Defining an American Recession: There’s an Art to It!

With two consecutive quarters of negative growth, is the U.S. economy in a recession? If only economics was as scientific as its data seem to suggest, we could settle this debate once and for all. But it’s not.

Outside the United States, there’s a simple rule-of-thumb: Two consecutive quarters of declining real gross domestic product (GDP) equals a recession. In the United States, the start and end dates of a recession are determined by a panel of economists at the National Bureau of Economic Research (NBER)—known as the Business Cycle Committee.

So what is a recession, according the committee? It defines a recession as “the period between a peak of economic activity and its subsequent trough, or lowest point.” While that sounds easy enough, determining a peak and a trough complicates the definition of a recession. The determination of peaks and troughs is based on a range of aggregate real economic activity measures, such as real personal income less transfers, nonfarm payroll employment, real personal consumption expenditures, industrial production and more. Interestingly, the committee notes that there is “no fixed rule” on how these measures contribute to or are weighted on its decisions. Basically, think of this process as an art. Recently, however, the committee has put the most weight to nonfarm payroll employment and real personal income less transfers. This likely explains why it has not yet called a recession in 2022 given the consistently strong employment figures.

Of all the measures listed above, real GDP growth is missing. The absence of GDP in NBER’s recession definition has a history behind it. In 1929, NBER began tracking dates of recessions—going back to 1855. It wasn’t until 1937 that NBER economist Simon Kuznets presented the original formulation of GDP. Yes, you read that correctly—we had the concept of a recession before GDP existed. Although GDP is not one of the measures used in defining recessions, it is indirectly reflected through measures that are its components. That is why recessions and GDP declines are strongly correlated, but GDP is not a direct player in NBER’s fine art of defining recessions. So, are we in a recession? We’ll just have to wait for NBER to tell us.

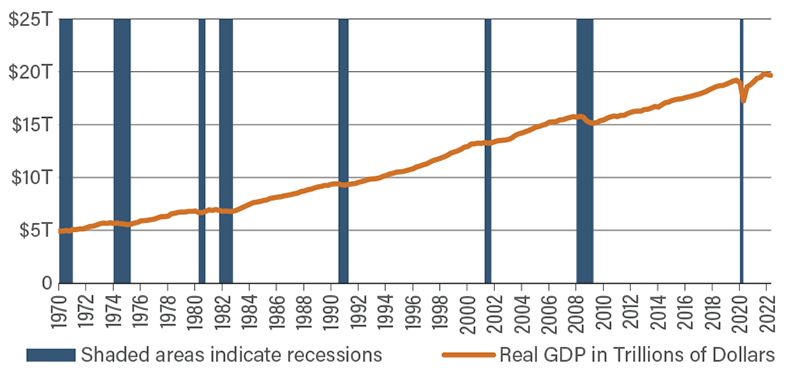

Real Gross Domestic Product Declines During Recessions