If the economy is so strong, why the long face? Real gross domestic product (GDP) grew 3.3% in the last quarter. The unemployment rate is low, and wages are growing fast. The stock markets keep rising. Inflation has eased. Even the consumer sentiment index has improved.

But have you noticed that people are still complaining about the economy? Is it because we read too much negative news and think everything is bad, disregarding the story that official data tell? Instead of blaming people for not understanding the economy, let’s explore how much economic measures actually reflect reality.

Only one type of economic measure needs to go wrong for others to lose real meaning, and that is the inflation measure. For example, the term “economic growth” typically refers to real GDP growth, which is nominal GDP growth adjusted for inflation. If we miscalculate inflation, we miscalculate economic growth. This is true for all economic measures expressed in real terms. In cases where the economic measures are expressed in nominal terms, such as average hourly earnings, inflation provides perspective for real growth. After all, you are poorer even if you make $100 more when inflation adds $150 to your expenditures. If inflation measures are wrong, the comparison between your before-and-after financial well-being is also wrong.

There are two commonly used inflation measures: the Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCE). Both suffer from major flaws, many of which arguably lead to underestimation of inflation. For instance, gratuities and extra fees that have recently increased or been added are not reflected in the inflation measures. But many consumers know how even a self-checkout kiosk now expects a tip.

Additionally, the Federal Reserve’s preferred inflation gauge, PCE, accounts for substitution—that is, if beef prices increase, consumers switch to a cheaper, possibly lower-quality meat. In this case, the inflation effect appears smaller while in reality our standard of living decreases. So why are we ridiculed for being grumpy about the economic landscape? Policymakers cannot reasonably expect those who are forced to eat ground chuck instead of the steaks they used to be able to afford to be happy—no matter what the economic growth rate is!

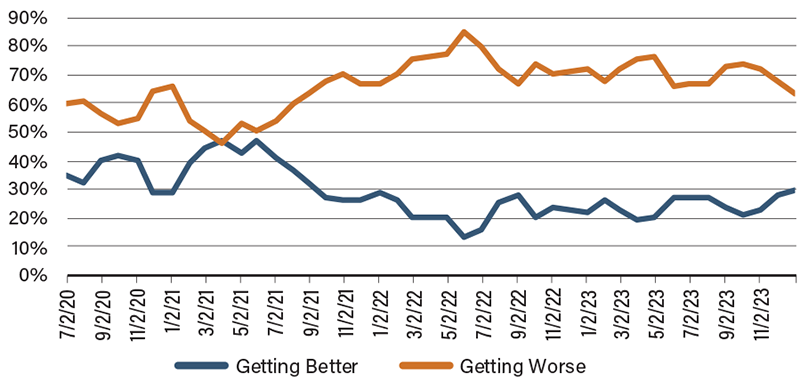

Americans’ Views of Economic Conditions

Source: GALLUP.