Eyes on the Economy: Inflation, Business Activity, Pessimism

Inflation Edges Up in September

The consumer price index (CPI) rose to 3% in September 2025, the highest reading since January, up slightly from 2.9% in August but just below expectations of 3.1%. Energy costs were a key driver, climbing 2.8% after a modest 0.2% gain in August. Fuel oil prices surged 4.1%, gasoline prices only declined 0.5% year-over-year and natural gas inflation eased to 11.7%. New vehicle prices rose 0.8%, while inflation slowed for food (3.1%), used cars (5.1%) and transportation services (2.5%). Shelter costs held steady at 3.6%. Core CPI—excluding food and energy—edged down to 3% from 3.1%, slightly under market forecasts. On a monthly basis, CPI rose 0.3%, slower than August’s 0.4% pace and below projections. Gasoline prices jumped 4.1% in September, contributing most to the overall monthly increase, while monthly core CPI rose 0.2%. Overall, the data suggest inflation risk remains tilted to the upside.

Business Activity Expands in October

The S&P Global U.S. Composite Purchasing Managers’ Index rose to 54.8 in October from 53.9 in September, the highest since July and above the Q3 average, signaling continued expansion across manufacturing and services. Business activity increased for the 33rd consecutive month, supported by strong domestic demand. However, export orders declined further. Manufacturing firms scaled back input purchases as backlogs fell, resulting in a buildup of unsold inventories. Employment improved slightly but remained weak, especially in manufacturing, amid cautious business sentiment driven by policy uncertainty and tariff-related concerns. Lower interest rates provided some support to business confidence. While input costs continued to rise due to wage and tariff pressures, output prices increased at the slowest rate since April, suggesting easing inflationary momentum. Overall, the data point to steady but uneven growth, with ongoing cost challenges tempered by resilient demand and lower borrowing costs.

US Consumers Turn Pessimistic

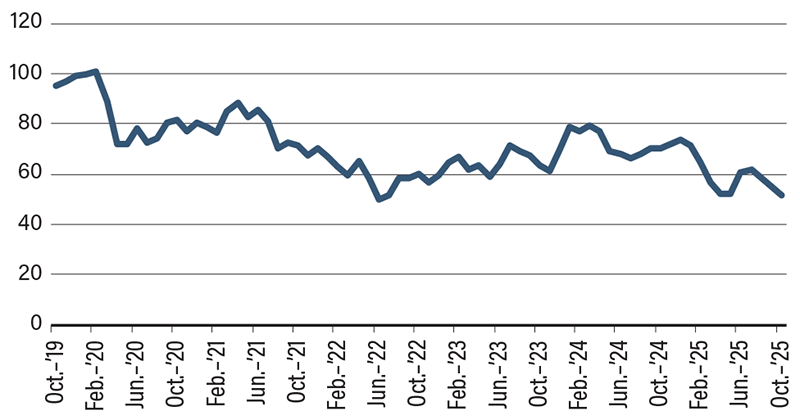

The University of Michigan Consumer Sentiment index declined slightly to 53.6 in October from 55.1 in September. Younger consumers showed improved optimism, offset by declines among middle-aged and older groups. While current personal finances rose modestly, expectations for future finances fell. Inflation and high prices remain key concerns, though few linked the federal government shutdown to economic conditions—only 2% mentioned it, compared with 10% in the 2019 shutdown. Year-ahead inflation expectations edged down to 4.6%, while long-run expectations rose to 3.9%, mainly among independents and Republicans.

Meanwhile, another gauge of U.S. consumer confidence declined for the third consecutive month in October, reflecting growing pessimism about the economic outlook amid signs of a slowdown and a softer labor market. According to the latest data, the Conference Board’s index dropped to its lowest level since April. The expectations measure for the next six months fell to 71.5, the weakest since June, while the gauge of current conditions improved slightly. Overall confidence remains below last year’s levels as concerns about job security and household finances persist. With job growth losing momentum and inflation edging up to 3%, Americans remain cautious about their economic prospects.

Consumer Sentiment Has Been Running Low

Source: Federal Reserve Bank of St. Louis.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Consumer Price Index (Sept.)(YoY) | 2.9% | 3.1% | 3.0% |

| S&P Composite PMI (Oct.) | 53.9 | 54.0 | 54.8 |

| University of Michigan Consumer Sentiment (Oct.) | 55.1 | 51.2 | 51.7 |

| The Conference Board Consumer Confidence (Oct.) | 95.6 | 93.2 | 94.6 |