Eyes on the Economy: Homebuilder Sentiment, Leading Indicators, Inflation

Homebuilder Sentiment Rises

The National Association of Home Builders (NAHB) Housing Market Index increased to 46 in November from 43 in October, the highest post in seven months and the third straight month of improvement. Builders expect market conditions to continue to improve with the upcoming unified government (both the White House and Congress will be controlled by the same party), as they anticipate “significant regulatory relief for the industry that will lead to the construction of more homes and apartments,” according to NAHB Chairman Carl Harris.

However, housing starts declined 3.1% in October to a seasonally adjusted annual rate of 1.31 million units. October’s reading reflected an increase in average mortgage rates from 6.18% to 6.43% between September and October. Despite the Federal Reserve’s first federal funds rate cut in September, mortgage rates have trended back up. Even after the second Fed cut in November, mortgage rates continued on an upward trend as of November 21. Nonetheless, existing-home sales increased 2.9% in October from a year ago, marking the first annual increase in more than three years while median existing-home sales continued to grow. Overall, the housing market still faces an affordability crisis.

Leading Indicators Continue To Fall in October

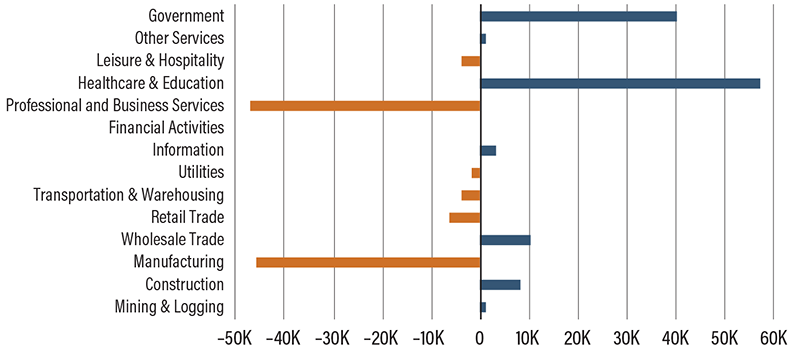

The Conference Board Leading Economic Index (LEI) declined 0.4% in October, following a decrease of 0.3% in September. The LEI provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The largest contributor to the decline was manufacturing new orders. Manufacturing work hours decreased, partly due to the hurricanes, while overall industrial production also posted a decline. Aside from the impact of the hurricanes, the index “continued to suggest challenges to economic activity ahead,” according to the Conference Board.

Inflation Accelerates After September Fed Rate Cut

The annual Consumer Price Index inflation rate accelerated to 2.6% in October after six straight of declines. Excluding food and energy, the core inflation rate remained at 3.3%. On a month-over-month basis, inflation rose 0.2% in October, the same as in September. More than half of inflation was driven by shelter inflation. On a year-over-year basis, shelter cost increased 4.9%. On a monthly basis, it accelerated from 0.2% in September to 0.4% in October. Given that shelter is the largest expense for consumers, the overall inflation is unlikely to return to the target rate without shelter inflation falling further. At the same time, wholesale inflation as measured by Produce Price Index accelerated to 2.4% in October from 1.9% in September, beating forecasts of 2.3%.

The acceleration in both inflation indices came after the Fed began its policy rate cuts in September, delivering a surprise jumbo reduction of 50 basis points—a move that may be seen as a mistake given the latest inflation data releases. While markets still anticipate rate cuts to continue, expectations have shifted to a slower speed. Fed officials have also signaled they are in no rush to cut rates fast.

Inflation Accelerates After Fed Rate Cut

Source: U.S. Bureau of Labor Statistics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| NAHB Housing Market Index (Oct.) | 43 | 44 | 46 |

| Leading Economic Index (MoM)(Oct.) | (0.3%) | (0.3%) | (0.4%) |

| Consumer Price Index (YoY)(Oct.) | 2.4% | 2.6% | 2.6% |

| Producer Price Index (YoY)(Oct.) | 1.9% | 2.3% | 2.4% |