Eyes on the Economy: Consumer Prices, Confidence, Jobs

Headline CPI Hits New High

The U.S. Consumer Price Index rose more than anticipated in September, and there could be even larger increases over the next couple of months due to the recent jump in energy prices and ongoing supply-chain disruptions. The headline index year-over-year jumped to 5.4 percent compared with the market expectation of 5.3 percent. Bloomberg’s current median forecast for the top inflation number is 4.4 percent for all of 2021.

“Supply-chain issues” is the phrase of the year. Vehicle inventories are near record lows, driving prices higher. Vehicle sales were running just shy of 19 million annualized units in April, but have plunged to around 12 million in September. Even with sales dropping, prices continue to climb. Apple, the world’s most valuable company, has finally joined a growing list of household names from Samsung to Target to Tesla that have been forced to cut back on business because of the global semiconductor shortage. Overcoming the supply-chain bottlenecks is key to boosting American manufacturing production, replenishing inventories and easing inflation pressures.

Consumer Confidence Sags

U.S. consumer confidence dropped in October thanks to the recent acceleration in inflation, political brinkmanship and worries about the debt ceiling. While the headwinds seem to be mounting, consumer sentiment is still a far cry from where it once stood below 56 during the financial recession of 2008. The University of Michigan Consumer Sentiment Index fell from 72.8 in September to 71.4 in October, according to the preliminary survey. Market consensus is that it could be a bumpy few months for consumer sentiment; however, stronger job growth and declining COVID-19 cases could help. A slowdown in inflation would also be welcome, not only signaling relief to the American consumer, but also putting more confidence in the Federal Reserve’s management of monetary policy.

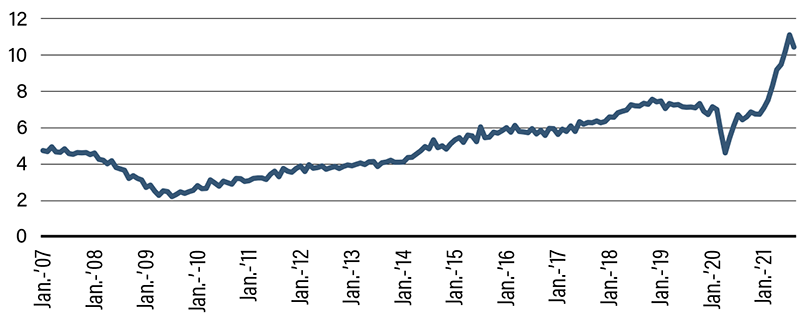

Job Openings Still Elevated for this Recovery

The August Job Openings and Labor Turnover Survey report revealed that openings declined, but so did hiring. Openings dropped from 11.1 million in July to 10.4 million in August, while hiring fell to 6.3 million from 6.8 million. Nearly every industry was seeking to fill fewer positions in August than in July—despite the fact a record 4.3 million people quit their jobs in August.

Hiring has eased in step with openings. Some of the weaker performance can be attributed to state and local education where less hiring than normal occurred at the start of the school year. This particular sector dragged down top-line employment in the September payroll employment report as well. Now that the delta variant is fading, economists expect economic conditions to improve. Critically, the hope is that workers who have been unable to participate in the labor market will make their way back. Increased labor force participation should help ease the extraordinary level of openings. However, longer-term issues remain as many people who worked in low-paying jobs with variable hours, particularly in leisure/hospitality, may be unwilling to go back to these types of positions. The industry will have to adapt by adopting more automation and other types of labor-saving measures. Economists predict employment will return to its pre-pandemic peak by the end of 2022.

U.S. Job Openings (in millions)

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| JOLTS' Job Openings (Aug.) | 10.934M | 10.954M | 10.439M |

| Consumer Price Index (YoY) (Sept.) | 5.3% | 5.3% | 5.4% |

| University of Michigan Sentiment (Oct.) | 72.8 | 73.1 | 71.4 |

Key Interest Rates

| 10/25/21 | 10/18/21 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.09% | 0.09% | -- |

| 3-mo. Libor | 0.13% | 0.13% | -- |

| 2-yr. UST | 0.45% | 0.44% | 0.01 |

| 5-yr. UST | 1.23% | 1.16% | 0.07 |

| 10-yr. UST | 1.66% | 1.59% | 0.07 |

| 30-yr. UST | 2.13% | 2.01% | 0.12 |

Rate Forecast - Futures Market

| Q4-21 | Q1-22 | Q2-22 | Q3-22 | |

|---|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | 0.25% | 0.25% |

| 1-mo. Libor | 0.12% | 0.15% | 0.20% | 0.20% |

| 3-mo. Libor | 0.20% | 0.25% | 0.30% | 0.30% |

| 2-yr. UST | 0.40% | 0.45% | 0.50% | 0.50% |

| 5-yr. UST | 1.05% | 1.10% | 1.20% | 1.20% |

| 10-yr. UST | 1.80% | 1.89% | 1.96% | 1.96% |

| 30-yr. UST | 2.30% | 2.40% | 2.50% | 2.50% |