Caffeine Addict: Treasury Auctions Reveal Fiscal Credibility

A hallmark of a great financial market economist is a combination of two things: 1) A coffee addiction intense enough to explain the difference between a flat white and a latte and 2) the ability to switch from talking endlessly about Federal Reserve meetings to yapping about Treasury auctions. The distinction between a flat white and a latte mirrors that of Fed meetings and Treasury auctions—both impactful, but with different delivery styles.

Federal Open Market Committee meetings are when voting members of the Fed decide on its policy rate. Much like the Fed meetings, the flat white is the golden oldie. When gross domestic product and Americano are too basic for you, the Fed meetings and a flat white provide the complications you crave. Both are more nuanced, rich in texture and crafted to shape expectations. You walk away alert—but with more questions than answers. Fed meetings were the major market driver from 2022 to 2024.

A Treasury auction is when the Treasury Department sells federal debt securities. Straightforward, efficient and over quickly, a Treasury auction and a latte are a clean delivery of results, perfectly measured with little room for interpretation. In 2025, markets are turning their attention to Treasury auctions, especially for longer-maturity Treasurys. Auction results give an immediate gauge of market appetite for federal debt, serving as a real-time test of investor confidence in U.S. fiscal credibility. Long-dated Treasurys are now more tied to political forces than monetary policy, whose impact is indirect—filtered through expectations. If demand is weak, higher yields are needed to attract buyers at auctions. Rising term premiums—the widening gap between long-term yields and expected short-term rates over the same period—suggest investors see greater risk in holding long-term federal debt, signaling concern about long-term outlook for U.S. fiscal credibility.

In today’s shifting landscape, a great economist knows when to savor the complexity of a flat white or reach for the simplicity of a latte. As attention shifts from Fed meetings to Treasury auctions, so must the economist—caffeinated, focused and ready to interpret every signal that key economic actors serve.

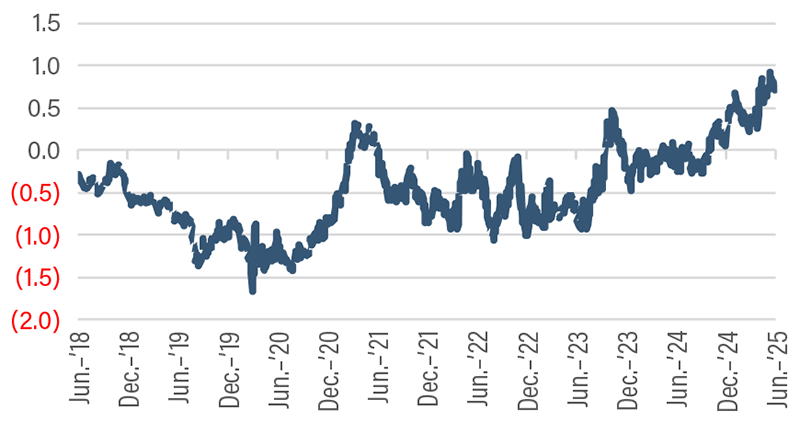

10-Year US Treasury Term Premium Rose Above Pre-COVID Level

SOURCE: Federal Reserve Bank of New York.

Note: 10Y AMC Index estimates the term premium by comparing the actual 10Y UST yeild with the expected average future short-term interest rates over the period of 10 years.