Education and Homeownership Are Turning the American Dream into a Fantasy

“Go to school to get a good job and buy a home.” Many children who grew up in the United States heard that mantra frequently. Education and homeownership are two key pillars of the American dream. Why that is the case isn’t so much important as the fact that every generation was better off than their parents by pursuing the American dream. This was true until many young Americans entered the labor market with tens of thousands of dollars in student loan debt that they can’t seem to pay off. Younger generations are also now facing record-high home prices and home supply shortages. What was once an obtainable American dream is turning into a distant fantasy. How did this happen?

It started with some people in positions of power missing their Econ 101 class. In a simple market economy, prices are determined by supply and demand. Our policymakers tend to favor demand stimulation as the answer to every economic problem because it quickly generates growth. Therefore, it’s a no-brainer to stimulate demand for these two pillars of the American dream. For homeownership, there have been many initiatives to make it “accessible” to many buyers, but those programs never make building homes easier, instead focusing on making borrowing more appealing—hence, stimulating demand without sufficient supply growth.

As for the other pillar, telling young people to get educated makes a great campaign slogan because no one is against education. The incentive for students is a high-paying job, which is a stepstone to buying a home and achieving prosperity. Once again, the policy choice was not to increase supply or enhance quality, but to guarantee borrowing so that students could pay whatever price higher education providers set. The federal government has even taken a step further with education as it mostly nationalized the student loan industry in 2010. Higher education providers never have to worry about their admitted students unable to pay tuition fees; therefore, raising the fees is unchallenged.

The American dream has become unaffordable because policy support focuses on demand without matching supply. In the first year of their very expensive college education, students learn that if demand rises more than supply, prices will increase. That’s Econ 101, which now costs thousands of dollars and appears to offer few rewards for the expense.

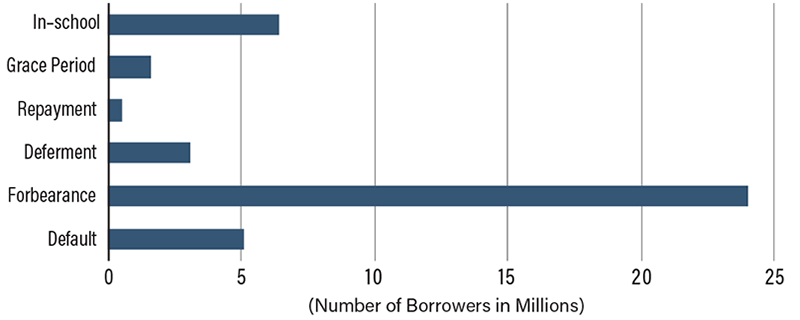

Repayment Status of the Federal Direct Loan Program

Source: Forbes; Federal Student Aid; MeasureOne