2020 Budget Deficit Breaks Record

As if the pandemic wasn’t bad enough, another side effect of the virus is the dramatic escalation of the federal budget deficit and our national debt. Prior to the COVID crisis, economists were fretting because the Congressional Budget Office (CBO) estimated a $900 billion federal budget deficit for fiscal year 2020, more than 4 percent of gross domestic product. Worse yet, it was expected to surpass $1 trillion in 2022.

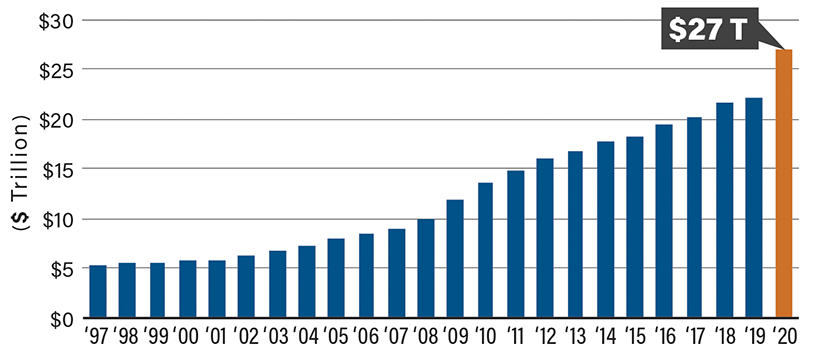

After being blindsided by the pandemic, the budget deficit is now projected to be $3.3 trillion by fiscal year-end, which is September 30. The previous record-setting budget deficit was $1.4 trillion in fiscal year 2009 in response to the Great Recession. The CBO is now projecting total national debt to exceed $27 trillion in 2021.

Virus Derails Federal Budget

The pandemic stimulus plan was a major budget buster. Governments are supposed to help out during stressful economic times by using fiscal policy to move the economy forward, but it would be better if the money had been spent on education, productivity enhancements, infrastructure improvement and the like. Instead, the CARES Act passed in March is being used solely to keep the U.S. economy afloat. Even worse: More help is needed.

Eventually, America—which has more national debt than any other country—may face a crisis, but how will the nation know when too much debt really is too much? The answer: When creditors both at home and abroad start to push up the interest rate the U.S. government pays on its debt. So far, that’s not a problem.

How Do We Get Back on Track?

To reduce the debt and avoid economic distress, the government has to impose higher taxes or reduce future spending. Raising taxes weakens incentives and slows economic growth—not what we need right now. Besides, any lawmaker who recommends higher taxes in this recessionary environment would have to be out of their mind. The better approach is to slow government spending growth at the appropriate time, which is not now since our economy has been severely weakened. There are many different approaches, but it has to start somewhere. If we do nothing, exploding national debt will be an increasing burden on the younger generation, economic growth and our future standard of living.

National Debt by Year