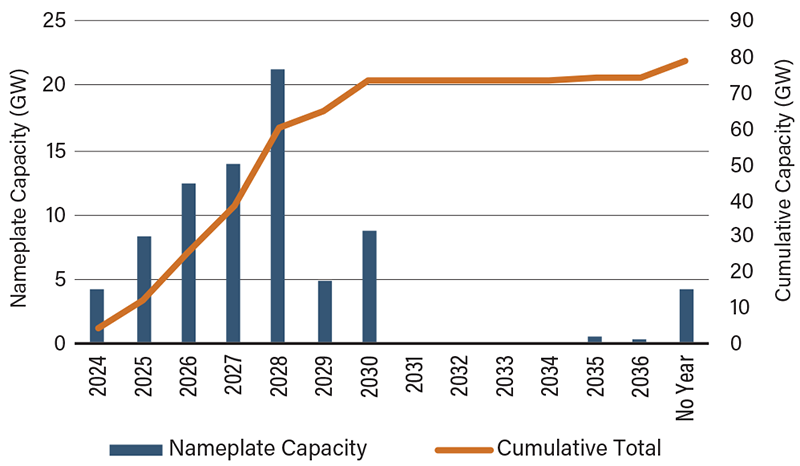

The power intensive nature of data centers requires access to firm and uninterrupted power supply. S&P Global assumes that the incremental capacity needed to add 50 GW of data center demand growth by 2030 would need to be made up of 50% natural-gas-fired units, 20% wind and 30% co-located solar/battery resources. This is based on current market assumptions and is not factoring in the future viability of expanded nuclear energy production.

Natural Gas Generation Projects

SOURCE: S&P Natural Gas Project Tracker.

“The largest supply constraint for both data centers and new power projects is transmission infrastructure,” Whittle said. “Grid connectivity and transmission access are quickly becoming the most significant drivers in new data center siting, pushing future growth to less congested areas, like parts of the Southeast, Texas, Midwest and Western states. Electric cooperatives across the country have received increased interest from data center customers as a result.”

Transmission infrastructure in the U.S. will need significant growth to support the demand for AI as well as to support other rapidly growing sectors of the U.S. economy like new manufacturing and electric vehicle loads.

In response to concerns over sharply rising power demand, investment in building new transmission is starting to pick back up after being relatively dormant since 2013. Most U.S. regions have announced projects to significantly expand their transmission infrastructure, including:

- PJM: board recently approved a $6.7 billion transmission expansion plan.

- MISO: Tranche 2.1, $21.8 billion Long Range Transmission Planning investment.

- Texas: ERCOT plans for over $13 billion in transmission investments; could be as high as $30 billion.

- SPP: 2024 transmission plan included $7 billion of new investment.

- CAISO: 2023–2024 transmission plan included $6 billion of new investment.

- Pacific Northwest: BPA announced $3 billion in new transmission investments.