Eyes on the Economy: Optimism, Household Debt, Job Cuts

Business Optimism Slips in October

The National Federation of Independent Business’s Small Business Optimism Index declined slightly in October, falling 0.6 points to 98.2, though it remains just above its 52-year average of 98. The subindex for uncertainty dropped 12 points to 88, its lowest level of the year. Small business optimism was tempered by weaker sales and profits, while labor shortages continued to pose significant challenges, with 27% of owners citing labor quality as their top problem. Job openings remained high at 32%, with many firms unable to find qualified applicants. Inflation pressures eased modestly, as both actual and planned price increases declined. Profit trends weakened sharply, contributing the most to the overall index drop. Despite cautious sentiment, 23% of owners planned capital spending in the next six months.

Household Debt Rises While Delinquencies Stabilize in Q3

Total U.S. household debt rose by $197 billion to $18.59 trillion in the third quarter of 2025, according to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit. Mortgage balances increased by $137 billion to $13.07 trillion, while credit card debt climbed by $24 billion to $1.23 trillion. Auto loans held steady at $1.66 trillion and student loans grew by $15 billion to $1.65 trillion. Home equity line of credit (HELOC) balances rose by $11 billion, marking continued growth since 2022. Mortgage originations totaled $512 billion, up from the previous quarter, while new auto loans dipped slightly to $184 billion. Credit card and HELOC limits expanded, indicating sustained credit availability.

Overall delinquency rates stabilized at 4.5%, though serious delinquencies increased slightly for most debt types, except mortgages. Student loan delinquencies remained elevated at 9.4%, reflecting the reporting of missed payments from the pandemic forbearance period.

Job Cuts Surge as Labor Market Weakens in Late 2025

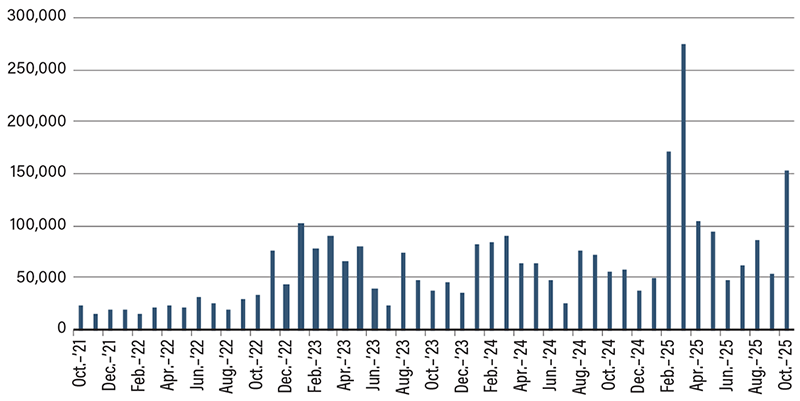

U.S. employers announced 153,074 job cuts in October 2025, a 175% increase from a year earlier and the highest October total since 2003, according to Challenger, Gray & Christmas. The surge reflects a mix of artificial intelligence (AI) adoption, weaker spending, rising costs and post-pandemic corrections, driving widespread layoffs and hiring freezes. Year-to-date cuts reached 1.1 million, up 65% from 2024 and the highest amount since 2020. Warehousing led October cuts with nearly 48,000 layoffs, followed by technology (33,000) amid automation and restructuring. Cost-cutting and AI were leading causes, accounting for over 80,000 layoffs in October. Meanwhile, hiring plans dropped 35% year over year to their lowest level since 2011, suggesting employers remain cautious heading into the holiday season.

In a separate report by ADP, private employers cut an average of 11,250 jobs per week in the four weeks ending October 25, 2025, signaling a slowing labor market in the latter half of the month. The data gain importance as the government shutdown delayed official U.S. Labor Department reports. Both the Challenger and ADP reports highlight growing labor market strain amid economic uncertainty.

Challenger Job Cuts

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| NFIB Business Optimism Index (Oct.) | 98.8 | 98.3 | 98.2 |

| Total Household Debt (Q3 25) | $18.39T | N/A | $18.59T |

| Challenger Job Cuts (Oct.) | 54K | 73K | 153K |

| ADP Average Weekly Job Change (Oct.) | 14.25K | N/A | (11.24K) |