Credit Card Troubles: Can We Weather the Storm?

It is usually the calm before the storm that leaves us complacent. It’s been six months since a series of bank failures took many by surprise. We were told the banking system was strong and inflation was transitory. Now we are told the U.S. economy may be emerging from this turbulent period without going through a recession, and disaster has been averted for our banking system. Forgive us for not taking this forecast seriously given the recent track record. One potential storm looming on the horizon is credit card loans.

We previously warned of the so-called resilient consumers who are relying heavily on credit cards to cover their increasingly unaffordable living expenses instead of pulling back on consumption. Buying into the optimistic story of economic resilience and a strong labor market—and probably the magic of contactless payment—U.S. consumers have fallen into record-high credit card debt. Many experts have downplayed the issue and repeatedly claimed that “consumers are in good shape.”

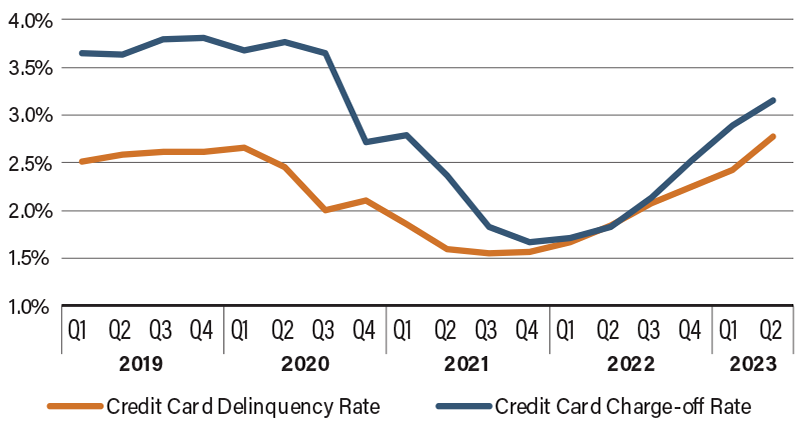

Despite this positive claim, U.S. banks recorded loan losses of $19 billion in the second quarter, the highest level in more than three years. The Financial Times reported that more than half of the losses came from credit card loans. The rate of credit card charge-offs—losses marked as unrecoverable—has trended up in seven consecutive quarters to 3.15%, though still below the pre-COVID level of 3.81%. However, the rate of delinquencies—defined as at least one missed payment—reached 2.77%, exceeding the pre-COVID level of 2.62%. An increase in delinquencies typically precedes an increase in charge-offs. Thus, we can expect the charge-off rate to exceed its pre-COVID level in the coming quarters. In addition, as interest rates go up, so do credit card interest payments—making it even tougher for struggling consumers to meet their minimums.

This level of losses is far from eye-popping, but remember that this is the beginning; we are warning of the storm before it floods your home. Whether it’s a tropical depression or a category 3 hurricane will depend on how prepared banks are. To their credit, many have recently increased cash holdings and allowances for loan and lease losses. Some analysts will tell you it’s going to be smooth sailing.

U.S. Credit Card Charge-off and Delinquency Rates

Source: Federal Reserve.