Eyes on the Economy: Homebuilder Confidence, Inflation

Homebuilder Enthusiasm Rebounds as Restrictions Ease

Homebuilder confidence jumped 21 points to 58 in June, indicating the economy and housing market are starting to recover from mandatory lockdowns. The National Association of Home Builders/Wells Fargo Housing Market Index fell below 50, the neutral threshold, in April and then surged in June, indicating a positive builders market.

Although COVID-19 has sent economies across the globe spiraling into recession, the U.S. housing market seems to be more resilient than others and is bouncing back faster than other sectors of the economy. Recent data also show that mortgage purchase applications are rising. This is partly thanks to low interest rates.

Inventory was already low, and the CARES Act stopped delinquent homes from hitting the market. As a result, supply is low and demand is recovering. The short-term outlook for builders is positive, and could be even more robust if the labor market heals itself. Expect homebuilder sentiment to continue to rise, but at a much slower pace. A number of housing indicators have come in better than originally expected, exhibiting the V-shaped recovery economists want to see. House prices continued their upward trend since the first quarter of 2020.

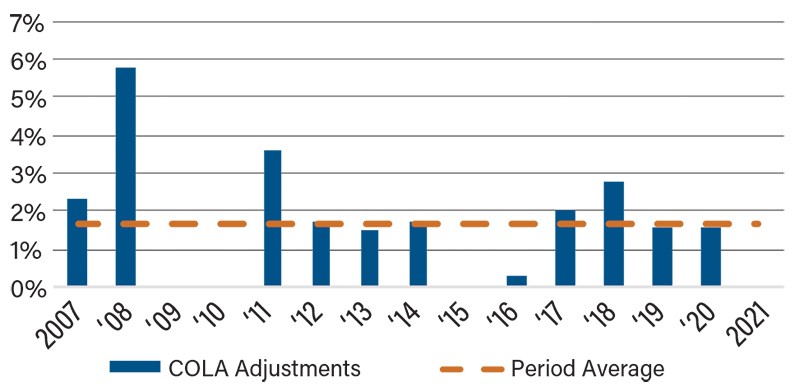

Social Security Cost-of-Living Adjustments 2007–2020

Inflation Indices Fall as Consumers Stay Home

Economists are now eyeing another possible symptom of COVID-19: a slowing inflation rate, otherwise known as disinflation. While the Federal Reserve has a playbook for taming inflation, addressing deflation is a different ballgame. Deflation denotes a persistent decline in overall prices.

The market’s rule of thumb is that an economy is experiencing deflation after more than six consecutive months of year-over-year declines in core consumer prices. The U.S. economy has seen both the Consumer Price Index (CPI) and core CPI fall for three consecutive months—so we’re almost halfway here. While the government’s monetary and fiscal stimulus measures can help, it doesn’t matter how much money you put in people’s pockets if stores aren’t open. Current social distancing is significantly hurting the retail sector. Online spending likely is not enough to move the needle on core consumer prices given the importance of the service sector, which is the hardest hit by closures.

Deflation is economically debilitating. During a period of deflation, consumers stop spending. Why buy something today that will cost less tomorrow? Investors hold off on acquiring assets such as stocks or real estate—instead waiting on prices to hit rock bottom. As sales fall, firms cut production and lay off workers, fueling the cycle.

It also hurts seniors as they may not get cost-of-living increases for Social Security benefits in 2021. If that happens, it would be only the fourth goose egg since 1975.

Analysts expect inflation to accelerate gradually over the next couple of years as the economy begins to heal.

All referenced economic data sourced from Bloomberg.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Consumer Price Index (CPI) (YoY) | 0.4% | 0.3% | 0.2% |

| Core Consumer Price Index (YoY) | 1.4% | 1.3% | 1.2% |

| NAHB/Wells Fargo Housing Market Index (June) | 37 | 45 | 58 |