Eyes on the Economy: Retail Sales, Oil Prices, Interest Rates

Retail Sales Fall in May

U.S. retail sales fell 0.9% in May, marking the steepest decline since January. The drop was greater than market forecasts of a 0.7% decrease and followed a downwardly revised 0.1% dip in April. Sales of motor vehicles and related parts saw the largest decline at 3.5%, followed by building equipment and materials at 2.7% and gas stations at 2%. The decline in May sales may partly reflect a normalization following April’s surge in major purchases, as consumers rushed to buy ahead of potential tariffs. However, the drop also extended to categories like restaurants, bars and health-related products. Modest gains in furniture and hobby-related spending were not enough to offset broader retail weakness as consumers remained cautious.

Oil Prices Fluctuate While Inventories Decline

U.S. commercial crude oil stocks stood at 415.1 million barrels for the week ending June 20—about 11% below the five-year June average. This drawdown in reserves comes at a precarious moment, as escalating tensions between Israel and Iran continue to disrupt energy markets.

Oil prices have fluctuated since the beginning of the conflict on June 12, with U.S. strikes on Iranian nuclear sites over the weekend of June 21 further increasing market uncertainty. Following the initial exchange between Iran and Israel, West Texas Intermediate crude oil prices rose almost 8% as markets feared possible obstruction of oil flows in the Middle East. Oil prices then continued to rise amid speculation about U.S. involvement in the conflict and jumped nearly 4% when trading opened after the American military action.

The potential for Iranian retaliation against U.S. energy assets or a shutdown of Iran’s Strait of Hormuz also contributed to price gains. However, oil prices began to fall back following a ceasefire agreement on June 24.

Meeting Expectations: Fed Holds Interest Rates Steady

The Federal Open Market Committee (FOMC) voted unanimously this month to hold the upper-bound target federal funds rate steady at 4.5% for the fourth consecutive meeting. Outcomes from the June 17–18 meeting aligned with market watchers’ expectations. Markets responded to the announcement with muted volatility, while two- and 10-year Treasury yields held relatively steady.

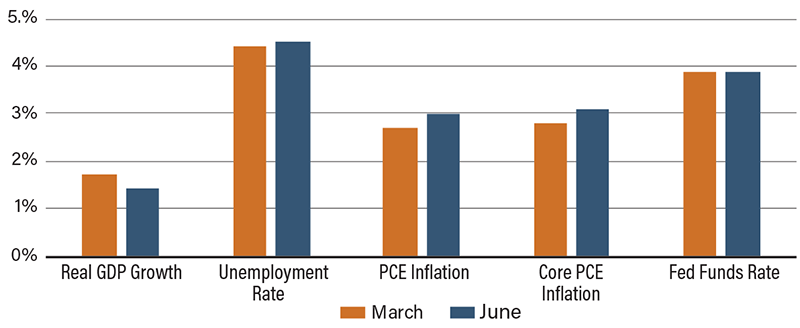

Fed Chair Jerome Powell emphasized that policymakers are waiting for tariff costs to hit consumers over the summer before making any cuts. He has also warned that increases in consumer prices may force the Fed to continue to hold rates steady in order to avoid increasing inflationary pressures. Economic forecasts released by the FOMC highlight expectations for higher inflation, weaker growth and increased unemployment for the rest of the year. In addition, the estimated neutral rate—the rate at which monetary policy neither stimulates nor restricts the economy—remained unchanged at 3%. The median projections also imply policymakers expect the upper-bound federal funds rate to be at 4% by the end of 2025. However, internal divisions are growing amid pressure to lower rates: Seven Fed policymakers foresee just one cut, while 10 project two more this year.

Federal Reserve Projection Comparison: March vs. June 2025

Source: Federal Reserve.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| U.S. Retail Sales (May)(MoM) | (0.1%) | (0.7%) | (0.9%) |

| U.S. Crude Oil Inventories (Week Ending June 20) | 420.9M Barrels | N/A | 415.1M Barrels |

| U.S. Strategic Petroleum Reserve (Week Ending June 20) | 402.3M Barrels | N/A | 402.5M Barrels |