2020 Saw an Unbelievable Year for the S&P 500

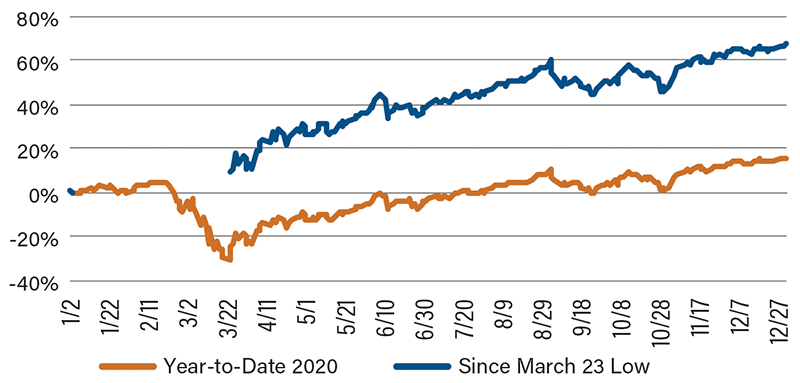

The S&P 500 ended 2019 with tremendous gusto, up 29 percent for the year—an impressive result. Then February 2020 arrived, along with the virus, sending the index tumbling 34 percent in a matter of days. It hit a low for the year on March 23. Since then, however, it has been pretty much all positive, even unbelievable, for equities, which finished 2020 up 65 percent from the March low point and closed out December up 16 percent for the year.

How Did That Happen?

Never has the saying “the stock market is not the economy” held more true than in 2020. In fact, economists can’t stop asking the bewildering question: Why, in the midst of a global pandemic that has killed some 1.9 million people and plunged the economy into the worst crisis since the Great Depression, did equity markets stage a historic rebound to reach new highs and become completely disconnected from the world economy? Several answers have been put forth, but one really big number stands out that may explain a great deal of the positive outlook: $14 trillion. That’s the aggregate increase in the money supply this year in the U.S., China, Euro Zone, Japan and eight other developed countries.

That’s a Lot of Money!

To put the surge in perspective, the jump to $94.8 trillion in supply far exceeds the previous record increase of $8.38 trillion in 2017, according to data compiled by Bloomberg. The mechanics behind the massive increase come from the world’s largest central banks, which were instrumental in printing the money they needed to inject directly into the financial markets by purchasing bonds and other assets on a scale never seen before. The U.S. Federal Reserve alone is pumping at least $120 billion a month into the financial markets through its purchases of fixed-income assets.

With such a flood of money, it's interesting to note that some investors are questioning the true value of currencies, which might explain the stunning rally in Bitcoin and other cryptocurrencies along with gold. It might take a generation to figure out if $14 trillion was too much, or even too little, to support the world economy during the pandemic and leading to the next bubble or rapid inflation, but it’s a step that had to be taken.

2020 S&P 500 Index