Transformers Are Facing Major Cost, Supply Chain Pressures

After decades of flat growth and predictable power generation resources, the United States is in the midst of a rapidly changing energy sector. As a result, transformers, one of the most critical and irreplaceable parts of the electricity grid, are under significant pressure, facing supply shortages and high prices amid high demand. Though it’s a standard component of electrical infrastructure, the supply of transformers, or lack thereof, is becoming a major factor in the energy transition.

Transformers are a crucial part of the electric grid infrastructure for generation, transmission and distribution. They support the grid through a myriad of functions across the system, helping regulate voltage to step up or step down and integrating different generation sources—particularly renewables—to the grid by matching the voltage level. Voltage adjustments also minimize losses along power lines and support energy efficiency. All of these functions play a key role in maintaining grid reliability, allowing for stable power supply across the grid. Safety is another important feature of transformers as they reduce the risk of electrical hazards, especially for the end users.

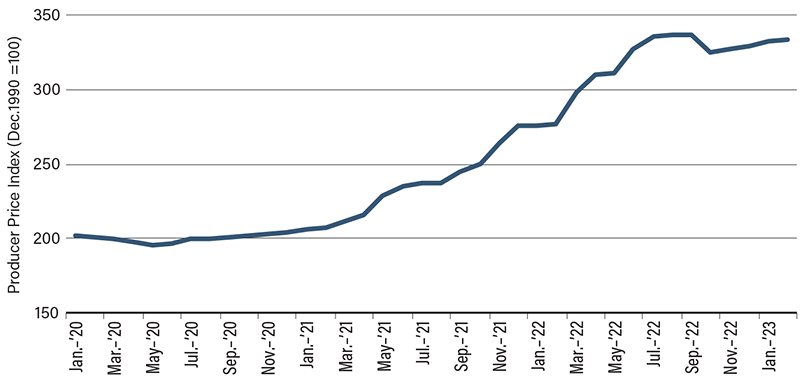

According to Wood Mackenzie, the prices of transformers have increased since 2020 by 60% to 80%, depending on the size and application of the transformer (Figure 1). In 2023 alone, the price of distribution transformers rose by 14% and substation transformers by 25%. Some of the key raw materials for transformers, such as grain-oriented electrical steel (GOES), copper and fuel oil, have seen corresponding price increases during this period. Both supply chain bottlenecks and inflationary pressure squeezed up GOES prices by 180% in 2020. Even though the price has fallen since then, demand has outpaced supply for transformers, keeping cost high. The tight labor market has also added to soft costs, which make up about 55% of average transformer costs. The cumulative impact of these annual price increases has put pressure on utilities planning and budgeting for new inventory.

Figure 1: Producer Price Index: Power and Distribution Transformer

Source: Federal Reserve Bank of St. Louis.

Global Supply Chains Causing Delays

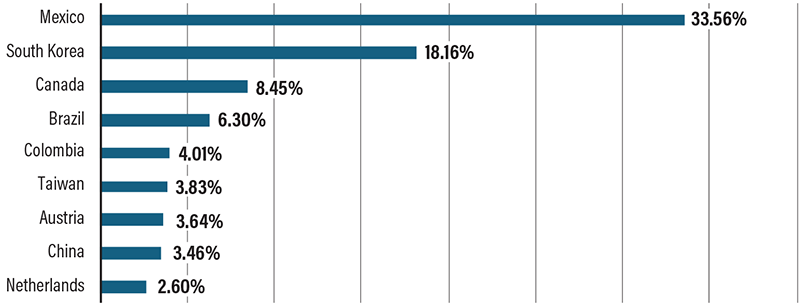

U.S. transformer manufacturing capacity is relatively small and has shrunk over the last few decades as steady electricity growth led to a consolidation of U.S. manufacturers. Currently, only 20% of the U.S. demand for transformers is met by domestic manufacturing, with the remaining 80% being met through imports, which amounted to $7.5 billion worth of trade in 2024.

The U.S. imports transformers from a diverse set of countries, with Mexico (33.56%), South Korea (18.16%) and Canada (8.45%) as the top three trading partners in 2024 (Figure 2). The tariffs recently added to goods coming into the U.S. from China, Mexico and Canada may further impact the price of transformers.

Figure 2: Import Partners for Electric Transformers (2024)

Source: U.S. Trade Administration, Department of Commerce.

Over the last few years, the lead times on manufacturing transformers have increased. Prior to the COVID pandemic, the lead time for large capacity and generation step-up transformers was about 30 to 60 weeks. The constraints imposed by the pandemic and a slowdown in manufacturing have increased the lead time for transformers to an average of 120 to 130 weeks.

It’s been five years since the start of the pandemic, so why are transformers still so affected by supply chain issues? The U.S. is experiencing unprecedented load growth from the rise of data centers, the electrification of heating and transportation, and expansion in manufacturing. The increased need for transformers is in step with electricity demand growth. The capacity of transformers required at the distribution level is also impacted by changing technology and user needs. Along with new loads, power generation has been growing, and renewables are being added to the grid at a rapid pace. Renewables located in more remote locations require new or upgraded infrastructure to connect to the grid.

Infrastructure, Extreme Weather Are Increasing Demand Concerns

Aging infrastructure is adding additional complexity to the issue. On the distribution side, most transformers have reached the end of their useful life and need replacements. The National Renewable Energy Laboratory estimates that about 50% of distribution transformers in service are more than 33 years old, close to the end of their designed life cycle. By 2050, NREL expects transformer capacity demand to increase by more than 140%.

Another factor driving demand for transformers, particularly this past year, is extreme weather events, such as hurricanes and wildfires, which are damaging grid infrastructure with higher frequency and intensity. After an extreme weather event, transformers often need to be replaced, creating yet another increase in demand for new units.

As the U.S. energy sector transitions and expands, an important part of this growth will be the ability of the key components of grid infrastructure to keep pace. The supply chain for transformers is under pressure, and utilities and cooperatives will have to plan ahead, continue to build partnerships with vendors and likely adjust budgets to meet these market changes.