Eyes on the Economy: GDP, Payrolls, FOMC

Trade Deficit Drags on GDP

Though the trade deficit widened less than the market anticipated, net exports will likely still be a noticeable drag on fourth-quarter gross domestic product (GDP) growth. There are a few factors behind the widening in the nominal trade deficit over the past several months.

For one, the U.S. dollar has been strong, which supports more imports while weighing on exports. However, the U.S. dollar is expected to continue to weaken in 2021, which should reverse this trend. Lean inventories are also a factor. Retailers have especially depleted store shelves, and their inventory-to-sales ratio is at an all-time low. Once retailers are able to operate at full strength, they will do some serious restocking and boost growth.

One wildcard to keep an eye on in 2021 is the recovery of China whose economy is expected to grow 8 percent this year. China’s speedy recovery could lift the rest of the world out of its current doldrums.

Payroll Additions Falter

Economists were not surprised when nonfarm payrolls turned negative in December due to increased state restrictions. Employment fell by 140,000 positions, driven by the loss of nearly 500,000 jobs in leisure and hospitality. These losses, combined with continuing declines in government payrolls, more than overwhelmed jobs strength elsewhere. The unemployment rate was unchanged at 6.7 percent as were other top-line household measures.

Health experts are hoping that widespread vaccinations will enable the economy to recover more rapidly by the second half of the year. However, employment will not completely rebound until the end of 2023, and many industries will be altered permanently. Educational services, retail and leisure/hospitality sectors will be forever changed. While people will return to traveling and dining out, many businesses will have closed permanently, and it will take years for new ones to take their place. The government could play an important palliative role in setting the path toward a healthy economy.

FOMC Keeps Foot on the Gas

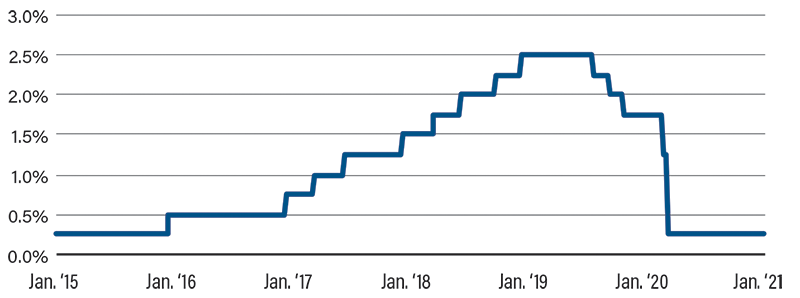

There were not many surprises in the minutes from the December Federal Open Market Committee (FOMC) meeting. The minutes revealed some discussion about the importance of reminding Americans that the federal funds rate is the central bank’s primary tool for economic manipulation, not its balance sheet.

There are no anticipated changes to the overnight rate until 2023, but that outlook could change depending on how much progress the U.S. economy makes in 2021. Once liftoff does occur, it will not be swift. It took almost a full four years for the Fed to get to 2.5 percent after the last recession. Keep in mind that 5 percent used to be considered the long-run neutral point.

The Fed does have room to adjust its balance sheet, but the FOMC minutes don’t show a consensus around either increasing the size or altering the composition of its Treasury purchases just yet. A gradual tapering of purchases could begin this year. If it does, expect the process to be similar to the 2013–2014 progression after the Great Recession.

Federal Reserve Overnight Lending Rate

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| FOMC Overnight Federal Funds Rate | 0.25% | 0.25% | 0.25% |

| U.S. Exports (Nov.) (MoM) | 1.2% | 1.0% | 1.1% |

| Nonfarm Payrolls (Dec.) (MoM) | 245K | 100K | -140K |

Key Interest Rates

| 1/18/21 | 1/11/21 | Change | |

|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | -- |

| 1-mo. Libor | 0.13% | 0.13% | -- |

| 3-mo. Libor | 0.22% | 0.23% | -0.01 |

| 2-yr. UST | 0.13% | 0.14% | -0.01 |

| 5-yr. UST | 0.46% | 0.50% | -0.04 |

| 10-yr. UST | 1.11% | 1.15% | -0.04 |

| 30-yr. UST | 1.85% | 1.88% | -0.03 |

Rate Forecast - Futures Market

| Q1-21 | Q2-21 | Q3-21 | Q4-21 | |

|---|---|---|---|---|

| Fed Funds | 0.25% | 0.25% | 0.25% | 0.25% |

| 1-mo. Libor | 0.10% | 0.10% | 0.10% | 0.10% |

| 3-mo. Libor | 0.20% | 0.20% | 0.20% | 0.20% |

| 2-yr. UST | 0.20% | 0.30% | 0.30% | 0.40% |

| 5-yr. UST | 0.65% | 0.60% | 0.70% | 0.70% |

| 10-yr. UST | 1.00% | 1.10% | 1.20% | 1.30% |

| 30-yr. UST | 1.80% | 1.90% | 2.00% | 2.10% |